The US dollar was seen trading flat on Thursday as investors prepared for Friday’s payrolls report. On the political front, the U.S. Steel and aluminum tariffs go into effect from Friday. Canada, Mexico and the EU are some of the economies that would be hit by the new tariffs.

EU officials vowed to retaliate against the tariffs which once again raise the specter of a full-blown trade war. On the economic front Canada's GDP increased 0.3% on the month which was better than expected. In the U.S. the core PCE price index showed a 0.2% increase on the month while both personal spending and income grew better than expected.

Investors will be geared into the U.S. nonfarm payrolls report that will be released later today. Economists forecast that the U.S. unemployment rate was steady at 3.9% while estimating that the average number of job gains during May increased 189k. This marks a slightly higher print compared to 164k jobs added in April. Wage gains are expected to accelerate at a pace of 0.3% on a month over month basis.

Following the payrolls report, the monthly ISM manufacturing PMI data is expected to be released. Estimates show a rebound in manufacturing activity from 57.3 in April to 58.2 in May.

Data from the Eurozone will see the release of the manufacturing PMI including that from the UK.

EUR/USD intra-day analysis

EURUSD (1.1681):The EUR/USD currency pair managed to post gains for the second day but price action was mostly subdued. The early trading on Friday showed some bearish momentum in price action which indicates perhaps a moderate pullback to the gains from the previous two days. On the 4-hour chart, the recent gains coincide with the upper end of the falling price channel alongside the hidden bearish divergence. Unless the EUR/USD clears the resistance level at 1.1730, we expect to see a pullback in price. Support is most likely to be established around 1.1610 - 1.1577. If price rebounds along this level, we could expect to see further gains in store.

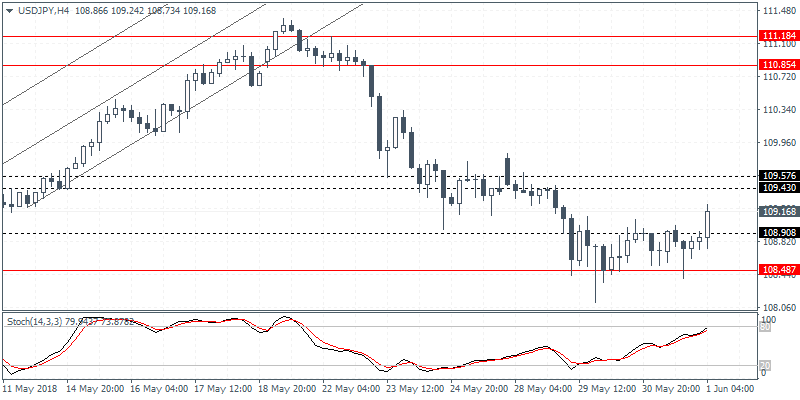

USD/JPY intra-day analysis

USD/JPY (109.16):The USD/JPY currency pair settled into a consolidation between 108.90 - 108.48 level before attempting to breakout from this tight range. The upside momentum currently is pushing the USD/JPY to rally toward the next main resistance level at 109.57 - 109.43 level. If resistance is established here, we expect USDJPY to maintain the range below this resistance level. For the short term, USD/JPY is likely to have formed a bottom in the near term.

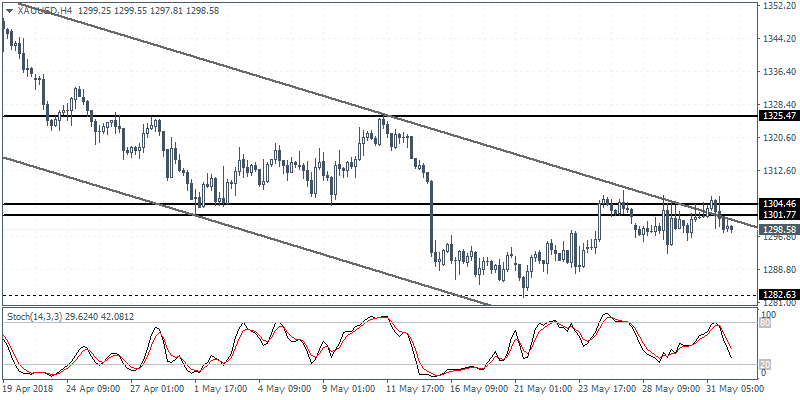

XAU/USD intra-day analysis

XAU/USD (1298.58): Gold prices were seen easing back following the test of resistance near 1304 - 1301 level. The reversal off this resistance level is expected to push gold prices to the downside. With the consolidation taking place, as long as the previous lows of 1282 are not breached, we expect to see gold prices staying subdued. A breakout above 1304 is needed in order for further gains to be posted. In the near term however, gold prices could remain range bound at the current price levels.