Market sentiment remained supported yesterday during the EU and US sessions. However, it softened during the Asian morning today, due to a mix of developments, the likes of fresh acceleration in Covid cases, Fed’s Powell remarks, and geopolitical tensions in Asia. As for today’s data, we already got the UK CPIs for May, while later in the day, we get more inflation data for the month, this time from Canada.

SENTIMENT DETERIORATES IN ASIA ON A BLEND OF DEVELOPMENTS

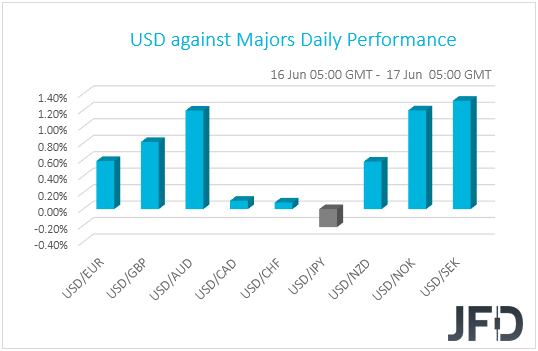

The dollar rebounded yesterday, and today it was found higher against most of the other G10 currencies. It gained the most versus SEK, AUD, and NOK in that order, while it eked out the least gains versus CAD and CHF. The greenback underperformed only against JPY.

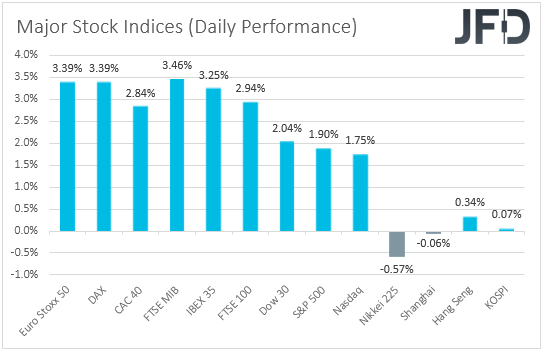

The strengthening of the yen, the dollar, and the franc, combined with the weakening of the Aussie and the Kiwi, suggests that risk appetite deteriorated again at some point yesterday. Looking at the performance in the equity world, we see that major EU and US indices traded in green territory, with investors perhaps adding to their risk exposure after the Fed announced it will start purchasing corporate bonds. What may have boosted sentiment even further may have been a report saying that the Trump administration is preparing a nearly USD 1trln infrastructure proposal, while market chatter suggested that US firms may be allowed to work with China’s Huawei on new 5G standards, which may have eased trade tensions between the world’s two largest economies. The fact that US retail sales jumped by a record 17.7% in May could have also been a positive.

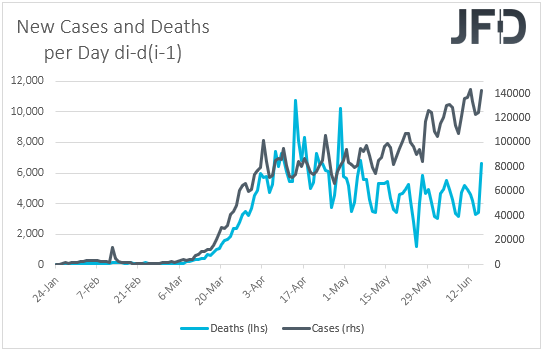

However, the broader optimism softened during the Asian session today, perhaps due to a fresh acceleration in infected cases around the globe from the coronavirus, with China ramping up restrictions on people leaving Beijing. Adding to the skepticism was Fed Chair Powell’s remarks before the Senate Banking Committee. He said that output and employment will remain well below their pre-COVID levels for a long time, adding that there is “a reasonable probability” that more policy support would be needed. Geopolitical tensions also weighed on sentiment, with India reporting that 20 soldiers had been killed in clashes with Chinese troops, while North Korea vowed to send back military forces to its border with South Korea after it blew up a joint liaison office set up to foster better ties between the two nations.

Still, our own view has not changed. Geopolitical tensions usually do not last forever, while most governments around the globe continue to ease their lockdown measures, something that keeps hopes over a potential economic recovery alive. What’s more, although Fed Chair Powell appeared somewhat pessimistic over the US economic outlook, still, data points that the economy is performing better than many may have anticipated. With encouraging headlines with regards to virus treatments also hitting the wires, we see decent chances for equities and other risk-linked assets to rebound again, and for the safe havens to pull back. As we noted yesterday, we will reconsider that view if more governments around the globe start re-imposing “stay at home” restrictive measures.

EURO STOXX 50 – TECHNICAL OUTLOOK

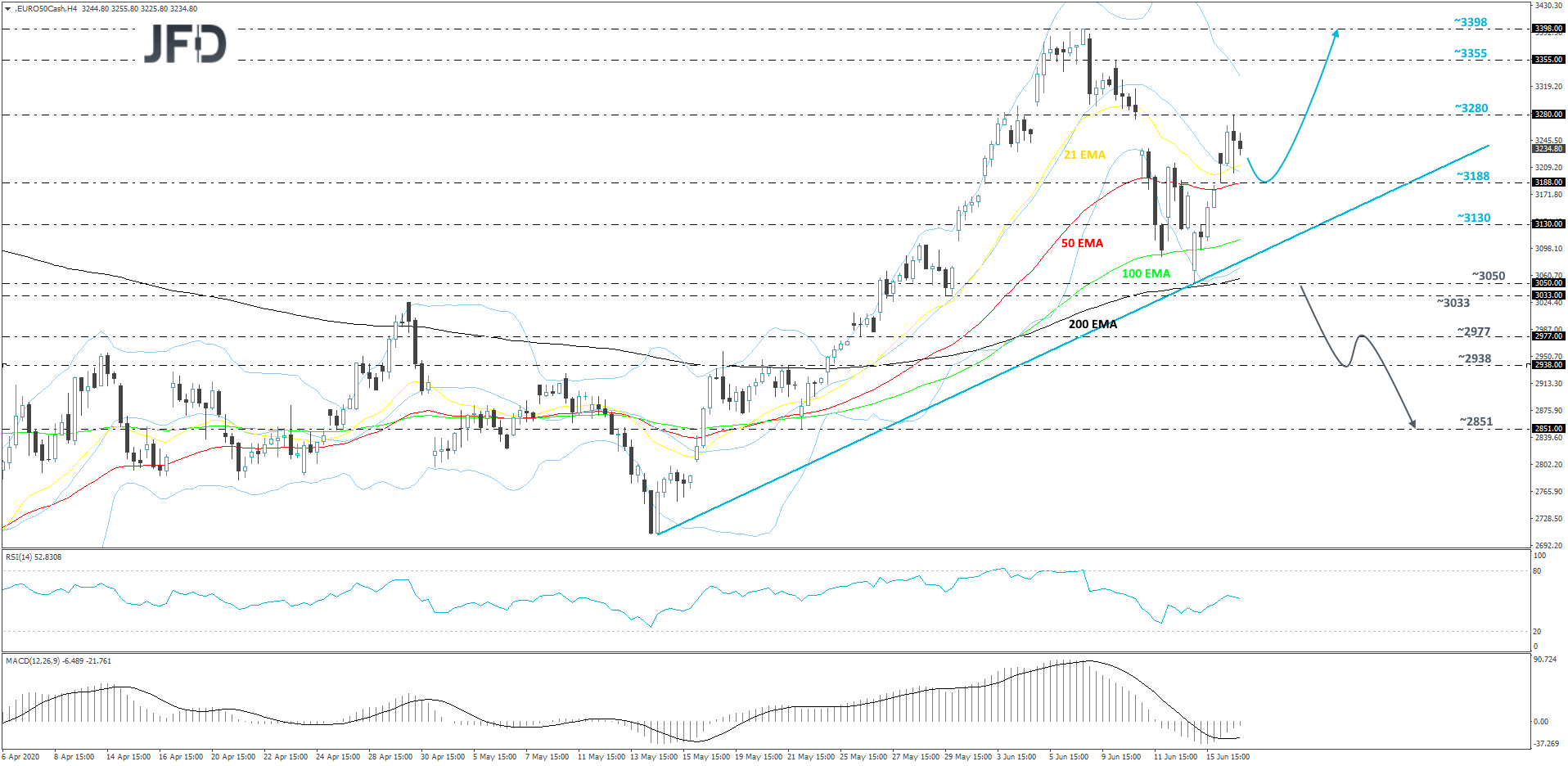

The Euro stoxx 50 index rallied yesterday, pushing further away from its short-term tentative upside support line taken from the low of May 14th. The index also managed to climb back above all of its EMAs on the 4-hour chart, what some might see as a positive sign. The price is also currently sitting above the 20 SMA, which is at the mid-point of the Bollinger bands. That said, there is a possibility to see a small correction lower first, before another leg of buying, hence why we will stay positive with the near-term outlook, at least for now.

A small decline first could test the 3188 hurdle, marked by yesterday’s low, which is also around the aforementioned 20 SMA and the 50 EMA. If that area manages to hold the index from dropping, the bulls may take advantage of the lower price and try to lift it again. If they succeed in doing that and Euro Stoxx 50 rises above yesterday’s high, at 3280, this will confirm a forthcoming higher high and could clear the way for a further acceleration. The index may then travel to the 3355 zone, a break of which might push the price to the current highest point of June, at 3398.

On the other hand, if Euro Stoxx 50 moves sharply lower and breaks the previously-discussed upside line, that could make the bulls worry again, especially if the price falls below the current low of this week, at 3050. If that happens, more sellers might jump into the action and this way sending the index further south. The price could then start declining sharply, potentially clearing out levels like 3033, or even the 2977 hurdle, which is the low of May 26th. Euro Stoxx 50 may end up testing the 2938 area, marked by the high of May 21st, which might provide a temporary hold-up. The index could rebound slightly, however if the bears are still feeling a bit more comfortable, this might result in another slide. A break of the 2938 obstacle may set the stage for a move to the 2851 level, marked by the low of May 22nd.

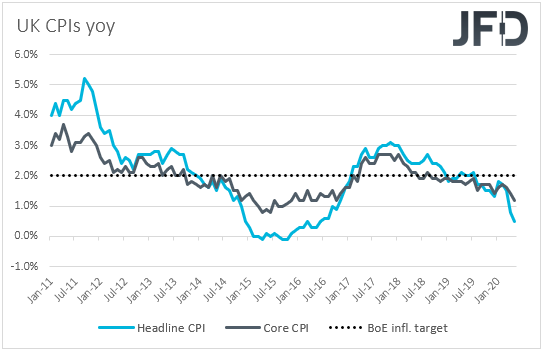

UK INFLATION SLOWS, CANADA CPIS IN FOCUS

As for today, during the early EU morning, we already got the UK CPIs for May. The headline CPI slowed to +0.5% yoy from +0.8%, while the core rate slid to +1.2% yoy from +1.4%, missing estimates of +1.3%. In our view, slowing inflation, further below the BoE’s objective of 2%, may have increased speculation that tomorrow, BoE policymakers will discuss the option of negative interest rates, something that could prove negative for the pound.

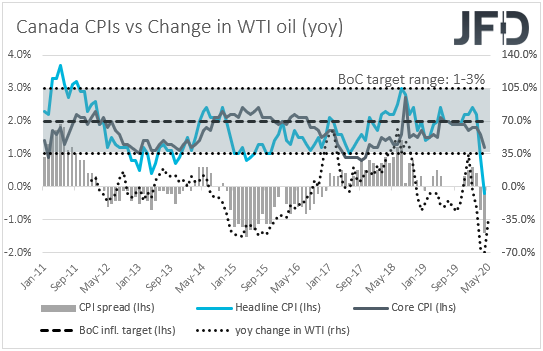

Later in the day, we get more inflation data for May, this time from Canada. The headline rate is expected to have ticked up, but to have stayed within the negative territory. Specifically, it is expected to have risen to -0.1% yoy from -0.2%, while no forecast is currently available for the core rate. At the prior BoC gathering, policymakers kept interest rates unchanged and said that given the improvement in short-term funding conditions, the Bank reduced the frequency of its term repo operations and its program to purchase bankers’ acceptances. They also said that the Canadian economy appears to have avoided the most severe scenario presented in the Bank’s April Monetary Policy Report and that the economy is expected to resume growth in the third quarter. With inflation also near the Bank’s estimates, all this suggests that as long as coronavirus-related restrictions are lifted, and as long as data continues to suggest that the worse is behind us, Canadian policymakers are likely to refrain from expanding their stimulus efforts anytime soon.

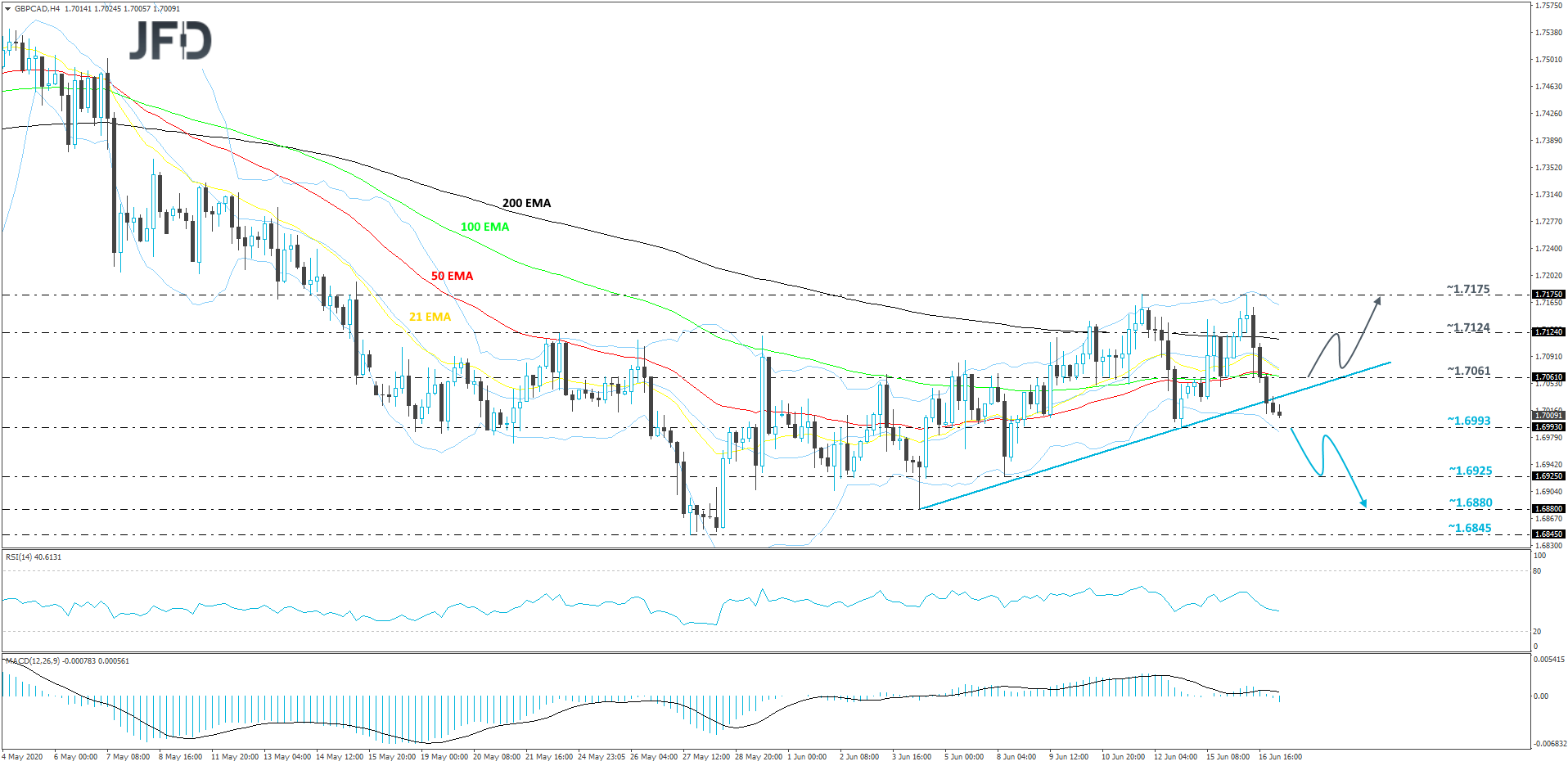

GBP/CAD – TECHNICAL OUTLOOK

Yesterday, after failing to overcome its key resistance barrier, at 1.7175, GBP/CAD sold off and ended up breaking its short-term tentative upside support line taken from the low of June 4th. The pair is once again seen trading below all of its EMAs on the 4-hour chart, what some might see as a bearish indication. However, we would prefer to wait for a drop below the 1.6993 hurdle, marked by the low of June 12th, in order to get slightly more comfortable with further declines.

If GBP/CAD eventually slides below the aforementioned 1.6993 territory, this would confirm a forthcoming lower low and more sellers could join in. The pair may then drift to the 1.6925 obstacle, marked by the low of June 8th, a break of which might set the stage for a move to the current lowest point of June, at 1.6880.

Alternatively, a push back above the previously-mentioned upside line and a rate-rise above the 1.7061 zone, marked near an intraday swing high of June 15th and an intraday swing low of June 16th, could place the short-term bullish outlook back on the table. GBP/CAD might then travel towards the 1.7124 obstacle, which if fails to provide resistance and breaks, could help the rate to have another go at testing the previously-discussed 1.7175 barrier. That barrier marks the highs of June 11th and 16th.

AS FOR THE REST OF TODAY’S EVENTS

Apart from the UK and Canadian inflation data, we also get Eurozone’s final CPIs for May, as well as the US building permits and housing starts, for the same month.

With regards to the energy market, we have the EIA (Energy Information Administration) weekly report on crude oil inventories, and the forecast points to a 0.152mn barrels decline after a 5.720mn increase. However, bearing in mind that yesterday, the API (American Petroleum Institute) report revealed a 3.900mn inventory build, we would consider the risks surrounding the EIA forecast as tilted to the upside.

Tonight, during the Asian morning Thursday, New Zealand’s GDP for Q1 and Australia’s employment report for May are coming out. New Zealand’s GDP is expected to have contracted 0.9% qoq after expanding 0.5% in the last three months of 2019, something that will drag the yoy rate down to +0.3% from +1.8%. Australia’s unemployment rate is expected to have risen to 7.0% in May from 6.2%, while the net change in employment is forecast to show that the economy has lost 125.0k jobs after losing 594.3k in April.

As for the speakers, Fed Chair Jerome Powell will present his testimony before the House Financial Services Committee, while we will also get to hear from ECB Vice President Luis de Guindos, ECB Executive Board member Yves Mersch and Cleveland Fed President Loretta Mester.