Introduction

For the last five years, US stock markets have been a good place to invest. Over that period, the S&P 500 is up 77%. And in the last year, it is up 20%. But there are worrying clouds on the horizon: the price/earnings ratios are creeping up – the S&P 500 is now at 24. And nobody knows whether Trump will be able to follow through on any of his promises to spur economic growth. With the US stock markets so high and considerable economic uncertainty over what Trump will do, it is worth considering options.

In this piece, I examine a selection of Eastern European countries (EEU) targeted on the southern part of the region. FocusEconomics provides the data and I am assisted by Ken Lefkowitz, a managing partner at New Europe Corporate Advisory. Ken, an economist, has been living in Bulgaria and covering the region for more than 20 years.

Countries Worth Considering for Investments

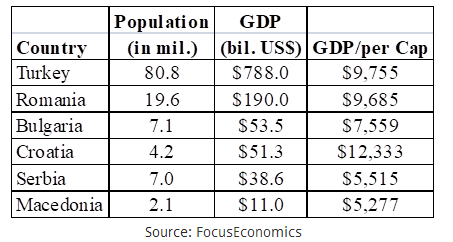

Elliott: The countries listed in Table 1 all have stock exchanges. Turkey is by far the largest while Croatia has the highest per capita income by a large margin. Should these countries be investment targets for individual or institutional investors from the West?

Ken: As you point out, size is an important criterion. Therefore Turkey and Romania merit the most attention. They are respectively the second and third largest countries after Poland in terms of population in Eastern Europe excluding the Commonwealth of Independent States (CIS). Turkey is well established as an emerging market, while Romania, long considered a frontier market, is on the cusp of achieving emerging market status – it may be worthwhile to get in early.

Croatia’s economy looks much larger than it actually is due to significant remittances. Bulgaria is worth considering due to its macro stability – more on that below. And Serbia stands out as one of the last convergence plays in the region with reasonable size and degree of industrialization. Macedonia, although extremely FDI-friendly, is too small and too unstable to prioritize. Macedonia probably looks smaller than it actually is due to a large informal economy (which also explains some of its very high trade deficit), but that is hardly investable.

Table 1. – Data on Selected Eastern European Countries, 2017

Economic Strength

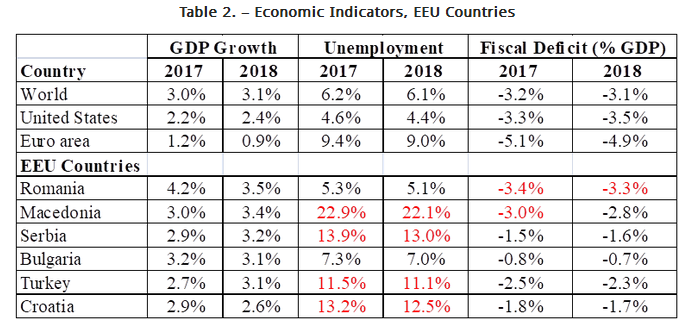

Elliott: Table 2 provides economic data on these EEU countries with the World, the US and Eurozone countries providing a frame of reference. Ranked by projected real GDP growth rates in 2018, it is notable that all EEU countries are projected to grow more rapidly than either the US or the European Union countries. I view unemployment rates greater than 10% and countries with fiscal deficits greater than 3% as worrisome.

Ken: I would counter that unemployment rates greater than 10% are an opportunity, because labor shortages are a significant issue in the better-performing countries such as Romania and Bulgaria. This is especially visible in software, information technology, and business process outsourcing, which are some of the fastest-growing industries in the region. Romania and Bulgaria will see significant wage inflation. And their tight labor markets will erode their competitiveness whereas the other countries have plenty of room to run.

In Turkey, however, high unemployment does not currently offer an investment opportunity. Political instability there – or enforced stability if you will – is restraining both growth and foreign direct investment (FDI). It may also be driving unemployment – I know Turks who have chosen not to work under the current circumstances. A large mass of unemployed and underemployed people with uncertain prospects is clearly a risk factor.

Fiscal and trade deficits definitely require scrutiny – these are relatively small economies in which external imbalances can lead to instability. My take on Romania is that its fiscal deficit more than accounts for its relatively high growth rate compared to, say, Bulgaria. In Bulgaria, the currency board has required much greater fiscal discipline than in other countries, but this has stimulated competitiveness and not taken a disproportionate toll on growth.

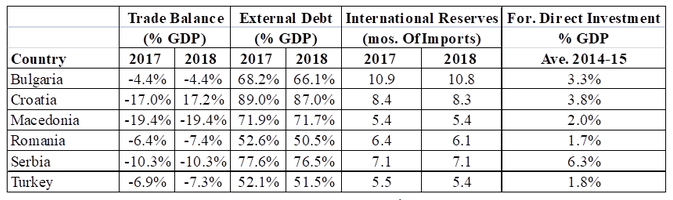

International Indicators

Ken: Serbia shows a very healthy imbalance that is typical for a convergence play: high FDI coupled with a high trade deficit. I claim this is healthy because it suggests that investment in imported capital goods is stretching the trade deficit, but creating a basis for growth in coming years.

Table 3. – International Economic Indicators, EEU Countries

Stock Market and Exchange Rate Considerations

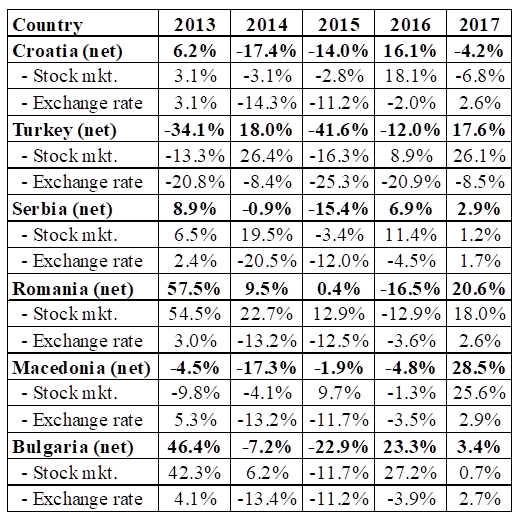

Elliott: Whenever investing in a country using a different currency, allowance should be made for exchange rate changes. For an example, an American’s investment in an EEU country that makes a 10% gain on a stock will lose some or all of that in exchanging it back into dollars if the EEU country’s currency weakens relative to the dollar. Data on these points for EEU countries are presented in Table 4.

Table 4. – Stock Market Performance, Exchange Rate Changes

Ken: Turkey’s economy is much more dollar-based than all the rest of the countries under discussion here. That said, a look at Table 4 shows that the lira has seen steady erosion against the dollar and by extension other hard currencies. This reflects a relatively weak foreign reserve position.

The rest of the countries are either EU members, candidates, or aspiring candidates, so their currencies closely track the euro. Bulgaria maintains a currency board with more than €23 billion in reserves (more than 10 months of imports as indicated in Table 3) backing up a fixed exchange rate with its euro peg. Bulgaria, Croatia, and Romania have agreed to join the ERM II exchange rate mechanism as a condition of their EU accession, and ultimately to join the Eurozone. They are likely to adopt the euro within 5-10 years. Macedonia operates an informal peg to the euro, while Serbia’s dinar floats freely.

If you position is large enough, you can hedge the bulk of the currency risk with a euro-denominated swap. Local currency hedges are available in some of the countries, including Turkey.

Elliott: The fluctuations for some EEU countries are quite disconcerting.

Ken: Harry Truman said “if you can’t stand the heat, get out of the kitchen.” In other words, one has to have a stomach for volatility to invest in the stock markets of the EEU countries, which are all either emerging or frontier markets. The adage among old emerging markets hands is that the time to invest is when there’s blood in the streets. Looking at the year-to-date performance, that rings true for Turkey, Romania, and Macedonia, all of which experienced political crises in the last 12 months and are now posting double-digit returns.

What’s not evident in the table is liquidity, but investors need to consider this carefully. Out of the markets under consideration, only Turkey and Romania have reasonably liquid stock markets by emerging/frontier markets standards. In the rest of the countries, it is all too easy to get stuck in a position that can’t be unwound without taking a haircut.

Investment Opportunities

Elliott: Ken, what do you see as attractive investment opportunities in these Eastern European countries?

Ken: On a macro level, I like Romania for its growth prospects, size, liquidity, IPO activity, and above all its real efforts to combat corruption, which is otherwise a plague across the region.

Ken: I also like Serbia for the convergence play, but one has to be very cautious and take tiny positions there due to the lack of liquidity. In fact, I would shy away from the Serbian stock market altogether and consider rather its sovereign debt. Serbia issues a 10-year euro-denominated T-note which yielded 4% at the last auction in March, and the shorter maturities also offer a meaningful yield premium over US Treasuries (max. 1.25%) or German Bunds (max. 1.36%).

At the sector level, software, IT and outsourcing are the growth industries in the region, but these are not necessarily the liquid listed issues. The best way to access this play is through the region’s private asset managers with a VC focus such as Earlybird and 3TS Capital.

Elliott: Corruption does not appear to be all that high in these EEU countries According to Transparency International’s Corruption Perceptions Index, corruption was highest in Croatia with a ranking of 49 out of 176 rankings where higher rankings indicate more corruption. Romania (48), Serbia (42), Turkey (41), Bulgaria (41), Turkey (41) and Macedonia (37) all had less-corrupt rankings than South Korea (53).

Question: How does one invest in Earlybird or 3TS Capital?

Ken: As with any private fund manager, one joins as a limited partner (L.P.) in their current fund-raising round. Alternatively, there are brokers who specialize in secondary trading in private equity and VC funds. Bank Gutmann in Austria is one such name that springs to mind. It may be possible to step into the shoes of an L.P. in a current fund who seeks an exit. With the caveat that I’m not a professional private equity placement agent, if some of your readers are qualified investors interested in these types of investments, I would be happy to provide appropriate referrals.

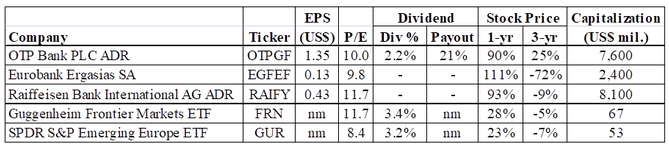

The banking and insurance sectors also are worth considering for being very much out of favor. But the cycle is turning and M&A activity is starting to pick up in those sectors after a 7-year hiatus. Banks in particular make natural proxies for a macro bet on the region. Certain regional banks such as Greece’s Eurobank Ergasias (EGFED), Austria’s Raiffeisen Bank International (RAIFY), and Hungary’s OTP Bank (OTPGF), offer significant exposure to the EEU and are accessible as ADRs.

Eurobank and Raiffeisen trade below book value, although that reflects in part their large bad loan portfolios. Eurobank in particular is heavily exposed to Greece and may have to divest from the rest of the EEU under the terms of Greece’s bank rescue package. It also looks the most expensive of the three, with a P/E close to 10.

Table 5. – Possible EEU Investments

Although the trailing P/E is a bit higher, OTP trades at a forward P/E 6 and price to book of 1.5 with a 2.17% dividend yield. OTP runs solid retail operations in Hungary, Romania, Bulgaria, and Serbia. Raiffeisen looks cheaper at a 1.7 P/E and 0.8 price to book. But it has not paid a dividend in 3 years, which suggests lingering post-crisis issues with its capitalization. Raiffeisen has the broadest footprint of the three banks, with significant exposure across most of the CEE/CIS region. Although Raiffeisen has more Romania exposure (following my thesis) than OTP does, I would tend to favor OTP taking into account the ratios.

There aren’t really any ETFs that specialize in the EEU. The SPDR S&P Emerging Europe ETF (NYSE:GUR) is heavily concentrated in Poland and Russia, but has significant Turkey exposure too. On the frontier markets side, the Guggenheim Frontier Markets ETF (FRN) comes closest, but only 6-7% of its holdings are EEU. If you’re willing to invest in local currency and don’t mind a heavy energy-sector concentration, Franklin Templeton-managed Fondul Proprietatea (FP) is a Bucharest-listed closed-end fund that provides a proxy for Romania. And is typical for a closed-end fund, it trades at a discount to net asset value, averaging around 28% this year.

Conclusions

The US stock markets are quite high so alternatives should be considered. Alternatives in Eastern Europe are considered above. Significant risks do exist. But rewarding investment opportunities also exist for savvy investors.