Investment management (part of the broader Finance sector) performed decently over the last several quarters. This time too, decent results are anticipated on positive markets, favorable currencies and better-than-expected flows.

The S&P 500 Index recorded a total return of 3.1% in the second quarter. Though the U.S. equity market recorded positive returns amid mixed economic data, it underperformed both non-U.S. developed and emerging markets. Hence, asset managers with global presence are anticipated to record a rise in equity asset under management (AUM). Moreover, weakness of the U.S. dollar drove the global diversified AUM mix.

Further, rising interest rates are expected to lead to decline in fee waivers. Also, demand for alternative investment sources might have aided revenue growth for the investment managers. However, rise in operating expenses, driven by marketing and investments might hurt the bottom line.

Conversely, during the quarter, fixed income generated positive returns as investors ran for safe haven assets. Consequently, fixed income prices increased and resulted in reduced yields.

Notably, some investment managers, including The Blackstone Group L.P. (NYSE:BX) , T. Rowe Price Group, Inc. (NASDAQ:TROW) , Ameriprise Financial Inc.’s (NYSE:AMP) and BlackRock, Inc. (NYSE:BLK) , have already released results. Out of these, Blackstone Group and BlackRock missed estimates despite recording AUM growth, while T. Rowe Price and Ameriprise beat estimates.

Notably, per our Earnings Preview, overall earnings for the Investment managers in second-quarter 2017 are likely to be up 7.7%.

Our quantitative model offers some insights into stocks that are about to report earnings. Per the model, in order to be confident of an earnings beat, a stock needs to have the right combination of the two key ingredients – a positive Earnings ESPand a Zacks Rank #3 (Hold) or better. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Let’s take a look at the investment management stocks that are scheduled to release quarterly numbers on Jul 28.

Franklin Resources, Inc. (NYSE:BEN) is scheduled to report fiscal third-quarter 2017 (ended Jun 30) results before the opening bell. Given Franklin’s AUM disclosure for Jun 2017, the upcoming release will display higher assets under management on a year-over-year basis. Franklin’s cost-control efforts should support bottom-line growth to some extent. Notably, management expects expenses in fiscal 2017 to remain flat or decline slightly, considering the impact of previous cost-cutting initiatives.

In addition, we believe that the company’s top line will likely get support from its diversified portfolio offerings, as well as global presence (read more: Franklin to Post Q3 Earnings: A Surprise in the Cards?).

Moreover, our proven quantitative model predicts a likely earnings beat. The company has a Zacks Rank #3 with an Earnings ESP of +1.37%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

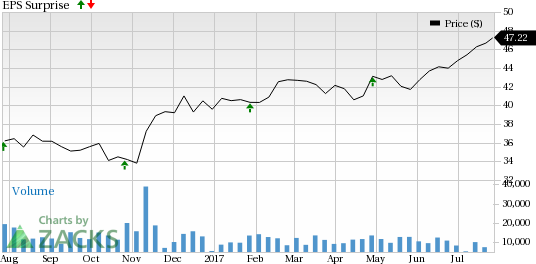

Notably, Franklin recorded positive earnings surprise in each of its trailing four quarters, with an average surprise of 14.80% as depicted in the chart below:

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential.

See these stocks now>>

WisdomTree Investments, Inc. (WETF): Free Stock Analysis Report

T. Rowe Price Group, Inc. (TROW): Free Stock Analysis Report

AMERIPRISE FINANCIAL SERVICES, INC. (AMP): Free Stock Analysis Report

The Blackstone Group L.P. (BX): Free Stock Analysis Report

Franklin Resources, Inc. (BEN): Free Stock Analysis Report

BlackRock, Inc. (BLK): Free Stock Analysis Report

Virtus Investment Partners, Inc. (VRTS): Free Stock Analysis Report

Original post

Zacks Investment Research