U.S. defense stocks have been witnessing significant upward trends, backed by factors like a growing international market for weaponries with more developing nations expanding their defense spending, the advent of innovative technologies in warfare and their increasing application as well as an increased demand for cost-efficient production. These, in turn, are also driving revenue growth in the broader Aerospace sector.

Moreover, a favorable defense spending strategy endorsed by the U.S. administration has also been another primary force driving these stocks. Evidently, this July, the U.S. House passed the fiscal 2018 defense policy bill worth $696.5 billion, which exceeded President Trump’s budget request. Notably, the defense budget reflects a 10% hike from the fiscal 2016 level.

The earnings picture for the third quarter of 2017 reveals a mixed bag in the near term. This is because the sector’s revenues are expected to improve 5% in the quarter, while earnings are expected to decline 13.7% (as of Sep 7, 2017). Nevertheless, considering the recent upward trajectory, in addition to the sumptuous flow of contracts from Pentagon, these numbers are most likely to improve as we proceed toward the next earnings season.

Is North Korea Driving Defense Stocks?

It is imperative to mention that the ongoing altercation between President Trump and North Korean leader Kim Jong-un has sent the major defense stocks rallying, of late.

Notably, on Aug 9, Trump warned North Korea that if the nation does not refrain from its repeated missiles threats, the United States will respond with “fire and fury.” In retaliation, Kim threatened to fire missiles on Guam, a U.S. territory in the Pacific, which houses military bases.

Consequently, while rest of the broader market reacted negatively to the escalated geopolitical tensions, defense stocks picked up pace. Next, at the end of the same month, North Korea fired a ballistic missile which flew over Japan's Hokkaido Island before crashing in to the sea. This pushed the major defense biggies to new highs.

Again, on Sep 3, North Korea successfully tested a hydrogen bomb. This once again rattled the broader stock market, as this nuclear test is the most severe foreign affairs emergency that the United States has witnessed in years.

In retaliation, Defense Secretary James Mattis gave a strict warning to North Korea, saying that if North Korea does not refrain from such violent acts against the United States or its allies, then the country will have to face a massive military response.

This time also, the U.S. defense stocks took a surge following the nuclear test, which indicated yet another major dispute between North Korea and America.

3 Defense Stocks to Buy

We have hereby zeroed in 3 defense stocks, which sport a Zacks Rank #1 (Strong Buy) or 2 (Buy) and promise long-term expected growth rate of 5% or higher, comparing favorably with the broader industry. We also have taken a Growth Style Score of A or B into consideration.

Our Growth Style Score highlights all of the vital metrics of the company’s financials to obtain a clearer picture of the quality and sustainability of its growth. Our research shows that stocks with Style Scores of A or B, when combined with a Zacks Rank #1 or 2, offer the best investment opportunities.

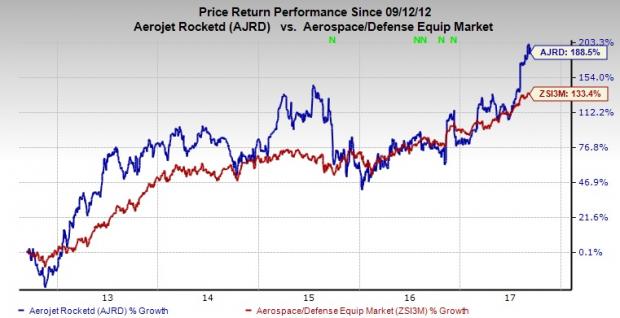

Aerojet Rocketdyne Holdings, Inc. (NYSE:AJRD) focuses on developing military, civil and commercial systems and components for the aerospace and defense industry markets.

The company’s projected earnings per share (EPS) growth for the next five years is 8%. Its Zacks Consensus Estimate for the current-year earnings climbed 17.8% over the last 60 days. Currently, Aerojet Rocketdyne has a Growth Score of A and sports a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here

The company’s stock has skyrocketed 188.5% in the last five years, outperforming the broader industry’s growth of 133.4%.

The Boeing Co. (NYSE:BA) is the largest aircraft manufacturer in the world in terms of revenues, orders and deliveries. It is also one of the largest aerospace and defense contractors.

The company currently holds a Zacks Rank #2 and its projected EPS growth for the next five years is 13%. Its Zacks Consensus Estimate for the current-year earnings moved up 1.2% over the last 30 days. Additionally, Boeing has a Growth Score of A.

Boeing’s share price has surged 239.1% in the last five years, outperforming the broader industry’s gain of 186.1%.

Huntington Ingalls Industries, Inc. (NYSE:HII) designs, builds and maintains nuclear-powered ships such as aircraft carriers and submarines, and non-nuclear ships like surface combatants, expeditionary warfare/amphibious assault and coastal defense surface ships for the U.S. Navy and Coast Guard. Moreover, it provides after-market services for military ships around the globe.

The company’s projected EPS growth for the next five years is 15%. Its Zacks Consensus Estimate for the current-year earnings inched up 0.4% over the last 30 days. Huntington Ingalls currently carries a Zacks Rank #2 and has a Growth Score of B.

Further, the stock has soared 416.9% in the last five years, outperforming the broader industry’s rally of 186.1%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Boeing Company (The) (BA): Free Stock Analysis Report

Huntington Ingalls Industries, Inc. (HII): Free Stock Analysis Report

Aerojet Rocketdyne Holdings, Inc. (AJRD): Free Stock Analysis Report

Original post

Zacks Investment Research