The invalidations of breakouts and breakdowns are strong signals in the opposite direction, and we just saw them throughout the market—also in gold.

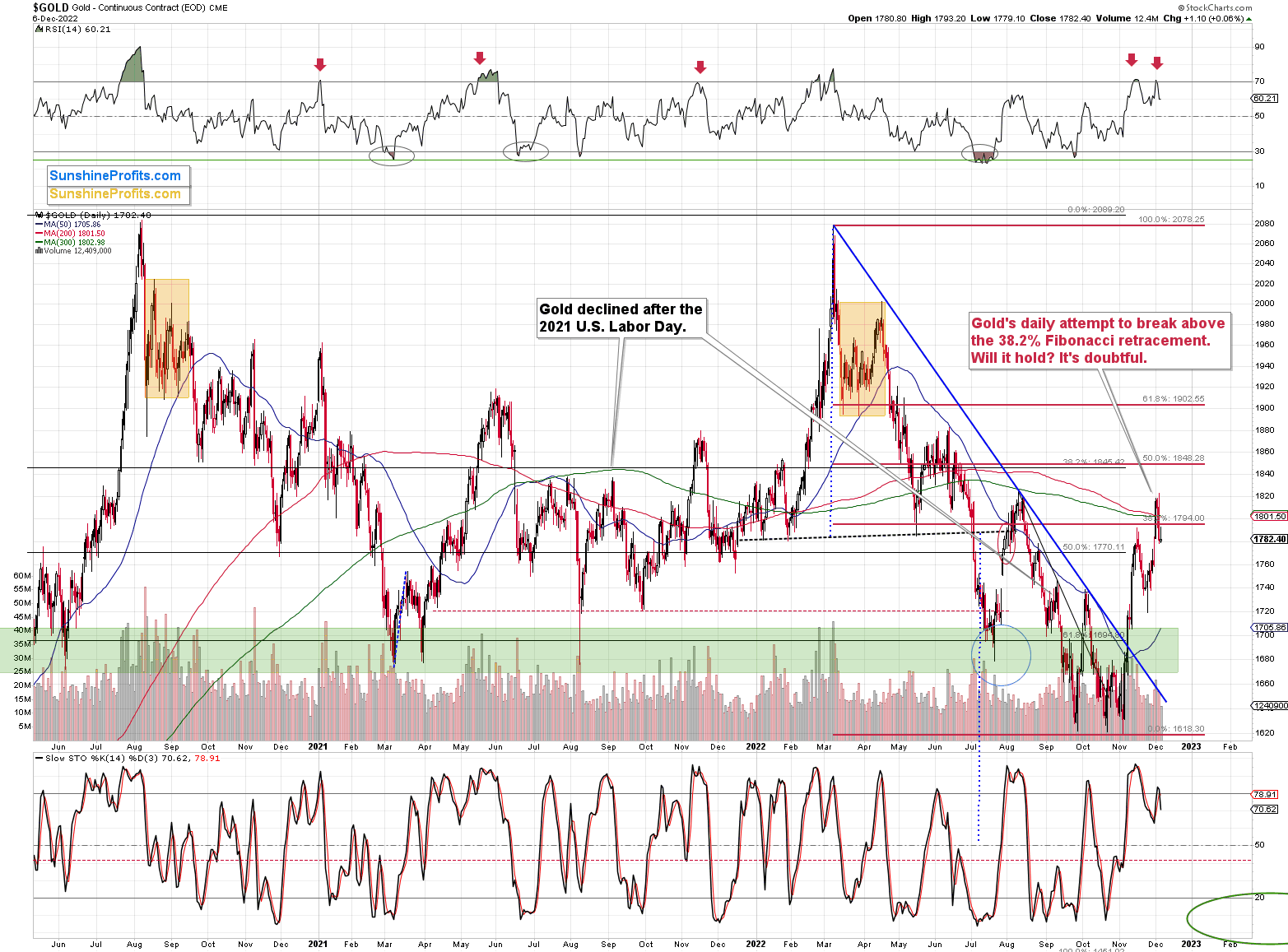

The gold price has recently invalidated its small breakout above the 38.2% Fibonacci retracement level, which is a strong bearish sign. If it was just gold where we saw this kind of performance, we could say it was by chance.

However, since we saw it almost everywhere (at least in almost every market that really counts for precious metals investors and traders), it’s something that shouldn’t be overlooked.

Especially since this invalidation coincided with a sell signal from the RSI indicator, which had just dropped below the 70 level. I used red arrows to mark previous cases where we saw something similar, and — you guessed it — declines followed in the majority of those cases.

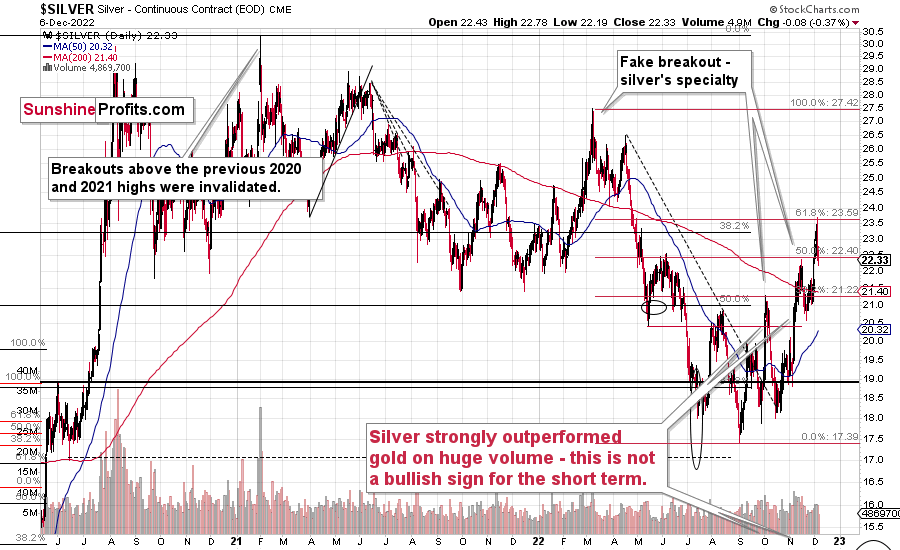

Silver is the odd guy, because it didn’t invalidate the breakout above the 38.2% retracement based on the 2022 decline. Instead, it invalidated its tiny breakout above the 61.8% retracement.

Fair enough, since silver is known to outperform gold just before bigger declines. The size of the correction seems to confirm this trading technique.

This is a subtle indication that silver’s very short-term outperformance remains intact, and it continues to have bearish implications for the short term.

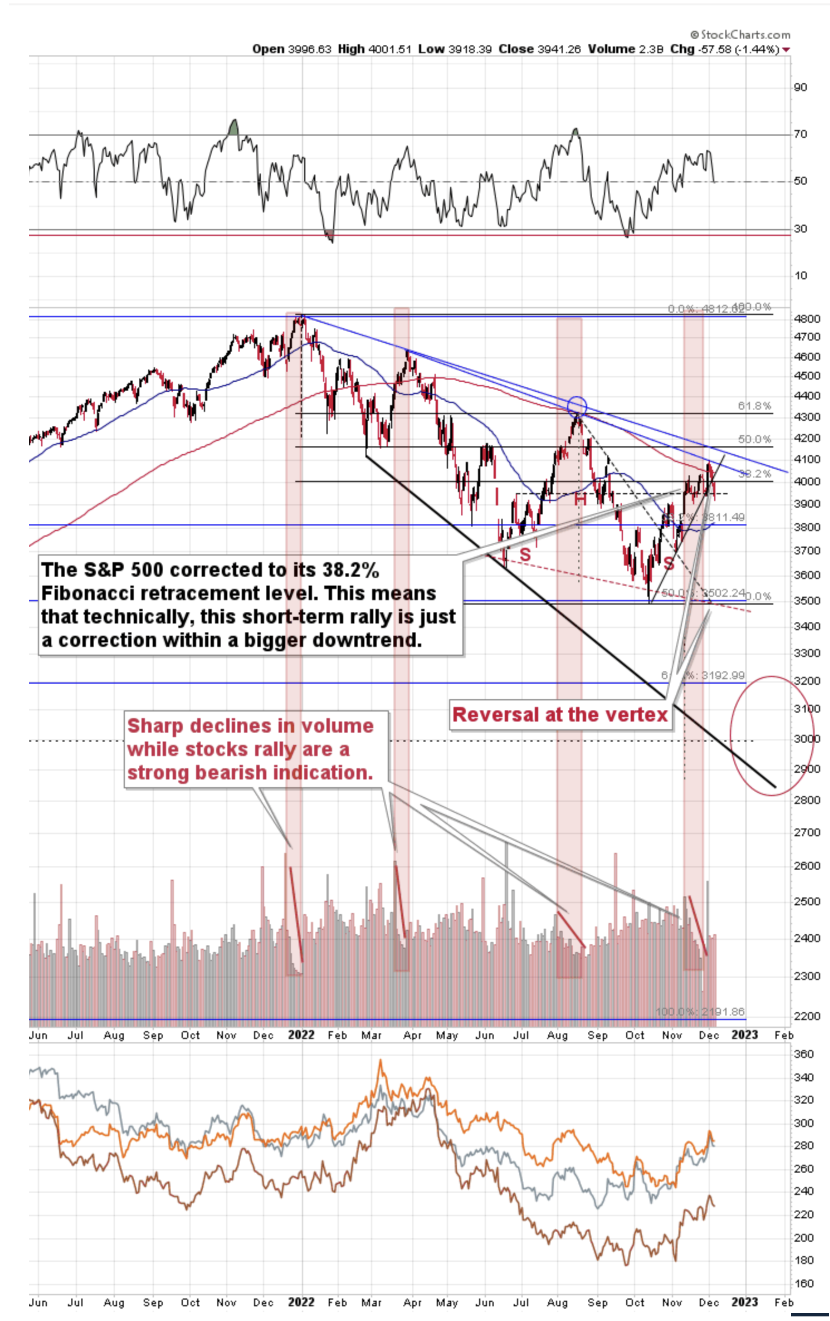

Stocks Invalidated Their Breakout, Too

As I wrote earlier, it’s not just the precious metals market that invalidated its recent breakouts – we saw something very similar in the S&P 500 Index.

The broad market moved lower this week, and there are two good reasons to think that, this time, the small move lower is just the beginning of a much bigger move to the downside.

One of the reasons is that this move lower came right after the triangle-vertex-based turning point. The declining black and red lines (both dashed) intersect at more or less the very recent top. As their name says, those turning points mark… Well, turning points. And since the most recent short-term move was to the upside, it currently has bearish implications.

The second reason is that stocks now broke below their rising support line (marked with a solid black line), and that’s not what happened during the two previous small moves lower.

The analogy in the price-volume link (marked with red rectangles) also points to much lower prices in the stock market.

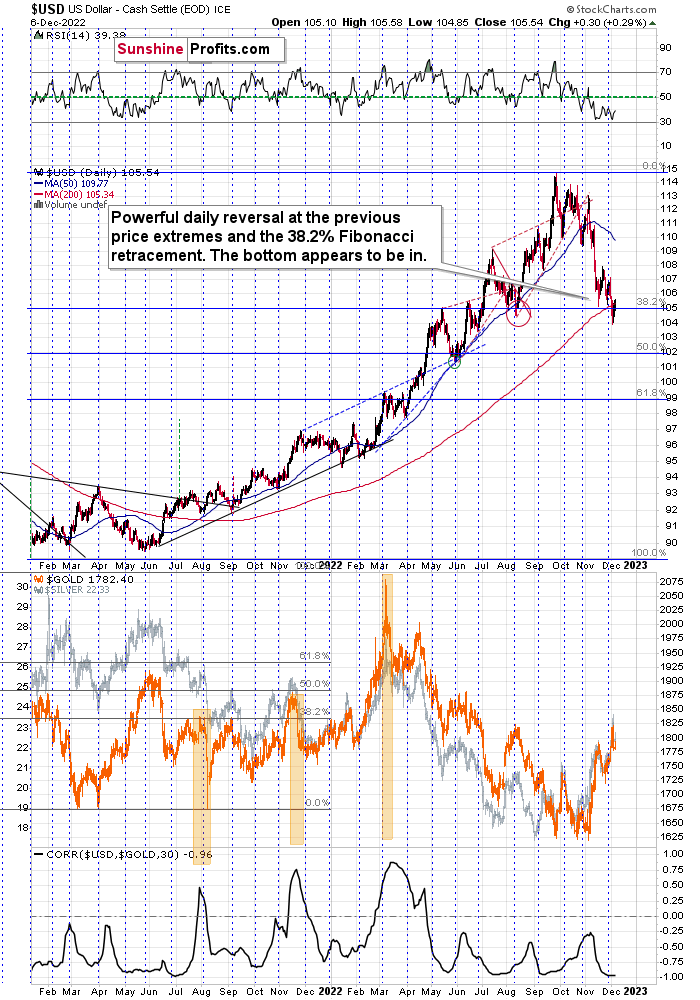

What About the U.S. Dollar Index?

Why is this important for gold and silver investors and traders? Because the last two big moves took place more or less in line with each other – in stocks and in precious metals (and miners). The slide in stocks could also trigger something similar in the case of commodities like crude oil. The same thing is likely to happen again this time, especially given what’s happening in the U.S. dollar index (USDX).

The USDX just invalidated a small breakout below its previous 2022 lows and its 38.2% Fibonacci retracement level. And it did so while being oversold from RSI’s point of view.

In fact, looking at the RSI, the current situation is very similar to what we saw in early June 2021. And you know what happened to gold shortly thereafter? It plunged.

So all in all, the outlook for the precious metals market is currently very bearish, not just from a medium-term point of view (which is mostly based on factors that I didn’t cover above), but also from a short-term point of view. Given the situation in both precious metals, and the stock market, it seems that the junior mining stocks are poised to decline the most.

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.