Intuit Inc. (NASDAQ:INTU) just released its fourth-quarter and full-year 2017 financial results, posting earnings of $0.20 per share and revenues of $842 million. Currently, Intuit is a Zacks Rank #3 (Hold), and is down 0.80% to $137.05 per share in after-hours trading shortly after its earnings report was released.

Intuit Inc. (INTU):

Beat earnings estimates. The company posted adjusted earnings of $0.20 per share, beating Zacks Consensus estimates of $0.16 per share.

Beat revenue estimates. The company saw revenue figures of $842 million, topping our consensus estimate of $805 million.

Intuit’s fourth-quarter revenues increased 12% year-over-year, which was bolstered by a 33% jump in revenues from its “small business online ecosystem.”

Full-year fiscal 2017 revenues rose by 10% from the year-ago period to $5.2 billion. The company’s GAAP operating income also jumped by 12% to $1.4 billion, while non-GAAP operating income climbed to $1.7 billion.

Intuit ended fiscal 2017 with 2,383,000 total QuickBooks Online subscribers, marking a growth rate of 58%. The company repurchased over $360 million shares in its fourth-quarter to raise the full-year total to over $830 million. Intuit’s board approved a $0.39 per share dividend, payable on October 18.

The company projects first-quarter 2018 revenues will grow between 8% and 11% to reach between $840 million and $860 million. Intuit expects a GAAP loss of $0.17 a share to $0.19 a share, and non-GAAP earnings per share of $0.03 to $0.05.

Intuit expects full-fiscal year revenues between $5.64 billion and $5.74 billion, which would mark 9% to 11% growth. The company projects GAAP earnings per share will grow by 8% to 10% and hit $4.00 to $4.10. Intuit’s expects to report non-GAAP earnings of $4.90 per share to $5.00 per share, which would mark a growth rate of 11% to 13%.

Intuit also announced that its long-time Chief Financial Officer, Neil Williams is set to step down in January 2018. The company’s Senior VP of Finance for Intuit’s Consumer Tax Group, Michelle Clatterbuck it set to take over for Williams in February.

"We had an excellent finish to the quarter and full year across the company," Intuit's Chairman and CEO Brad Smith said in a statement. "In Small Business we are encouraged by the momentum driving QuickBooks Online subscriber growth as well as online ecosystem revenue growth. We are also pleased with our success in Consumer Tax and ProConnect, with both delivering revenue at the high end of our expectations this tax season.”

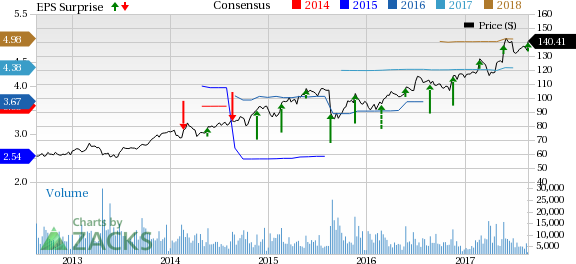

Here’s a graph that looks at Intuit’s Price, Consensus and EPS Surprise history:

Intuit's mission is to revolutionize how people manage their financial activities. The company's objective is to greatly expand the world of electronic finance. Electronic finance encompasses three types of products and services: desktop software products that operate on customers' personal computers to automate financial tasks; products and services that are delivered via the Internet; and products and services that connect Internet-based services with desktop software to enable customers to integrate their financial activities.

Check back later for our full analysis on Intuit’s earnings report!

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month. Learn the secret >>

Intuit Inc. (INTU): Free Stock Analysis Report

Original post

Zacks Investment Research