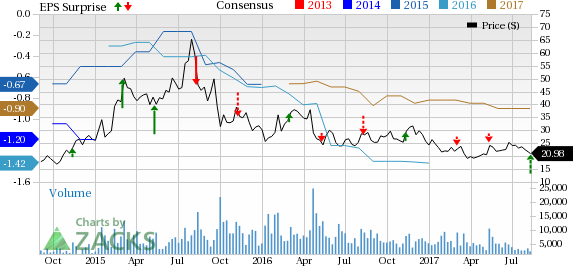

Intrexon Corporation (NYSE:XON) incurred loss of 16 cents per share in the second quarter of 2017, which was narrower than the Zacks Consensus Estimate loss of 21 cents.

Total revenue came in at $54.4 million in the quarter, up 4% year over year. Reported revenues missed the Zacks Consensus Estimate of $57 million.

Notably, the stock has been down 17.2% on a year-to-date basis compared with the Zacks classified industry’s gain of 1.9%.

Quarter in Detail

Intrexon’s revenues primarily consist of collaboration and licensing revenues as well as product and service revenues.

Collaboration and licensing revenues increased 2.5% to $28.2 million year over year. The uptick was owing to the recognition of deferred revenue associated with the payment received in June 2016 from ZIOPHARM Oncology, Inc. (NASDAQ:ZIOP) , to amend the collaborations between the parties.

While product revenues came in at $9.9 million, down 8.3% from the year-ago period, service revenues amounted to $15.9 million, up 14.1% year over year.

Notably, the company follows a business model under which it commercializes its technologies through exclusive channel collaborations (ECC), licensing agreements and joint ventures with collaborators that have market and product development expertise as well as sales and marketing capabilities to bring new and improved products and processes to market. Such agreements provide the company with funds in the form of technology access fees along with milestones and other payments.

Furthermore, the company is developing several candidates in partnership with other companies.

In May 2017, Intrexon’s collaborator, ZIOPHARM, announced that the FDA accepted investigator-initiated Investigational New Drug (IND) application for a phase I study infusing Intrexon’s CD33-specific chimeric antigen receptor T cell (CAR-T) and therapy, for the treatment of relapsed or refractory acute myeloid leukemia (AML). First patient is expected to begin treatment in the third quarter of 2017.

ZIOPHARM's immuno-oncology programs, in collaboration with Intrexon, include CAR-T and other adoptive cell-based approaches that use non-viral gene transfer methods for broad scalability.

During the quarter, the company accelerated its plans to move the healthcare business into Precigen, Inc., a wholly owned subsidiary of Intrexon transitioning into a fully-integrated biotherapeutics company and leading player in gene and cell therapy. Currently, the consolidation of health-related assets is ongoing and the company is on track to complete this project by year-end 2017.

In Mar 2017, Intrexon announced the formation of Precigen, Inc., a wholly-owned subsidiary of the company as part of an ongoing evaluation of structural alternatives concerning its business in healthcare. Going forward, it plans to consolidate all health-related assets under this new corporate entity as the company considers potential strategic options to enhance shareholder value.

Additionally, Intrexon completed the acquisition of GenVec, Inc. in the reported quarter. It also announced plans to integrate GenVec's industry-leading gene delivery system with Intrexon's synthetic biology technologies to develop a next generation adenoviral platform with a significantly higher payload capacity that exceeds 30kb as compared to current viral delivery methods ranging from 4.5kb – 9kb.

Zacks Rank & Stocks to Consider

Intrexon is a Zacks Rank #3 (Hold) company. Better-ranked pharma stocks in the same space include Enzo Biochem, Inc. (NYSE:ENZ) and Sanofi (NYSE:SNY) sporting a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Enzo Biochem’s loss per share estimates narrowed from 12 cents to 7 cents for 2017 and from 11 cents to 3 cents for 2018, over the last 60 days. The company delivered positive earnings surprises in all the trailing four quarters, with an average beat of 55.83%. The share price of the company has increased 61.1% year to date.

Sanofi’s earnings per share estimates increased from $3.18 to $3.31 for 2017 and from $3.30 to $3.38 for 2018, over last 30 days. The company came up with positive earnings surprises in two of the trailing four quarters, with an average beat of 5.10%. The share price of the company has increased 18.1% year to date.

One Simple Trading Idea

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars. This proven stock-picking system is grounded on a single big idea that can be fortune shaping and life changing. You can apply it to your portfolio starting today. Learn more >>

Sanofi (SNY): Free Stock Analysis Report

ZIOPHARM Oncology Inc (ZIOP): Free Stock Analysis Report

Enzo Biochem, Inc. (ENZ): Free Stock Analysis Report

Intrexon Corporation (XON): Free Stock Analysis Report

Original post

Zacks Investment Research