The following are the intraday outlooks for EUR/USD, USD/JPY, AUD/NZD and S&P500 as provided by the technical strategy team at SEB Group.

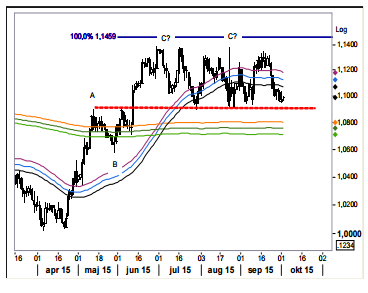

EUR/USD: Looking for a downside exit. The final bounce (wave-e if looking into an hourly graph) went a few points higher (1.1209) than the outlined 1.1186 – 94 before stalling. With the five sub-waves (a-e) now likely in place (an alternative is a continued bounce to the upper boundary, 1.1260, before peaking) downside risks are rapidly on the rise. Once the triangle has been exited the March trend line will come into the limelight.

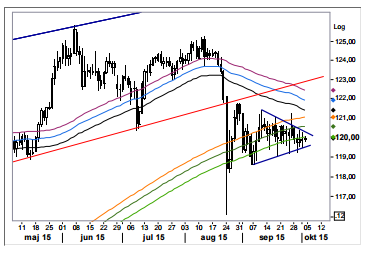

USD/JPY: Something’s got to give. With the prices now out into the apex area of the triangle the probability for a directional move is decreasing (there’s a tendency for triangles that comes too close to the apex point to just disintegrate hence leaving no directional clue). NFP today will of course be a key event as continued falling US bond yields will be a drag on USD/JPY suggesting a downside solution to the current stalemate.

AUD/NZD: Heading for a key support test. Underpinned by recovering dairy prices the NZD has recovered some its previous losses (whereas for instance iron ore seems to have ended its recent reaction hence imposing downside pressure on the AUD). The cross, also underpinned by a lower high in Sept, now seems to be just about to make a test of the important 1.0895/1.0915 support zone. If broken, a double/triple top will be confirmed in place indicating potential losses down toward the 1.05-area.

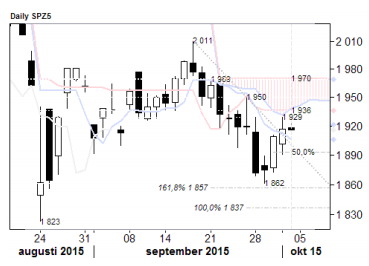

S&P 500: Respecting nearby resistance. TA 2nd winner was added yesterday, but overhead dynamic resistance (1,92936) was left at rest. Expect those to lid and 1,892/90 to floor the market into NFP – then we’ll see…