The second-quarter earnings season is in full swing, with over 171 S&P 500 members having reported their results as of Jul 26, 2017.

Per the latest Earnings Trends, total earnings are up 8.8% on a year-over-year basis, while total revenue saw a 3.4% rise. 78.9% of the companies beat EPS estimates. Meanwhile, almost 70.8% of the companies beat top-line estimates as well.

The trend indicates that we will finally see four back-to-back quarters of earnings growth after five straight declines. Total second-quarter earnings for S&P 500 companies are now expected to increase 8.7% year over year, with a 4.7% rise in revenues.

Growth has been driven by strength in Energy, Technology, Aerospace, Construction, Finance, and Industrial Products sectors. This week has seen a vast majority of results from tech companies, including Amazon (NASDAQ:AMZN) and Facebook (NASDAQ:FB) .

The techsector has been a strong performer driven by solid demand for cloud-based platforms, increasing adoption of Artificial Intelligence (AI) solutions, Augmented/Virtual reality (AR/VR) devices, autonomous cars, advanced driver-assisted systems (ADAS) and Internet of Things (IoT) related software. Total earnings for tech sector companies are up 13.5% on 7.2% higher revenues from the prior-year quarter.

According to the report, total earnings of the tech sector are likely to be up 11.8% on 6.3% higher revenues for the first quarter.

Let’s see what’s in store for three tech stocks, all of which are expected to release quarterly numbers on Jul 31.

Pandora Media Inc (NYSE:P) is slated to report second-quarter 2017 results. The company is likely to beat expectations this quarter as it has a favorablecombination of a Zacks Rank #3 (Hold) and an Earnings ESP of 15.39%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Per our proven model, a company needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 to deliver an earnings surprise. You can see the complete list of today’s Zacks #1 Rank stocks here.

We caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into an earnings announcement, especially when the company is seeing negative estimate revisions.

For Pandora, the Zacks Consensus Estimate for the quarter is pegged at loss of 39 cents. Last quarter, the company posted a positive earnings surprise of 26.00%. Notably, Pandora has outperformed the Zacks Consensus Estimate over the trailing four quarters, with an average positive surprise of 18.46%. (Read: Is a Beat in Store for Pandora this Earnings Season?)

In the past one year, the company has underperformed the industry. While the industry gained 18.7%, Pandora lost 26.8% over the same time frame.

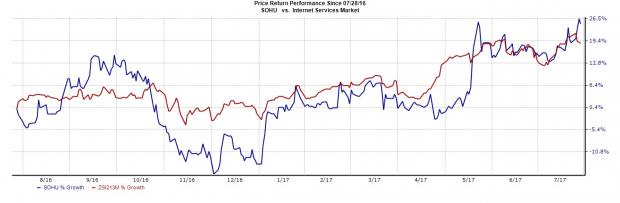

Sohu.com, Inc. (NASDAQ:SOHU) is unlikely to beat second-quarter 2017 expectations as it has an Earnings ESP of 0.00% and a Zacks Rank #3. The Zacks Consensus Estimate for the quarter is pegged at a loss of $1.73. (Read: What's in the Cards for Sohu.com in Q2 Earnings?)

In the past one year, the stock has returned 24.7%, substantially outperforming the 18.7% gain of the industry it belongs to.

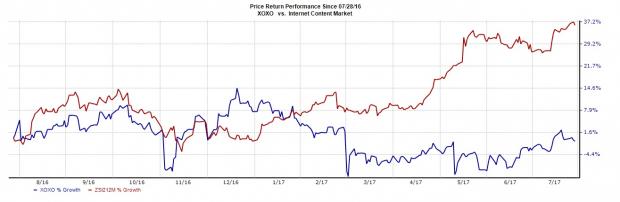

XO Group Inc. (NYSE:XOXO) is also unlikely to beat second-quarter 2017 expectations as it has an Earnings ESP of 0.00% and a Zacks Rank #3. The Zacks Consensus Estimate for the quarter is pegged at 11 cents. Notably, XO Group has an average positive surprise of 2.22% in the trailing four quarters.

In the past one year, the stock has depreciated 0.9% against the industry’s gain of 35.9%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaries," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

XO Group, Inc. (XOXO): Free Stock Analysis Report

Sohu.com Inc. (SOHU): Free Stock Analysis Report

Facebook, Inc. (FB): Free Stock Analysis Report

Pandora Media, Inc. (P): Free Stock Analysis Report

Original post

Zacks Investment Research