Dual portfolio drives recent outperformance

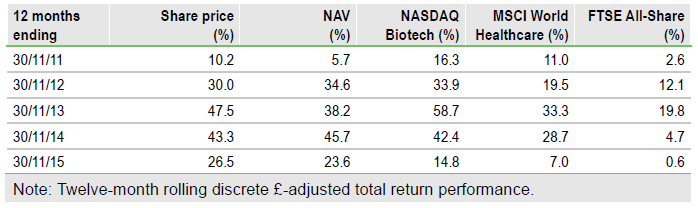

International Biotechnology Trust (L:IBT) is an established investor in the high-growth area of biotechnology. It is differentiated from peers by including unquoted companies (<10% of assets) alongside quoted holdings. The biotech sector seems largely to have shrugged off recent criticism over excessive pricing in some areas and long-term performance has been impressive, with the benchmark NASDAQ Biotech Index up 304% over five years compared with a return of 45% for the FTSE All-Share. IBT has outperformed the benchmark over one and two years under new manager Carl Harald Janson and is top of its peer group for one-year NAV total returns; the discount to NAV, while in line with averages, remains wider than peers, suggesting a relative valuation opportunity.

Investment strategy: Seeking strong candidates

IBT blends investment in quoted (>90%) and unquoted biotechnology companies. The managers of the quoted portfolio seek attractively valued companies with strong management and innovative, wholly owned assets, addressing high unmet medical need. Potential investments should demonstrate strong and differentiated intellectual property, with pricing power in growing markets. In the unquoted portfolio, companies may have been started or incubated by the SVLS venture team, although to reduce risk they are not usually considered for inclusion in IBT until there is proof of concept.

To Read the Entire Report Please Click on the pdf File Below