Arguably the focus of the US session has been the bizarre events unfolding at Tesla (NASDAQ:TSLA), and whether Elon Musk is genuinely going to take the business private, with his suggestions that it is on the cards occurring shortly after the Saudi Sovereign Wealth Fund had amassed a $2 billion stake in the company.

Tesla’s bonds due 2025 rallied to the highest levels since March, as did the equity, while their Credit Default Swaps continue to tighten. However, what we have seen front and centre once again is that there is no stock in the equity markets globally that divides and promotes such raw emotion than a move in Tesla. Especially one caused by Elon Musk himself and one that seemingly has no real meat on the bone to justify the stock closing on its highs.

More broadly, US equities continued their steady grind higher (the S&P 500 closed +0.3% at 2858), with energy, industrials and financials having the outperformance on the day. Feeding the good-will was an upbeat European session, which in itself would have taken modest uplift from a relief rally in Chinese mainland and offshore (Hong Kong) equity indices, which were buoyed on by property stocks, with Evergrande and Country Garden giving good earnings outlooks. The Shanghai Property Index closed up 4.4% - the biggest one-day gain since August 2016. It wouldn’t surprise to see follow-through buying in this space today which could support sentiment in the region, although if this sub-index were easily tradable, I would be looking at higher levels at which to sell.

The fairly positive flow around markets was seen in commodities, with copper and lumber, two commodities which are seen as bellwethers on what has been seemingly deteriorating economics, closing up 0.8% and 0.9% respectively. Gold closed on a flat note, with the metal currently residing at $1211 and facing the cross-current of a slight weaker USD (the DXY was 0.2% weaker on the session), while at the same time we have seen US Treasuries offered across the curve, with the 10-year sitting at 2.97% and up three basis points (bp) on the day. Adjust the 10-year Treasury for inflation expectations, or what we know as ‘real’ yield, and we can see this has moved up to 84bp and now resides sits at the top of the range, and again this is a modest headwind for anything without a yield - such as gold.

The debate around the near-term direction on US Treasuries rolls on and isn’t going away. It seems fitting then to highlight that we have seen confirmation that the Trump administration has imposed a further $16 billion of tariffs on Chinese imports and this won’t shock as it was always part of the $50 billion previously identified.

As detailed yesterday, a decision on the $200 billion comes in September, and perhaps we may even see further tariffs imposed on the remaining $250 billion in trade further down the line, and the balance of probabilities suggests that will be the case. However, one thing that seems clear is that while Trump is coming from a position of relative economic strength, there is no doubt that these tariffs are going to be inflationary for the US economy. Chinese exporters are not going to take the hit to margin and while this indirect tax on the US consumer will be partially offset by a more accommodative fiscal position in the shape of tax cuts and infrastructure spending. The blow out in the US deficit and additional funding requirements of the US Treasury still suggests the market is under-pricing the risk this turns ugly in the coming months and should become a volatility event.

It also plays into the hands of those calling for higher Treasury yields longer-term.

In FX land there have been no clear pronounced trends in G10, with AUD and NOK advancing modestly against the USD. AUD/USD was interesting because a focus on the bond markets and we can see a strong widening of the premium demanded to hold US Treasury’s over Aussie debt blowing out by 10bp and this spread further incentives investors to hold USDs for the carry. The move higher in the AUD came at a time when the Australian interest rate curve adjusted modestly in the wake of the RBA statement, and we now see the markets base-case for a hike from the RBA pushed from September 2019 to November 2019.

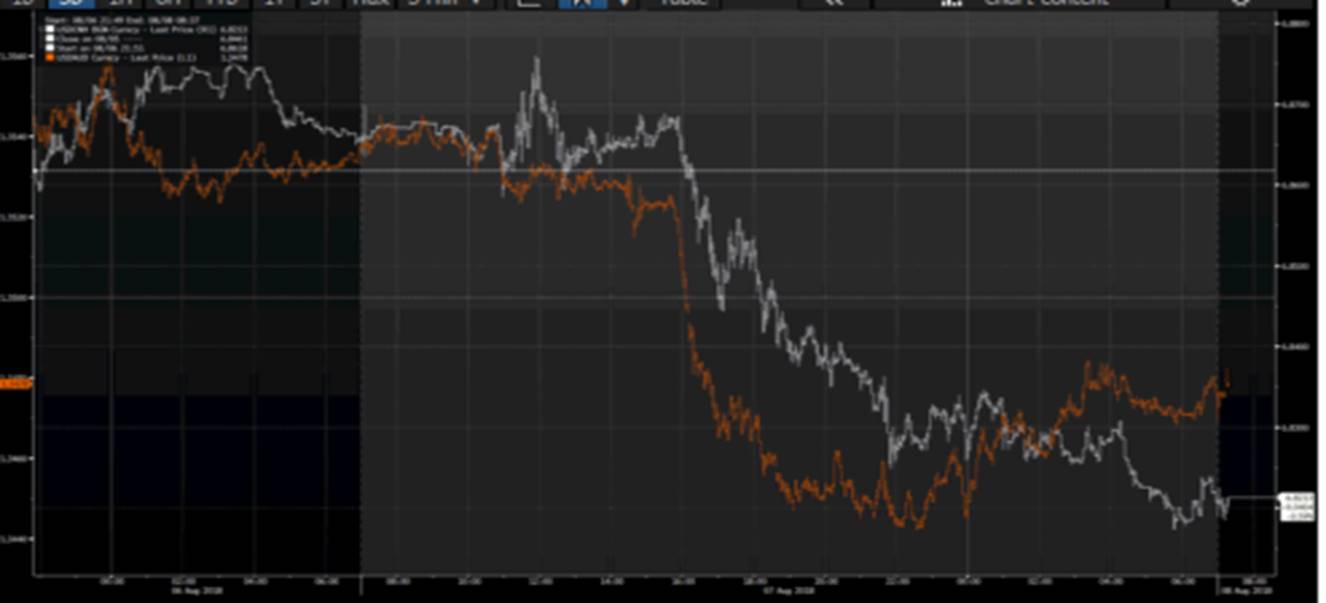

A simple overlap of AUD/USD and USD/CNH shows that the key influence in explaining the AUD/USD upside has been the move lower in USD/CNH, with the cross moving from 6.6862 into 6.6173 on reported demands from the PBoC to halt ‘herd behaviour’. So a weaker USD resonated through the China proxies (such as AUD) at a time when the Aussie rates market probably suggests selling AUD/USD.

AUD traders should keep an eye on RBA governor Phillip Lowe who speaks in Sydney at 13:05 aest. I am still holding a bias to sell moves into the top of the multi-week range at 0.7450, although I will reassess this bias on Friday ahead of the RBAs Statement on Monetary Policy and US core and headline CPI.

So, all leads are slightly reasonably supportive, and we should see China, Japan and the ASX 200 open a touch higher. Here in Australia, BHP is likely to open 1% higher, although CBA will garner the lion’s share of the headlines. On first blush, the numbers are not going to blow the lights out, with FY cash earnings below the street's expectations and a weaker than expected ROE and the CET1 capital ratio of 10.1%. That said, the 2H dividend is higher than forecast at $2.31 (vs $2.26 consensus), and on a forward earnings multiple of 12.5x its valuation is undemanding, and investors can afford to give it some margin of error. All eyes remain on whether the ASX 200 can push into the top of its recent range of 6300 and how price behaves into this quasi-ceiling.