If you've been long bonds since July of 2015, it/s been a long and hard 6 months, as bond prices have fallen hard and yields have shot up. Could rates be peaking and bond prices at their lows? For sure, the short-term trend in bonds is down and yield is up. Is the longer-term trend about to change?

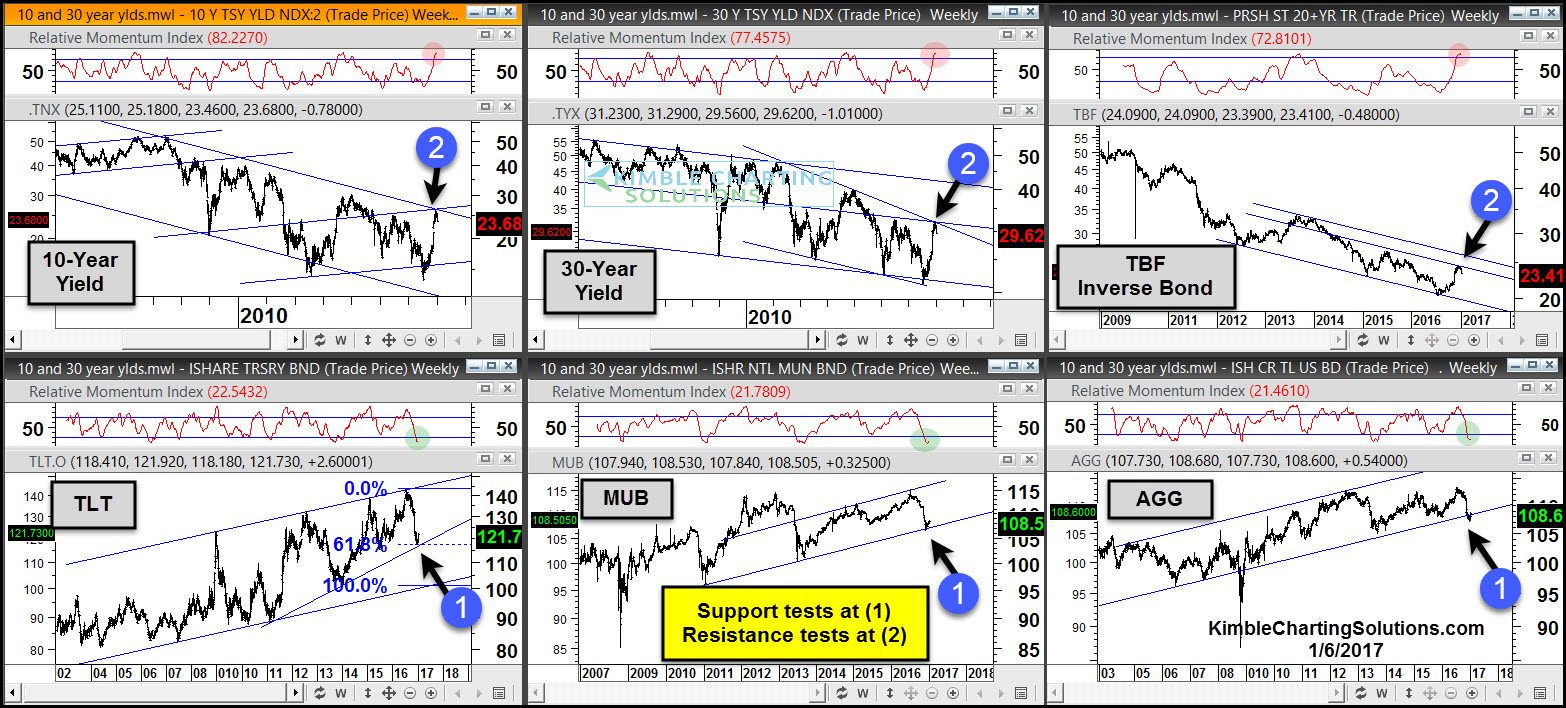

Below looks at our rate 6 pack, which shows price and yields.

The top row reflects that yields and inverse bond ETF TBF are all testing falling resistance in a downtrend, with momentum lofty. The bottom row shows that bond prices are testing support of rising channels, with momentum deeply oversold.

Sentimentrader.com reports that bond bulls on the 10-year yield are hard to find, as the bullish percentage now stands at 0%.

Below looks at the Stock/Bond and Bond/Stock ratios, which compares the S&P 500 to TLT, since TLT’s inception.

With yields testing falling resistance and bond prices testing rising support, the above ratio could become important when it comes to portfolio construction.

Full Disclosure; Premium Members shorted bonds at the highs in July and have recently purchased a long bond ETF.