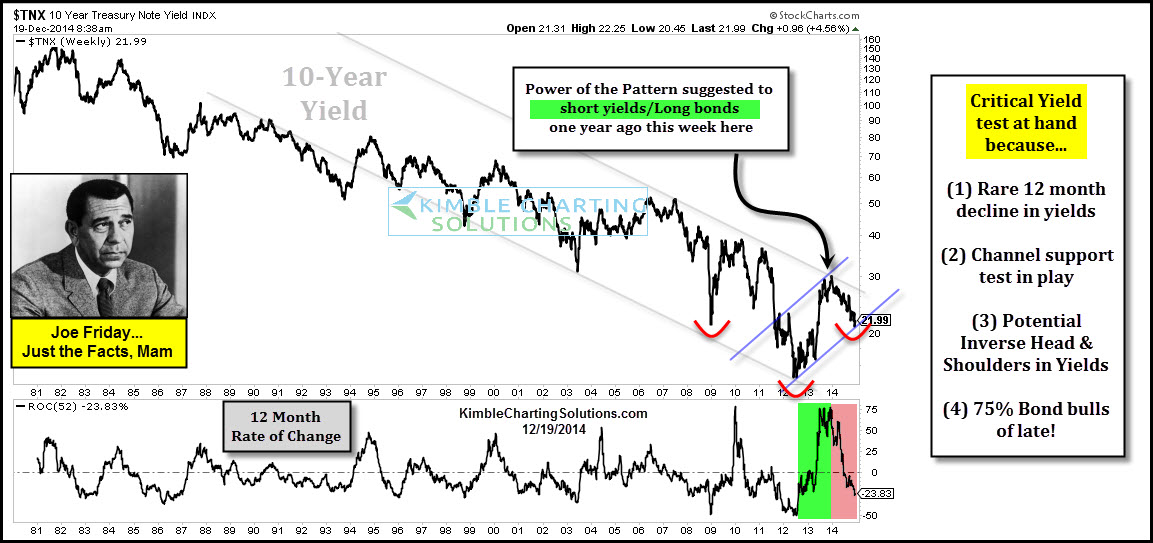

One year ago this week, the Power of the Pattern suggested interest rates were due for a BIG CHANGE and readers purchased iShares Barclays 20+ Year Treasury (ARCA:TLT).

Patterns suggested an interest rate decline/bond rally was due, while 100% of economists were predicting rates would do the opposite. (see post here) The S&P is having a good year (up 13%), anyone surprised that TLT is up over 50% more (20% overall)? That's now all in the past, so what about going forward?

Let me be perfectly clear on this point....There is not doubt long-term yields remain inside a multi-decade falling channel and if yields break support here, bonds will continue to do well as bond players would suggest deflationary pressure are still in the cards (taking place at this time).

Why could yields rise now? See above - (1) The U.S. 10-Year yield has experienced one of the largest 12-month rates of change in a few decades. (2) Yields are testing support of a 2-year rising channel. (3) Yields could be forming a bullish inverse head & shoulders pattern. (4) Market Vane reported recently that bond bulls stood at 75%.

Joe Friday says, "Yields could rise sharply if support holds here, due to patterns and sentiment conditions."

Full disclosure: Subscribers have no government bond positions at this time.