The second-quarter earnings season is busy wrapping up with only 16% members of the elite S&P 500 Index left to be reported. Per the latest Earnings Preview, the performance of 420 index members (accounting for 86.7% of the index’s total market capitalization), having already reported their financial numbers this quarter, indicates that total earnings have increased 11.6% on 5.6% higher revenues. The beat ratio is impressive with 74.3% companies surpassing the bottom-line expectations and 68.3%, outperforming with the top line.

The Finance sector (one of the 16 Zacks sectors) has delivered a strong performance till now and is almost done with results. 99% companies on the S&P 500 Index (accounting for 88.7% of the index’s total market capitalization) that have already reported quarterly results, shows 8.7% earnings growth on 3.6% increase in revenues, both on a year-over-year basis. The beat ratio of 77.9% for the bottom line and 68.4% for the top line compared favorably with that of the S&P 500.

The second quarter witnessed several catastrophe losses, likely to weigh on underwriting results as well as the bottom line of insurers. Per Aon Benfield, the global reinsurance intermediary and capital advisor of Aon plc (NYSE:AON) AON, the estimated amount of catastrophe losses suffered globally is $53 billion in the first half of 2017. A few insurers have incurred losses due to severe wind and hail catastrophe events, occurred during April-May in the U.S.

Nonetheless, prudent underwriting standards should have helped the insurers guard against the capital reserve erosion, conserved on a benign catastrophe environment.

Net investment income, a major component of an insurer’s top line, has witnessed improvement; albeit far lower than the historical highs. The Federal Reserve has been increasing the interest rates, reflecting confidence in the developing economic conditions. In fact, the Fed has raised interest rates thrice in three quarters. A better rate environment not only increased net investment income but has also improved investment yields.

Higher rates should offer some respite to the life insurers which suffered spread compression on products like fixed annuities and universal life due to continual low rates. Annuity sales should have also benefited from higher rates. However, life insurers have considerably curbed their exposure to interest-sensitive product lines.

Notably, an improving economy means more disposable income and a better consumer sentiment. This in turn might have also prompted more policy writings, thus driving the premiums higher to generate a lion’s share to an insurers’ top line. Besides, core business growth, geographic expansion, strategic buyouts and prudent capital deployment via share repurchase have probably encouraged the insurers.

On the flip side, we do not expect robust pricings. To write new business and retain renewals, insurers have been reducing the pricing pressure. Commercial property, workers’ compensation and general liability were mostly experiencing this low pricing.

Let’s find out where the following insurers stand before their release of quarterly numbers on Aug 8.

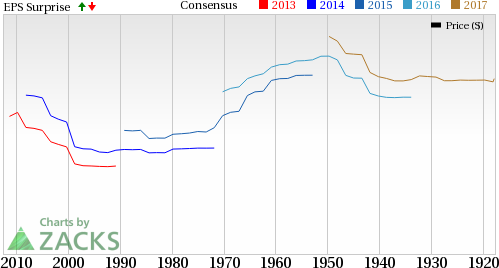

AmTrust Financial Services, Inc. (NASDAQ:AFSI) underwrites and provides property and casualty insurance in the United States and globally. Last quarter, the company missed the Zacks Consensus Estimate by 50%. The company’s current Zacks Rank #5 (Strong Sell) and an Earnings ESP of 0.00% leave our earnings surprise prediction inconclusive. Both the Most Accurate estimate and the Zacks Consensus Estimate stand at 41 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

We caution against the Sell-rated stocks (#4 or 5) going into an earnings announcement.

With respect to the surprise trend, AmTrust Financial beat estimates in two of the last four quarters but with an average negative surprise of 20.26%.

AmTrust Financial Services, Inc. Price and EPS Surprise

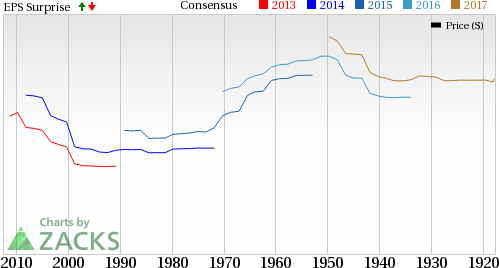

Primerica, Inc. (NYSE:PRI) distributes financial products to middle-income households in the United States and Canada. Last quarter, Primerica missed the Zacks Consensus Estimate by 3.48%. The company’s Zacks Rank #3 (Hold) increases the predictive power of ESP. However, its Earnings ESP of 0.00% makes surprise prediction difficult. The Most Accurate estimate and the Zacks Consensus Estimate are pegged at $1.35.

Per our proven model, a stock needs to have both a positive Earnings ESP and a favorable Zacks Rank #1 (Strong Buy), 2 or at least 3 for an earnings beat. You can see the complete list of today’s Zacks #1 Rank stocks here.

With respect to the surprise trend, Primerica surpassed expectations in two of the last four quarters with an average beat of 4.19%.

Primerica, Inc. Price and EPS Surprise

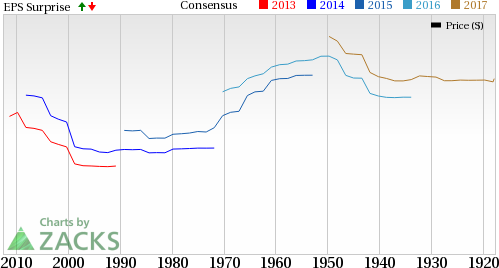

State Auto Financial Corporation (NASDAQ:STFC) engages in writing personal, business and specialty insurance products. Last quarter, the company missed the Zacks Consensus Estimate by 69.23%. It carries a Zacks Rank #4 with an Earnings ESP of 0.00%. We caution against all Sell-rated stocks (#4 or 5) going into an earnings announcement. Also, the company’s ESP of 0.00% makes our earnings surprise prediction difficult. For both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at a loss of 16 cents per share.

With respect to the surprise trend, State Auto Financial missed estimates in three of the last four quarters with an average miss of 52.79%.

State Auto Financial Corporation Price and EPS Surprise

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

Primerica, Inc. (PRI): Free Stock Analysis Report

AmTrust Financial Services, Inc. (AFSI): Free Stock Analysis Report

State Auto Financial Corporation (STFC): Free Stock Analysis Report

Original post

Zacks Investment Research