The second-quarter earnings season is at its high with 70% members of the elite S&P 500 Index having reported solid quarterly numbers so far. Per the latest Earnings Outlook, the performance of 350 index members (accounting for 79.3% of the index’s total market capitalization), having already reported their financial numbers this quarter, indicates that total earnings have increased 11% on 5.9% higher revenues. The beat ratio is impressive with 74% companies surpassing the bottom-line expectations and 16%, outperforming the top line.

The Finance sector (one of the 16 Zacks sectors) has delivered a strong performance till now. About 83.3% companies on the S&P 500 Index (accounting for 77.7% of the index’s total market capitalization) that have reported quarterly results, shows 7.1% earnings growth on 4.8% increase in revenues, both on a year-over-year basis. The beat ratio of 80.0% for the bottom line compared favorably with that of the S&P 500. However, the beat ratio of 66.3% for the top line is lower than the same of S&P 500.

The second quarter witnessed several catastrophe losses, likely to weigh on underwriting results as well as the bottom line of insurers. Per Aon Benfield, the global reinsurance intermediary and capital advisor of Aon plc (NYSE:AON) , the estimated amount of catastrophe losses suffered globally is $53 billion in the first half of 2017. A few insurers have incurred losses due to severe wind and hail catastrophe events, happened in during April-May in the U.S.

Nonetheless, prudent underwriting standards should have helped the insurers guard against capital reserve erosion, preserved on a benign catastrophe environment.

Net investment income, a major component of an insurer’s top line, has witnessed improvement; albeit far lower than the historical highs. The Federal Reserve has been increasing the interest rates, reflecting confidence in the developing economic conditions. In fact, the Fed has raised interest rates thrice in three quarters. A better rate environment not only increased net investment income but has also improved investment yields.

Higher rates should offer some respite to the life insurers which suffered spread compression on products like fixed annuities and universal life due to persistent low rates. Annuity sales should have also gained from higher rates. However, life insurers have considerably cut their exposure to interest-sensitive product lines.

Notably, an improving economy means more disposable income and a better consumer sentiment. This in turn might have also boosted more policy writings, driving the premiums higher to generate a lion’s share to an insurers’ top line. Besides, core business growth, geographic expansion, strategic buyouts and prudent capital deployment via share repurchase have probably lifted the insurers.

On the flip side, we do not expect pricings to have been strong. To write new business and retain renewals, insurers have been curbing the pricing pressure. Commercial property, workers’ compensation and general liability were mostly experiencing this soft pricing.

Let’s find out where the following insurers stand before their release of quarterly numbers on Aug 4.

Berkshire Hathaway Inc. BRK.B is a conglomerate providing insurance and reinsurance. Besides, it operates railroad systems, generates, transmits and distributes electricity, plus regulates natural gas distribution and storage facilities among others. Last quarter, Berkshire missed the Zacks Consensus Estimate by 15.79%. The company’s Zacks Rank #4 (Sell) and an Earnings ESP of 0.00% leave our earnings surprise prediction inconclusive. Both the Most Accurate estimate as well as the Zacks Consensus Estimate stand at $1.85. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

We caution against the Sell-rated stocks (#4 or 5) going into an earnings announcement.

Berkshire Hathaway is likely to report higher catastrophe losses in the soon-to-be-reported quarter, which in turn will render volatility to earnings. It has also likely experienced a decline in operating earnings across Insurance Operations and Finance & Financial products segments. However, the company’s Railroad, Utilities and Energy units have likely witnessed a rise in operating revenues. (Read: Berkshire Hathaway Q2 Earnings: What’s in Store?)

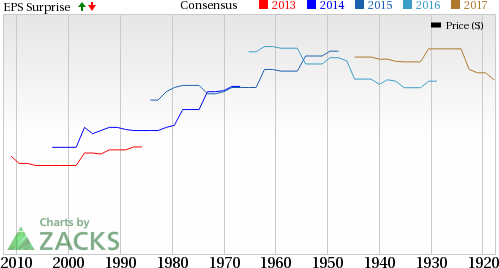

With respect to the surprise trend, Berkshire beat estimates in two of the last four quarters but with an average negative surprise of 3.12%.

Berkshire Hathaway Inc. (NYSE:BRKa) Price and EPS Surprise

Cigna Corp. (NYSE:CI) provides health care and related benefits, the majority of which are offered through workplace. Last quarter, Cigna beat the Zacks Consensus Estimate by 13.52%. The company’s Zacks Rank #2 (Buy) with an Earnings ESP of +1.61% makes us confident about an earnings surprise this quarter. The Most Accurate estimate is pegged at $2.52 while the Zacks Consensus Estimate stands at $2.48 per share.

Per our proven model, a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 or at least 3 (Hold) for an earnings beat. You can see the complete list of today’s Zacks #1 Rank stocks here.

Cigna’s upcoming results are expected to demonstrate its continued strong operating performance from the Global Supplemental Benefits business. Strong management of fee-for-service expenses will keep the medical costs at bay. Group Disability and Life segment, premiums and fees are expected to grow on the back of modifications in the claims process made last year. (Read: Is a Beat in Store for Cigna Corp This Earnings Season?)

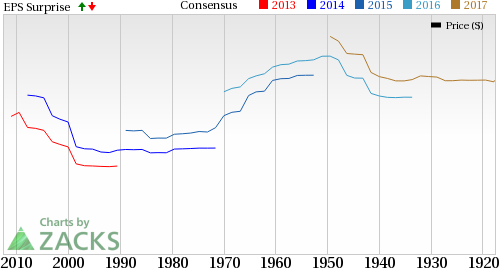

With respect to the surprise trend, Cigna surpassed expectations in three of the last four quarters with an average beat of 1.35%.

Cigna Corporation Price and EPS Surprise

Aon Corp. (AON) offers risk management services, insurance and reinsurance brokerage, human resource consulting as well as outsourcing services worldwide. Last quarter, Aon beat the Zacks Consensus Estimate by 13.28%. The company carries a Zacks Rank #3, which although increases the predictive power of ESP, its Earnings ESP of 0.00% however, makes our earnings surprise prediction difficult. Both the Most Accurate estimate as well as the Zacks Consensus Estimate are pegged at $1.45 per share.

On the back of proactive client partnerships, Aon is likely to increase retention rates, boosting global revenues in turn. Aon’s strategic investments to strengthen underlying performance and numerous initiatives to maximize return on invested capital are expected to boost its Risk Solution segment. Share buybacks are likely to have boosted the bottom line. However, rising operating expenses and pricing pressures in various countries across Europe and Asia might weigh on the upside. (Read: Aon plc to Report Q2 Earnings: What's in the Cards?)

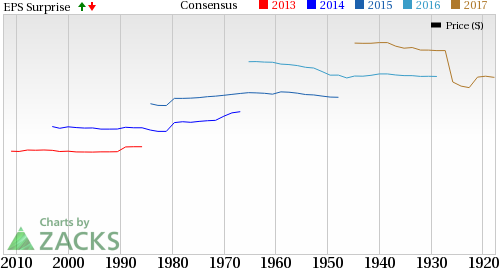

With respect to the surprise trend, Aon outpaced estimates in three of the last four quarters with an average beat of 4.04%.

Aon PLC Price and EPS Surprise

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Aon PLC (AON): Free Stock Analysis Report

Cigna Corporation (CI): Free Stock Analysis Report

Berkshire Hathaway Inc. (BRK.B): Free Stock Analysis Report

Original post

Zacks Investment Research