The insurance industry faced tough times in the past couple of weeks due to Hurricane Harvey, which wreaked havoc in America’s fourth-largest city with heavy rainfall and flooding. Speculation of massive destruction by Hurricane Irma, which was poised to hit Florida, was also rife (read: ETFs to Watch in Harvey Aftermath & New Hurricane Irma).

This is because damage was expected to reach billions and hit a number of insurance companies, especially property and casualty insurers. Wall Street estimated insured losses from Harvey as high as $20 billion, making it one of the top 10 costliest hurricanes to hit the United States. Additionally, insurers posted their worst day of 2017 on Sep 5 in the wake of Irma.

Now, the damage from Irma appears less than feared. According to the latest projection from risk modeling firm AIR Worldwide, Hurricane Irma will cause insured losses of $20-$40 billion in the United States, down from the previously expected $15-$50 billion. Meanwhile, Morgan Stanley (NYSE:MS) stated that the insurance industry has a strong balance sheet to weather the financial impact and that the stocks have historically outperformed post such events (read: Irma Aftermath Puts These ETF Areas in Focus).

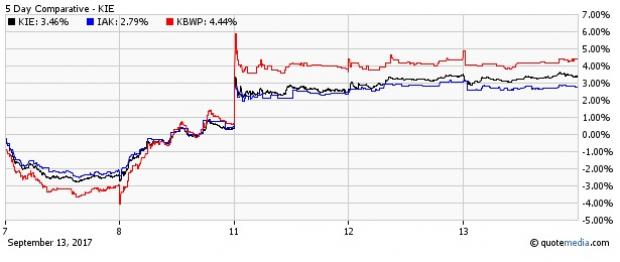

As a result, insurance stocks and ETFs have rebounded and are rising this week. The trend is likely to continue given encouraging industry fundamentals.

Solid Industry Trends

With multiple interest rate hikes since December 2015 and improving economic activity, the insurance industry is performing remarkably well compared with the other corners of the financial space. The segment is expected to be a clear beneficiary of a rising interest rate environment.

This is because most insurance companies, in particular life insurance, invest in longer-duration bonds, which enable them to earn more on their investment portfolios from higher interest rates. At the same time, these firms incur loss as the value of longer-duration bonds goes down with rising interest rates. Nevertheless, since insurance companies have long-term investment horizons, they can hold investments until maturity and hence, no actual losses will be realized.

Further, solid job growth, rising consumer confidence, and resurgent housing market would lead to higher demand for all types of insurance services. Moreover, the industry is expected to benefit from the implementation of new technologies and innovative processes in response to various disruptions (see: all the Financial ETFs here).

ETFs in Focus

Given this, investors looking to capitalize on the current trend may want to take a look at the following three ETFs, as these offer diversified exposure to a variety of insurance companies.

SPDR S&P Insurance ETF (LON:KIE)

This fund follows the S&P Insurance Select Industry Index, holding 52 stocks in its basket with each accounting for around 2% share. About 40.7% of the portfolio is allocated to the property and casualty insurance sector, while life & health insurance accounts for 26.3% share. The ETF has managed $879.6 million in its asset base and trades in a good average daily volume of about 145,000 shares. The product has an expense ratio of 0.35% and has a Zacks ETF Rank #4 (Sell) with a Medium risk outlook.

iShares U.S. Insurance ETF IAK

With AUM of $169.7 million, this product tracks the Dow Jones U.S. Select Insurance Index and charges 44 bps in annual fees. Volume is light, trading in roughly 12,000 shares per day. In total, the fund holds 63 securities in its basket with double-digit allocation going to the top firm Chubb (NYSE:CB). Here also, property & casualty insurance accounts for the largest share at 45.5%, while life & health insurance and multiline insurance round off the top three with a double-digit exposure each. IAK has a Zacks ETF Rank #3 (Hold) with a Medium risk outlook.

PowerShares KBW Property & Casualty Insurance Portfolio KBWP

This fund offers exposure to 24 property and casualty insurance companies by tracking the KBW Nasdaq Property & Casualty Index. It is moderately concentrated across components with each holding no more than 8.7% of assets. The fund has $92 million in its asset base while trades in average daily volume of 14,000 shares. It charges 35 bps in annual fees and has a Zacks ETF Rank #3 with a Medium risk outlook (read: Volatility Shakes Market: Top and Flop ETFs Over a Month).

Want key ETF info delivered straight to your inbox?

Zacks’ free Fund Newsletter will brief you on top news and analysis, as well as top-performing ETFs, each week. Get it free >>

ISHARS-US INSUR (IAK): ETF Research Reports

PWRSH-K P&C INS (KBWP): ETF Research Reports

SPDR-KBW INSUR (KIE): ETF Research Reports

Original post

Zacks Investment Research

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Insurance ETFs Back On Track Post Hurricane Irma

Published 09/13/2017, 10:25 PM

Updated 07/09/2023, 06:31 AM

Insurance ETFs Back On Track Post Hurricane Irma

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.