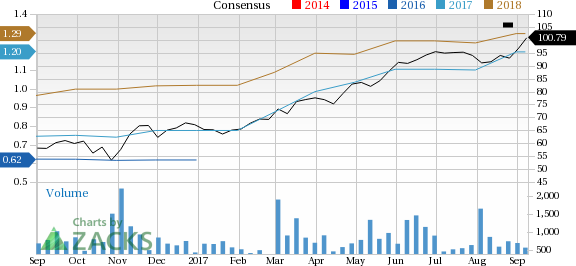

Shares of Inogen Inc. (NASDAQ:INGN) rallied to a new 52-week high of $101.14 on Sep 7, closing a tad lower at $100.79. This represents a strong year-to-date return of approximately 50.1%, higher than the S&P 500’s 10.2% over the same time frame. The stock has a Zacks Rank #3 (Hold).

Taking the stable stock performance into consideration, we expect Inogen to scale higher in the coming quarters. Also, the company’s long-term expected earnings growth rate of 20% is higher than the broader industry’s 18.3%.

For the majority of the last three months, the company’s share price has considerably outperformed the broader industry. The stock has rallied 10.9% over the last three months, beating the industry’s gain of just 3.7% over the same time frame.

Factors Driving the Stock

Guidance Upbeat: Banking on the solid performance in the last quarter, Inogen raised its 2017 revenue and adjusted net income guidance. Moreover, the company narrowed its full-year adjusted EBITDA guidance.

Inogen projects revenues in the range of $239 million to $243 million, higher than the previous range of $233 million to $239 million. This represents year-over-year growth of 17.8%-19.8%, up from the previous range of 14.9%-17.8%. Adjusted EBITDA is projected in the band of $48 million-$50 million, compared to $46 million-$50 million estimated earlier. This represents an increase of 10.6% to 15.2% as compared with the year-ago quarter’s 6%-15.2%. Inogen expects adjusted net income in the range of $25 million-$27 million, up from the previous band of $22 million-$24 million.

Unique Direct-to-Customer Business Model: Notably, Inogen has a market cap of $1.99 billion. The company’s direct-to-customer business model has lent it a leading position in the oxygen therapy market. The direct-to-consumer model gives companies an opportunity to build a unique brand relationship directly with customers. In an initiative to support growth in the direct-to-consumer line of business, the company had announced that it has secured an additional facility in the Cleveland, OH area.

Solid Q2 Results: Inogen reported a stellar second quarter of 2017, beating the Zacks Consensus Estimate for both the counts. Solid domestic and international business-to-business sales drove revenues. In fact, the company expects direct-to-consumer sales to be its fastest growing channel, followed by domestic business-to-business sales in the coming quarters, with solid focus on Europe.

Bright Prospects in LTOT Space: Inogen develops, manufactures and markets portable oxygen concentrators (POC). The company recently announced the receipt of EC Certificate for the Inogen One G4 platform, which will be available for sale in select international countries. We believe an expanding Long-Term Oxygen Therapy (LTOT) market, advantages of POCs over traditional delivery model, direct-to-customer business model, underpenetrated international markets and expanding product portfolio are key growth catalysts.

Favorable Estimate Revision Trend: Inogen’s estimate revision trend has been promising for the full year. In the last two months, three estimates moved north compared to no movement in the opposite direction. Full-year estimates rose almost 9% to $1.20 per share over the same time frame.

For the current quarter, two estimates moved up, compared to one downward revision in the last two months. As a result, the Zacks Consensus Estimate for the current quarter increased 3.7% to 28 cents per share over the same time frame.

Key Picks

A few better-ranked stocks in the broader medical sector are Edwards Lifesciences Corp. (NYSE:EW) , IDEXX Laboratories, Inc. (NASDAQ:IDXX) and Cogentix Medical, Inc. (NASDAQ:CGNT) .

Notably, Edwards Lifesciences sports a Zacks Rank #1 (Strong Buy), while IDEXX Laboratories and Cogentix Medical have a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Edwards Lifesciences delivered an average earnings beat of 10.8% over the trailing four quarters. The company has a long-term expected earnings growth rate of 15.2%.

Cogentix Medical registered a positive earnings surprise of 200% in the last reported quarter. The stock represented a stellar return of 100.9% over the last one year.

IDEXX Laboratories delivered an average earnings beat of 9.3% over the trailing four quarters. It has a long-term expected earnings growth rate of 19.8%

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

IDEXX Laboratories, Inc. (IDXX): Free Stock Analysis Report

Inogen, Inc (INGN): Free Stock Analysis Report

Cogentix Medical, Inc. (CGNT): Free Stock Analysis Report

Edwards Lifesciences Corporation (EW): Free Stock Analysis Report

Original post

Zacks Investment Research