Innospec Inc. (NASDAQ:IOSP) said that the registration of its new fully-owned enterprise in China, Innospec Chemical (Beijing) Co. Ltd., has been completed and will commence full operation from Oct 1.

According to Innospec, the move will help to gradually extend the company’s footprint in global markets as demand for specialty chemicals continues to grow, especially in China. It will also allow the company to manage and trade inventory locally and expand business in a thriving market.

Innospec will be able to improve customer services across all businesses in China including, performance chemicals, fuel specialties and oilfield services, as it looks forward to develop profitable solutions for long-term growth.

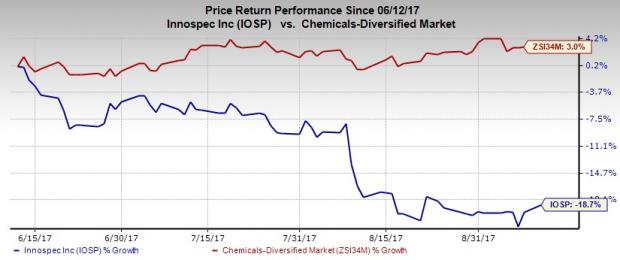

Innospec’s shares have lost 18.7% in the last three months, underperforming the industry’s gain of 3%.

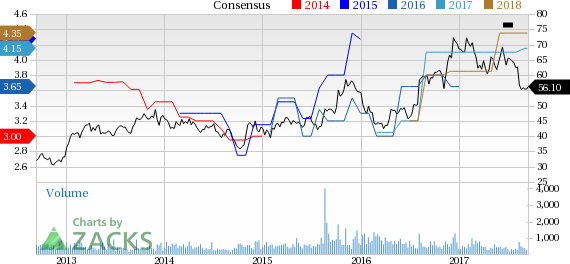

Innospec reported adjusted earnings of $1.16 per share for second-quarter 2017, coming ahead of the Zacks Consensus Estimate of $1.08. The chemical maker’s revenues soared 43% year over year to $326.3 million in the quarter.

Innospec, in its second-quarter 2017 call, said that it is optimistic about meeting its expectations for 2017. The company also noted that new products will help it achieve sustainable growth in the longer term while its balanced capital management program is likely to enable it create shareholder value, moving ahead. Innospec also remains optimistic about making more acquisitions. The company also sees healthy prospects for Oilfield Services for the balance of 2017.

Innospec currently carries a Zacks Rank #2 (Buy).

Other Stocks to Consider

Some other top-ranked stocks in the basic materials space are Kronos Worldwide Inc. (NYSE:KRO) , Smurfit Kappa Group plc (OTC:SMFKY) and Versum Materials Inc. (NYSE:VSM) .

Kronos Worldwide sports Zacks Rank #1 (Strong Buy) and has an expected long-term earnings growth rate of 5%. You can see the complete list of today’s Zacks Rank #1 stocks here.

Smurfit Kappa flaunts a Zacks Rank #1 and has an expected long-term earnings growth rate of 4%.

Versum Materials carries a Zacks Rank #2 and has an expected long-term earnings growth rate of 11%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Innospec Inc. (IOSP): Free Stock Analysis Report

Versum Materials Inc. (VSM): Free Stock Analysis Report

SMURFIT KAPPA (SMFKY): Free Stock Analysis Report

Original post