Innophos Holdings, Inc. (NASDAQ:IPHS) has closed the earlier announced acquisition of Novel Ingredients for $125 million in cash. The deal was funded with borrowings under the company’s existing credit facility.

According to Innophos, the strategic move will help the company to develop innovative ingredient solutions more effectively and serve customers in a better way. The acquisition reinforces the company’s position as a leading provider of vital ingredient solutions by combining technological capabilities and expanding product portfolio and also closely align important mega-trends such as energized aging, clean labels and health and wellness in the consumer segment.

The merger expands Innophos' portfolio in the high-growth nutrition end markets and create a $500 million Food, Health and Nutrition (FHN) platform, which represents roughly 60% of revenues for the combined entity.

Innophos expects the acquisition to be accretive to the company’s earnings per share in the first year following the completion of the transaction and create significant value for shareholders and customers in the long term.

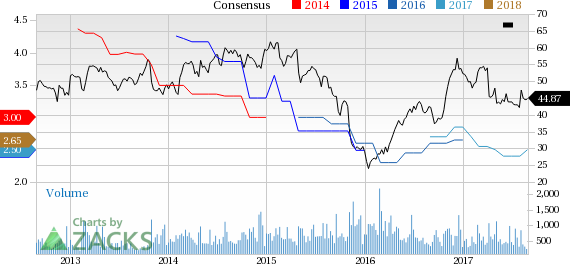

Shares Innophos inched up 0.8% in the last three months, underperforming the industry’s 4.5% growth.

In second-quarter 2017, Innophos reported adjusted earnings of 57 cents compared with adjusted earnings of 63 cents recorded a year-ago. However, the figure topped the Zacks Consensus Estimate of 52 cents. The company’s margins benefited from cost-saving initiatives.

Innophos expects earnings in the third quarter to be positively affected on sequential-basis, benefiting from first-time cost savings from Phase 2 operational excellence and reduced implementation fees. The company anticipates input costs to be in line with second quarter figures.

Innophos currently carries a Zacks Rank #2 (Buy).

Other Stocks to Consider

Some other top-ranked stocks in the basic materials space are The Chemours Company (NYSE:CC) , POSCO (NYSE:PKX) and Kronos Worldwide Inc. (NYSE:KRO) . All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks Rank #1 stocks here.

Chemours has expected long-term earnings growth rate of 15.5%.

POSCO has expected long-term earnings growth rate of 5%.

Kronos has expected long-term earnings growth rate of 5%.

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing and exclusive of fees, it can turn thousands into millions of dollars.

But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month.

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

Innophos Holdings, Inc. (IPHS): Free Stock Analysis Report

POSCO (PKX): Free Stock Analysis Report

Original post

Zacks Investment Research