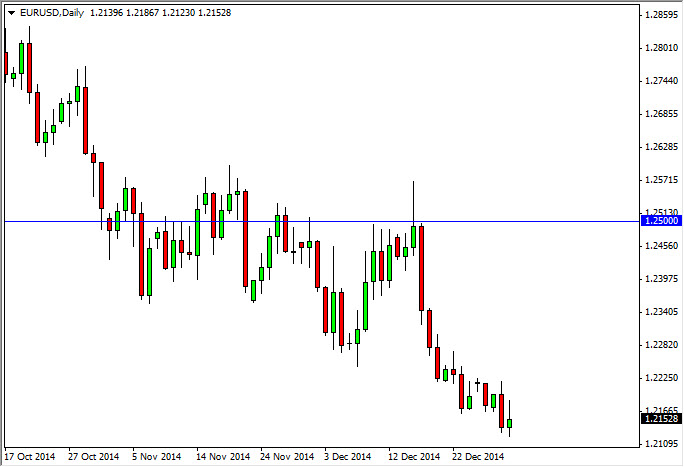

Looking at the EUR/USD pair, you can see that we continue to struggle to hang onto any significant gains. Tuesday wasn’t any different, and it now looks like buying puts on short-term rallies will continue to be the way going forward. With that, we believe that the market continues to fall towards the 1.20 region, but recognize that with the lack of liquidity we are probably better off looking for short-term options at best. Hanging onto any position for any real length of time is probably risky at this juncture.

The S&P 500 fell during the session on Tuesday, and as a result tested the 2080 handle. With that being the case, the market is one that should find buyers in this area yet again, because it was once resistance. We like buying calls on short-term supportive candles, and we have no interest in buying puts regardless. With that being the case, we believe that the S&P 500 will be much like the other US indices, and simply go higher over the longer term.

The DAX fell hard during the session on Tuesday, but still has a bit of negativity left in it as far as we can see. After all, we close the very bottom of the range for the day which is always a bad sign. We are looking for calls to be bought at lower levels, but do not have supportive candles quite yet. We are simply going to wait to see a supportive daily candle in order to go long and go with the longer-term uptrend.

The precious metals markets had a relatively positive session during the day on Tuesday as well, with gold testing the $1200 region, and the summer testing the $16.50 level. Nonetheless though, we are still bearish of both of these markets and we are buyers of puts on short-term resistive candles. Ultimately, we believe that the US dollar is far too strong for precious metals to catch any serious traction to the upside.