The board of Infosys Limited (NYSE:INFY) announced a $2 billion share repurchase program a day after the sudden resignation of CEO and MD Vishal Sikka. This move reflects an initiative to improve stakeholder returns for the Indian software exporter, after heightened tensions between the board and the founders led by ex-Chairman N R Narayana Murthy resulted in Sikka’s quitting.

Asia’s second-largest software services developer plans to repurchase as many as 113 million shares at Rs 1,150 apiece, per an exchange filing. Investors actually lost $3.5 billion as Infosys’s market value plunged on Friday in the wake of Sikka’s step-down. The repurchase price represents a 25% premium to Friday’s closing price.

Despite this generous offer, the shareholders’ response was lukewarm at best.

Sikka’s resignation had led to a deep unrest among investors, causing shares to decline 10.8% at one point before paring the losses to end at 7.2% lower. Even now, Infosys shares are continuing their downward trend, having fallen 5.4% in today’s pre-market trading at the time of writing.

Simply put, the repurchase price might have appeared more attractive, had Sikka’s resignation the previous day not led to the plummet of Infosys shares to historic lows.

Infosys’s shares have lost 6.4% in the past year versus the industry’s 17.8% average gain.

Experts opine that Infosys faces a major business disruption due to a high-profile CEO’s exit, bitter ego battles between top management and a co-founder, plus the reputational damage suffered because of a possible securities fraud charge. These factors could affect new business acquisitions in the key markets and allow rivals to grab the company’s existent market share.

Also, potential clients may refrain from making deals with Infosys until there is more clarity on who will replace Sikka and what the strategies and vision of the new CEO might be.

Sikka had taken over the reins of India’s second-largest software and outsourcing company in June 2014. Over time, he had been instrumental in realigning the company’s consulting business toward strategy consulting. During his term, Infosys had increased its $100 million clients from 12 to 19. The company’s large deal wins rose from $1.9 billion in 2015 to $3.5 billion in FY17.

Per news reports, Infosys is struggling with deep rifts formed within the board. Plus, the board’s relationship with the company founders has been splintered. Perhaps, it is time for the company to revamp the board completely in order to restore investors’ confidence.

The road ahead for Infosys looks long and difficult. The company needs to begin anew with recruiting the right CEO and MD, which seems a daunting task in the light of a possible disparity between what the founders expect and what the shareholders probably want to see in their new leader.

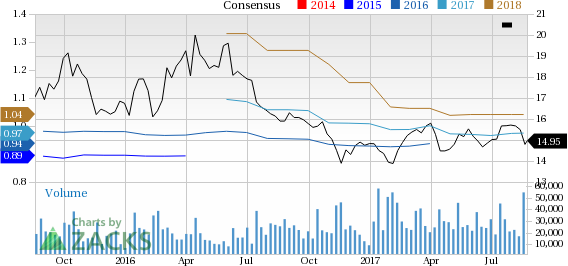

Infosys Limited Price and Consensus

Zacks Rank & Stocks to Consider

Infosys presently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader space are Axcelis Technologies, Inc. (NASDAQ:ACLS) , CoStar Group, Inc. (NASDAQ:CSGP) and HP Inc. (NYSE:HPQ) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Axcelis Technologies has a solid earnings surprise history for the trailing four quarters, having beaten estimates thrice for an average beat of 35%.

CoStar Group also has a robust earnings surprise history with an average beat of 15.4% over the trailing four quarters and topping estimates throughout.

HP generated an average positive surprise of 3% over the trailing four quarters, surpassing expectations thrice.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

HP Inc. (HPQ): Free Stock Analysis Report

Axcelis Technologies, Inc. (ACLS): Free Stock Analysis Report

CoStar Group, Inc. (CSGP): Free Stock Analysis Report

Infosys Limited (INFY): Free Stock Analysis Report

Original post

Zacks Investment Research