I typically have a song or two in my head. After all, watching ticks is musical and has a lot of different beats. And typically, those songs turn into parodies.

For this past week, the first song was sealed in our brains after Tesla’s extraordinary run.

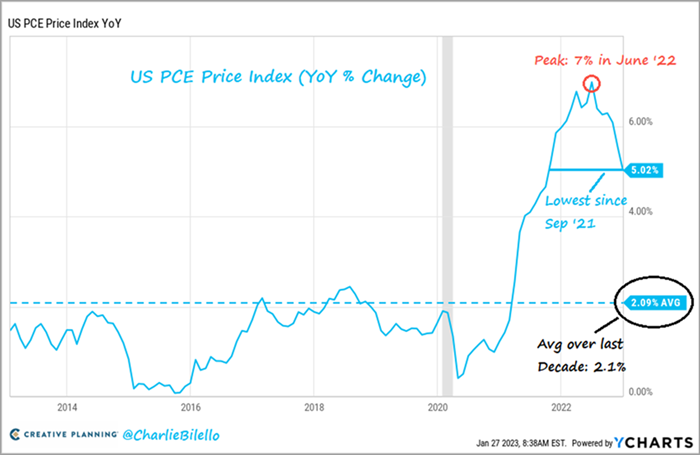

And then again after Friday’s PCE (Personal Consumption Expenditure) numbers were released. Core PCE excludes food and energy.

PCE includes health care, education, haircuts, hospitality, and more, accounting for about 50% of consumption.

Powell has called it "the most important category for understanding the future evolution of core inflation."

The first song? Reasons to be Cheerful 1,2,3 Ian Dury and The Blockheads

So, we got 1 (Tesla (NASDAQ:TSLA)) and 2 (Softer Inflation) -what is 3?

Reason 3

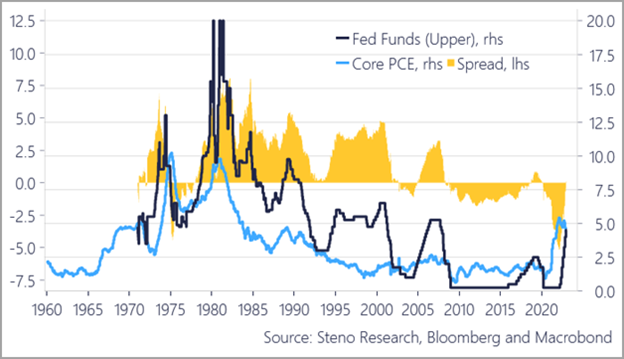

Note on the chart that the Fed Funds rate is now in line with the Core PCE rate.

Direct us to the next song. Powell should be doing a happy dance as this gives him the ammo to….

When Doves Cry Prince.

However, as doves fly, so will inflation….the ultimate problem we have been writing about.

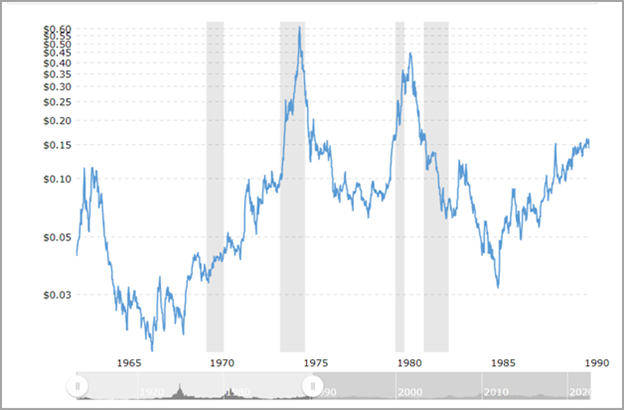

Pretty significant bounce in lumber prices.

You see, our dear readers, as rates soften, as Fed pauses, as markets rally, and as consumers spend money, commodities wake up.

It’s a vicious cycle. A simple economic formula of supply and demand.

Our Big View tool is invaluable in showing you the ratios among all the commodities and inflation ratios.

Many raw materials remain in low supply. Copper, lithium, sugar, and steel, to name a few.

And speaking of sugar, Friday, the price closed above 21 cents a pound. CANE, the Sugar Fund ETF, closed at a new yearly high.

In 1972, supply shortfalls and rising demand, along with the devaluation of the dollar, all contributed to a large increase in the price of sugar.

By February of 1974, with rising inflation, rising demand, and the perception of imminent shortages, sugar prices spiked to over 65¢ in November.

In 2023, there is speculation that smaller sugar output in India will force the country not to allow additional sugar exports.

Furthermore, reduced sugar production in Europe may force European sugar and food manufacturers to import sugar, leading to tighter global supplies.

If sugar is a barometer and mirror of the 1970s, well, here’s a bonus song for you all-

1979 Smashing Pumpkins “That we don’t even care as restless as we are..”

ETF Summary

- S&P 500 (NYSE:SPY): SPY has crossed the 200-DMA and is now slightly above it but is still in a very narrow price range below 50-DMA. Held pivotal support, and now what was resistance is support at the 200-DMA, and resistance is no longer 405 but 408 overhead.

- iShares Russell 2000 ETF (NYSE:IWM): Filled the gap and continued to hold the 200-DMA and overhead resistance at 189 still. Closed at 189.58 resistance, now 190.66.

- Dow Jones Industrial Average ETF Trust (NYSE:DIA): Back over the 50-DMA and holding support at the 50-DMA, and 341 is resistance still.

- Invesco QQQ Trust (NASDAQ:QQQ): Crossed the 50-DMA last Friday and closed above this Friday the 200-DMA and 50-DMA. The first resistance level is 299 at the 200-DMA, and 200-DMA is support.

- S&P Regional Banking ETF (NYSE:KRE): The first level of support is 50-DMA now. It closed slightly above.

- VanEck Semiconductor ETF (NASDAQ:SMH): Still holding key support easily at the 50-WMA and 200-WMA. 237 is still support and resistance 243.

- iShares Transportation Average ETF (NYSE:IYT): First level of support holding 227 with resistance at 231.

- iShares Biotechnology ETF (NASDAQ:IBB): Still the best sector with 132 key support still holding and holding first level of support at 134 now with 139 still resistance.

- S&P Retail ETF (NYSE:XRT): Holding pivotal support at 63. The first level of support at 66 resistance is still 70.