The CPI jumped 0.4% in February, led by gasoline. Year-over-year inflation was benign once again.

Consumer Price Index For February 2021

Economists are scouring the BLS CPI Report for February looking for signs of inflation.

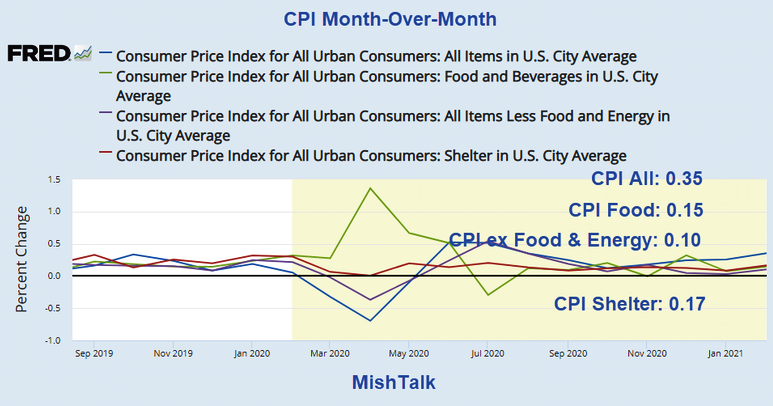

Month-Over Month Details

- The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.4 percent in February on a seasonally adjusted basis after rising 0.3 percent.

- The gasoline index continued to increase, rising 6.4 percent in February and accounting for over half of the seasonally adjusted increase in the all items index.

- The Electricity and natural gas indexes also increased, and the energy index rose 3.9 percent over the month.

- The food index rose 0.2 percent in February, with the index for food at home and the index for food away from home both rising.

- The index for all items less food and energy rose 0.1 percent in February.

- The indexes for shelter, recreation, medical care, and motor vehicle insurance all increased over the month.

- The indexes for airline fares, used cars and trucks, and apparel all declined in February.

I put gasoline on the chart but it so distorted the scale that nothing else was readable.

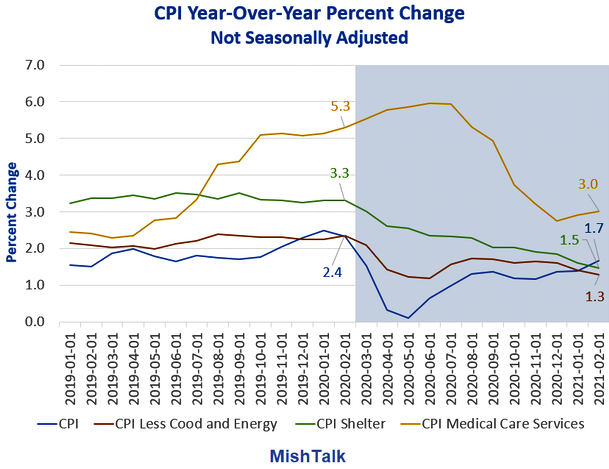

CPI-Year-Over-Year

Year-Over-Year Details

- The all items index rose 1.7 percent up from 1.4 percent in January.

- The index for all items less food and energy rose 1.3 percent over the last 12 months.

- The food index rose 3.6 percent over the last 12 months.

- The energy index increased 2.4 percent over the last 12 months.

- Medical care services rose 3.0 percent over the last 12 months.

- The Shelter Index rose 1.5% over the last 12 months.

Pause In The Storm?

I think not. Nor do I think there is much of a storm to begin with. Before any one of my readers scream, I am talking about inflation as measured—not as it really exists. It's easy to have "low inflation" when you don't count housing and undercount the cost of medical care. Motor fuel is only 3.76% of the CPI so it does not matter much.

Gold And Silver Pop As US Treasury Yields Drop

Wednesday, Treasury yields declined on the news of a tame CPI. In advance of this report, I noted Gold and Silver Pop as US Treasury Yields Drop.

Looking for Inflation?

Inflation is easy to find. Look at housing. Look at asset bubbles in stocks and junk bonds. I estimate inflation is up 3.5% from a year ago, just counting housing, not stock or junk bond bubbles.

If you are looking for inflation, the last place to look is where they tell you to look.

For discussion, please see Fed Hubris: Housing Prices Show the Fed is Making the Same Inflation Mistake.