Gold and Silver rallied strong yesterday in conjunction with falling Treasury yields. Let's discuss what happened and why.

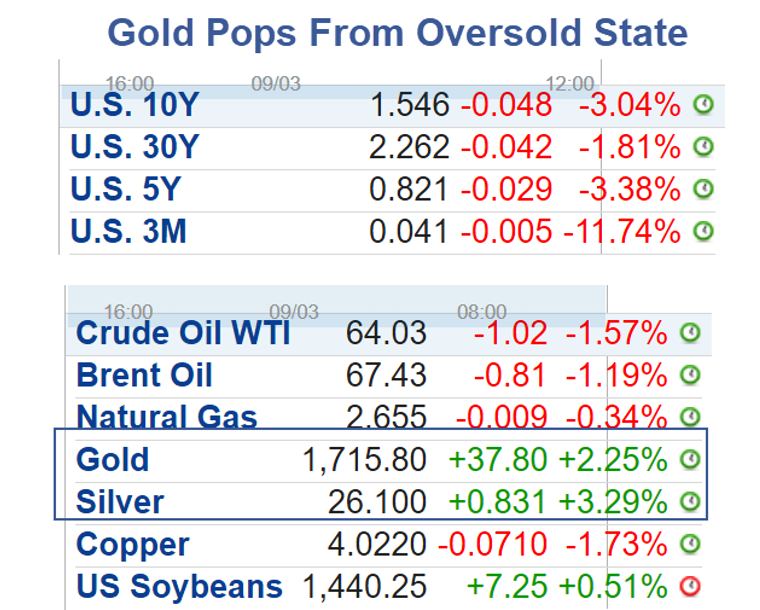

US Treasury Yields Decline Across the Board

US Treasuries rallied yesterday and gold went along for the ride as expected.

Gold and Silver Reacted Strongly

- Gold: +37.80, +2.25%

- Silver: +0.83, +3.29%

Small Speculators Pile Into Treasury Shorts, Is a Short Squeeze Coming?

Two days ago I asked Small Speculators Pile Into Treasury Shorts, Is a Short Squeeze Coming?

I offered this opinion: "I suspect a strong rally in bonds will soon wipe out the latecomers into these trades."

Inflation Meme

Nearly everyone bought into the inflation meme. And as discussed in the above link, it was small speculators leading the way.

Gold had been struggling on the notion the Fed would have to hike sooner. In isolation, rising yields are generally not good for gold, but there are other factors.

In Congress there is already talk of more stimulus but I suspect that is dead on arrival.

It's not that I don't see inflation, it's I don't see a lot more of it as it is incorrectly measured.

Bubble Talk

The Fed blew bubbles and they will pop.

If there is a sustained stock market decline or economic weakness yield rates could plunge.

Moreover, everyone seems to have bought into the notion of COVID immunity and things soon getting completely back to normal. Even if so, it's already priced in.

Technical and Economic Setup

So far, this is just a one-day reaction. If so, it does not mean much.

However, I suspect the rally in Treasuries and gold just got started for technical reasons (short squeeze), and economic reasons (the reflation trade is way ahead of itself and bubbles will pop).

Three-Point Synopsis

- This economy is not as strong as widely believed

- Bubbles in equities and junk bonds will pop and that is deflationary

- Technical rally fueled by Treasury shorts and gold bears