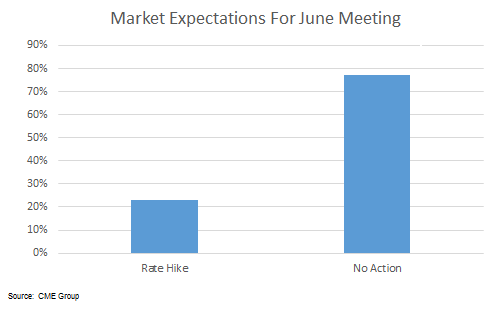

Market Remains Skeptical Of June Rate Hike

Based on 30-day Fed fund futures prices, the market is pricing in a 23% probability of a Fed rate hike in June. Said another way, the market currently believes there is a 77% probability Janet Yellen and company will continue with the “do nothing” script at their June 14-15 gathering.

Action vs. No Action Could Determine Market’s Fate

The ratio of Treasury inflation-protected securities (iShares TIPS Bond (NYSE:TIP)) vs. intermediate-term treasuries (iShares 7-10 Year Treasury Bond (NYSE:IEF)) can be used to monitor inflation expectations. All things being equal, in the current environment with lingering fears of global deflation, rising inflation expectations tend to be favorable for “risk on” assets. Conversely, when inflation expectations start to fall, it can adversely impact the equity market (see S&P 500 in the bottom portion of the graph below).

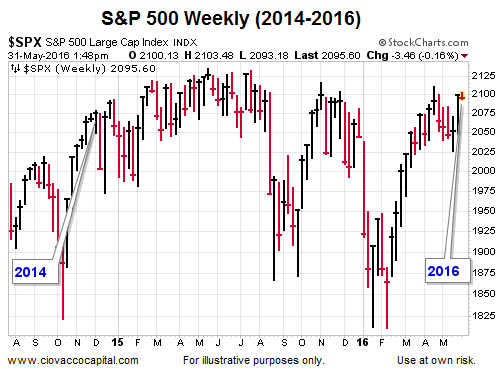

Navigating In Indecisive Stock Market Waters

The S&P 500 hit 2093 in 2014. On Tuesday, May 31, 2016, the S&P 500 traded at 2093.

This week’s stock market video examines the current state of the long-term standoff between the bulls and the bears, including some potential targets above and below the market.

Yellen Leaves Both Doors Open

Janet Yellen was at Harvard last Friday to receive an award. During her visit she made some remarks regarding the future path of interest rates. From the Harvard Gazette:

Yellen said she expects the economy and the labor market to continue to improve and that, as it does, interest rates will “probably” rise. “It’s appropriate — and I’ve said this in the past — I think, for the Fed to gradually and cautiously increase our overnight interest rate over time. And probably in the coming months, such a move would be appropriate.” Still, she urged caution. “If we were to raise interest rates too steeply and we were to trigger a downturn or contribute to a downturn, we have limited scope for responding, and it is an important reason for caution.”

The no hike in June camp could point to Yellen’s use of “in the coming months” and “an important reason for caution” as evidence the Fed Chair is not leaning toward a June hike. If the Fed takes no action in June, it is possible inflation expectations and stocks could break to the upside. If the Fed raises rates in the context of a skeptical market, it could trigger a reversal in both inflation expectations and risk assets.