The Q2 earnings season is in its last leg, with only 16% of the S&P 500 members left to report their quarterly figures.

Our latest Earnings Preview reconfirms broad-based expectations of better-than-expected results in the reporting cycle. As of Aug 4, 420 S&P 500 companies have released earnings, accounting for 86.7% of the index’s total market capitalization, with 74.3% topping earnings per share estimates and 68.3% coming in ahead of top-line expectations.

As of Aug 4, roughly 91.7% of the Industrial stocks in the S&P 500 Group have reported results for this quarter, recording 19.3% rise in earnings and 14.9% upside in revenues on a year-over-year basis.

We believe that improved job market picture, upbeat consumer confidence, recovery of U.S. housing market scenario, improving oil prices and growth friendly policies of the new U.S. administration will bolster industrial spending and hence improve performance of industrial stocks, moving ahead.

What's in the Cards for these 3 Industrial Stocks?

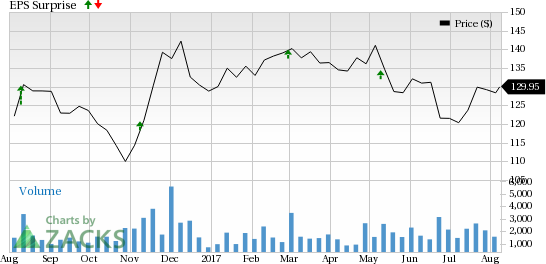

The Middleby Corporation (NASDAQ:MIDD) is scheduled to report second-quarter 2017 results, after the market closes. The company’s average positive earnings surprise for the last four quarters is 13.39%. However, our proven model does not conclusively show that Middleby will likely beat estimates in this quarter. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or at least 3 (Hold) for an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

That is not the case here as we will see below.

Middleby’s Earnings ESP is -0.73%, as the Most Accurate estimate of $1.37 per share comes below the Zacks Consensus Estimate of $1.38.

You can see the complete list of today’s Zacks #1 Rank stocks here.

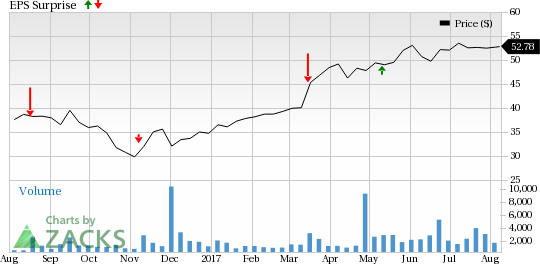

Welbilt, Inc. (NYSE:WBT) is scheduled to report quarterly numbers, after the market closes. The company witnessed an average negative earnings surprise of 8.31% over the trailing four quarters. Also, our proven model does not conclusively show that Welbilt will likely beat on earnings in the quarter.

The company carries a Zacks Rank #3, but an Earnings ESP of 0.00% makes surprise prediction inconclusive. The stock’s Most Accurate estimate of 18 cents is in line with the Zacks Consensus Estimate. Notably, there has been no change in the quarterly estimate over the last seven days.

SiteOne Landscape Supply, Inc. (NYSE:SITE) is slated to report quarterly figures, before the market opens. The company recorded an average negative earnings surprise of 139.67% over the last four quarters. Our proven model does not conclusively show that the company will likely beat estimates this quarter.

SiteOne Landscape Supply carries a Zacks Rank #3, but an Earnings ESP of 0.00% makes surprise prediction inconclusive. The stock’s Most Accurate estimate of $1.09 per share is in line with the Zacks Consensus Estimate.

Notably, the quarterly estimate remained unchanged over the last seven days.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

The Middleby Corporation (MIDD): Free Stock Analysis Report

SiteOne Landscape Supply, Inc. (SITE): Free Stock Analysis Report

Manitowoc Food Service, Inc. (WBT): Free Stock Analysis Report

Original post