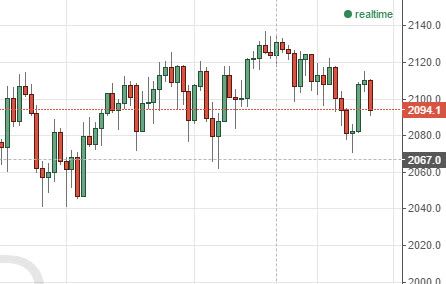

During the session on Monday, there’s very little to move the markets without some type of surprising headline. The one sole exception might be the Industrial Production numbers coming out of the United States, which of course can have a bit of an effect on both the US dollar and the US stock markets. With that, we look at the S&P 500 and see that the pullback on Friday may very well offer a call buying opportunity. This is a market that continues to go higher over the longer term, so we certainly don’t want to buy puts anytime soon.

The EUR/USD pair fell initially during the session on Friday, but found enough support below the 1.12 level to turn things back around and form a nice-looking hammer. The hammer, of course, is a bullish sign and therefore we are buyers of calls on short-term pullbacks. However, we do recognize the 1.14 level above is pretty significant resistance, so we are bit hesitant to start buying calls for any major move yet. Nonetheless, we do think that eventually this pair does break out well above the 1.15 level, and changes its longer-term trend to the upside.

Looking at the DAX, we fell initially during the session on Friday, but found enough support just above the €11,000 level to turn things back around and form something akin to a hammer. We believe that the DAX will continue to go higher and we are buyers of calls on short-term pullbacks. We become very bullish of the DAX once we get above the €11,500 handle.