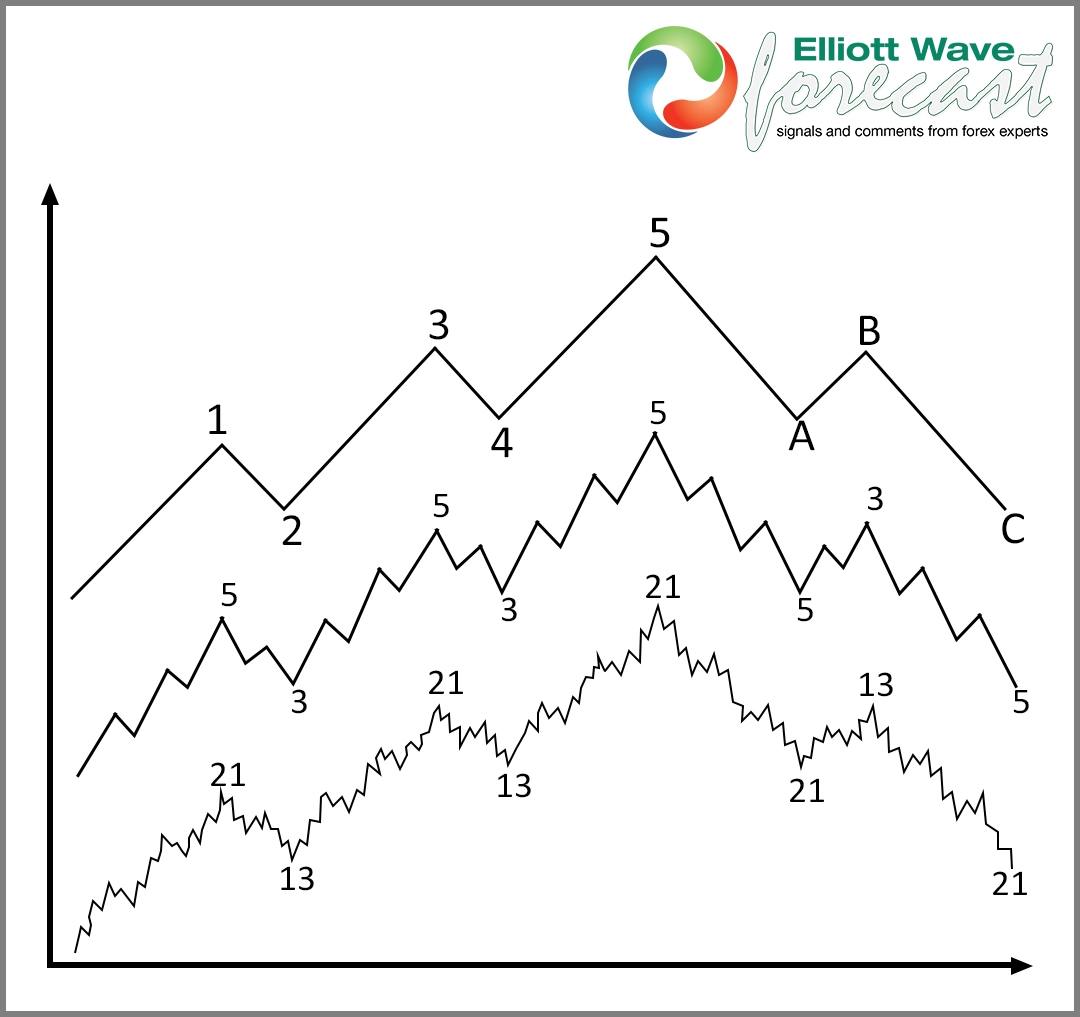

In the Elliott wave Theory, the main idea is an advance in 5 waves followed by 3 waves back, this is seen most of the times in Indexes and right now INDU (Dow Jones Industrial Average) is showing a possible 5 waves advance since the low at 1.19.2017. As of right now, we should be ending the wave ((iii)) in black and soon should do a 3 waves pull back which we believe would be a wave ((iv)) and result in another leg higher to complete a 5 wave move up from 1.19.2017 low.

Wave ((iv)) should be rather shallow and ideally end between 23.6 – 38.2 Fibonacci retracement of wave ((iii)) and should not exceed 50% Fibonacci retracement of wave ((iii)). We like the idea of the impulse because the subdivisions are perfect, each sub wave is in 5 waves and each sub wave shows momentum divergence between wave iii and v. Considering wave ((iii)) is extended also supports the idea of impulse because if we use the Fibonacci extension of wave ((i)) and ((ii)), we can see we already passed the 1.618 extension which invalidates the 3 waves move or simple ABC from the same low.

The instrument is within a bullish trend and should be reaching the 20989-21289 area within this cycle when the 5 waves advance could be completing. INDU (Dow) Index remains supported and as far as 1.19.2017 low remains in place, the Instrument should keep extending but after the 5 waves are completed, we should see a 3 waves back and that would be another chance to buy. In Elliott wave Forecast, we have added some rules to the Theory and having extension pass the 1.618 of 1-2 is needed to be labelled an impulse, also each leg needs to be in 5 waves and properly subdivided.

INDU (Dow) 1 Hour chart

5 Wave up followed by 3 waves back