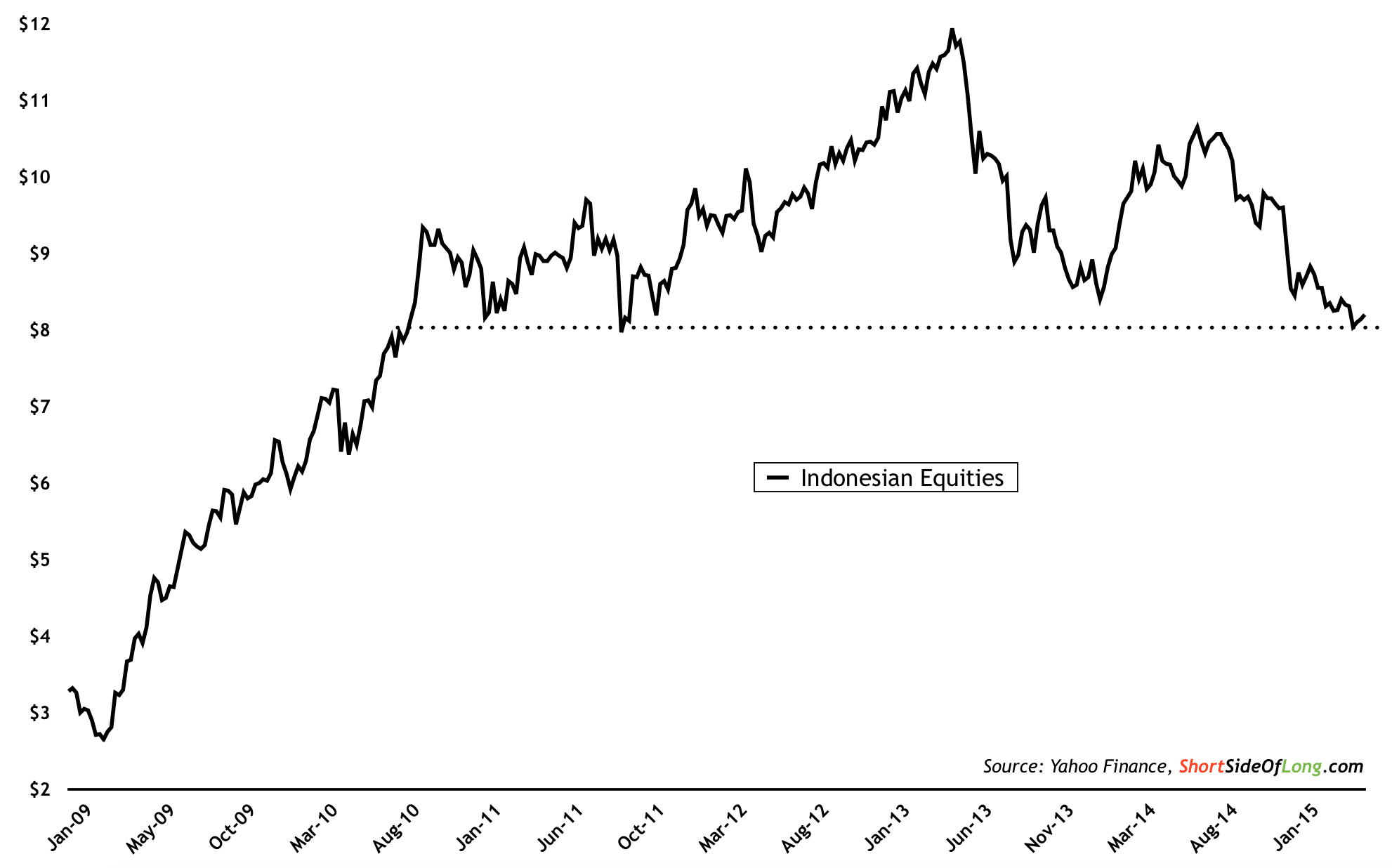

This chart of the day focuses on the Indonesian stock market, which has been under pressure since Dr Ben Bernanke (remember him?) started to discuss Federal Reserves plans to taper the QE3 program. Indonesian equities priced in US dollars peaked in May of 2013, and despite a rally throughout early 2014, has failed to push towards new highs like US, Japanese and European equities.

Chart Of The Day: Indonesian stocks aren't a bargain, but could bounce

I am not necessarily advising long term investors to start opening up positions in Indonesia stocks right now, despite the fact that they have under-performed other developed markets since May 2013. While these stocks offer some value, they aren't necessarily cheap. However, traders with shorter term time horizons might find it interesting that the Aberdeen Indonesian ETF (AMEX:IF) is currently trading on a major support line.

Could it bounce and rally for a while from the current price level? Readers should remember that any execution of trades should be taken with serious tight risk management protocols in highly volatile markets, such as these.