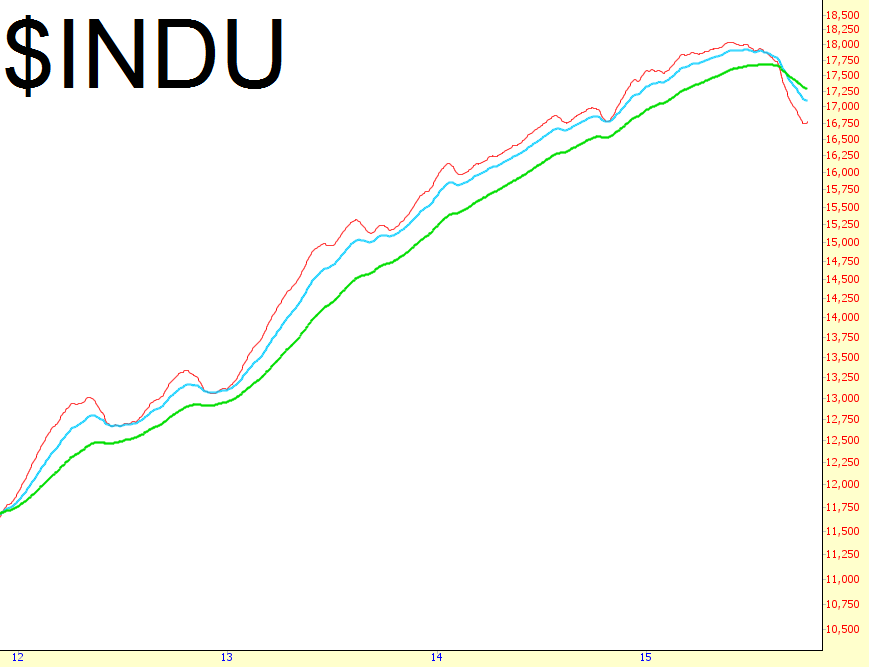

I’m getting uncomfortable pounding on the same theme over and over again (there’s only so many times I can point out the large, looming topping patterns across the board), so I thought I’d mix things up a bit and just get off the price bars entirely and catch up on a trio of exponential moving averages to show how things have turned south, irrespective of the gargantuan, quadruple-point rally on the Dow. Here are the Dow Industrials:

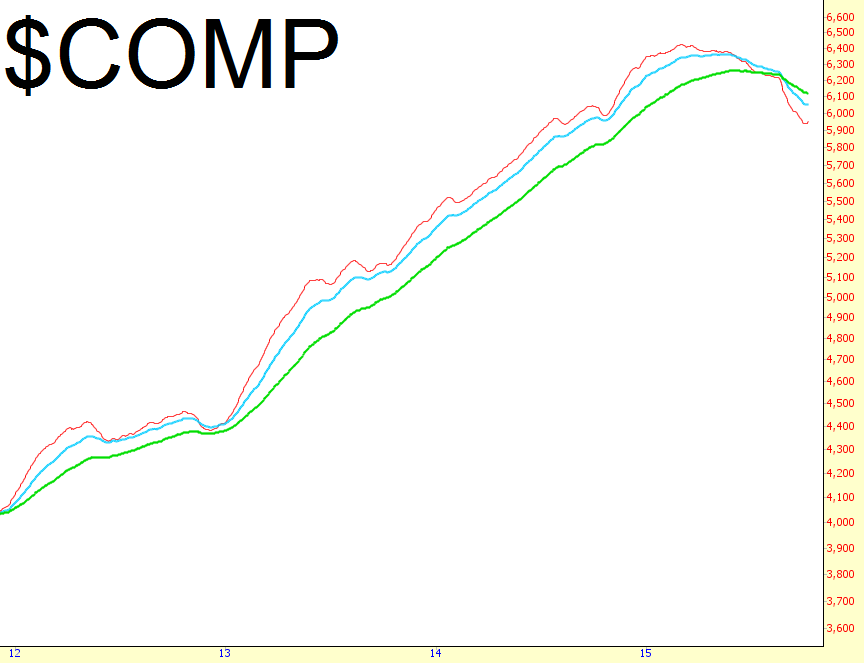

The even-more-important Dow Composite:

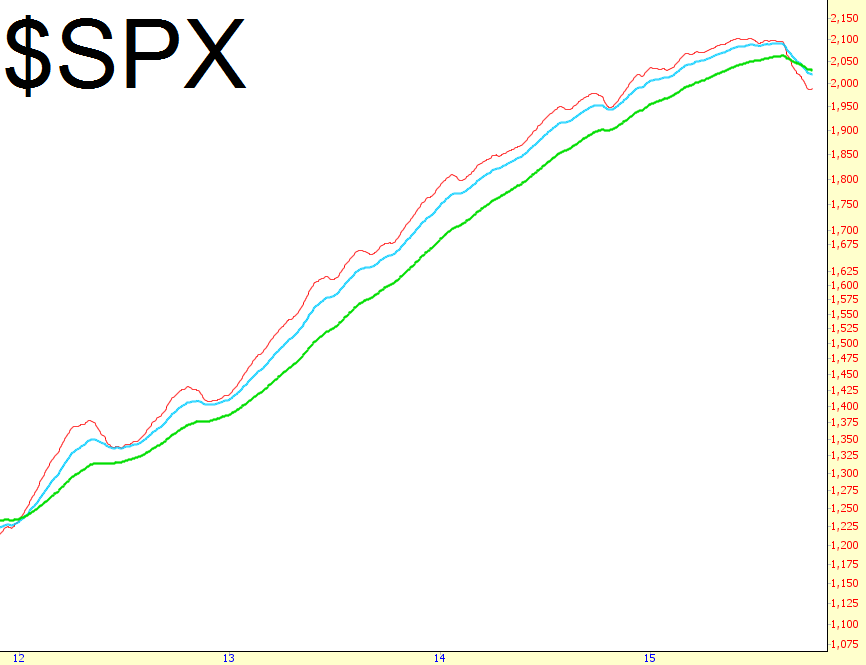

And the S&P 500:

I’ll be the first one to admit that the moving averages looked very similar to this in October 2011, after which time we simply kept soaring higher. But – dare I say it? – it’s different this time! OK, OK, stop throwing rotten vegetables at me. I’m serious.

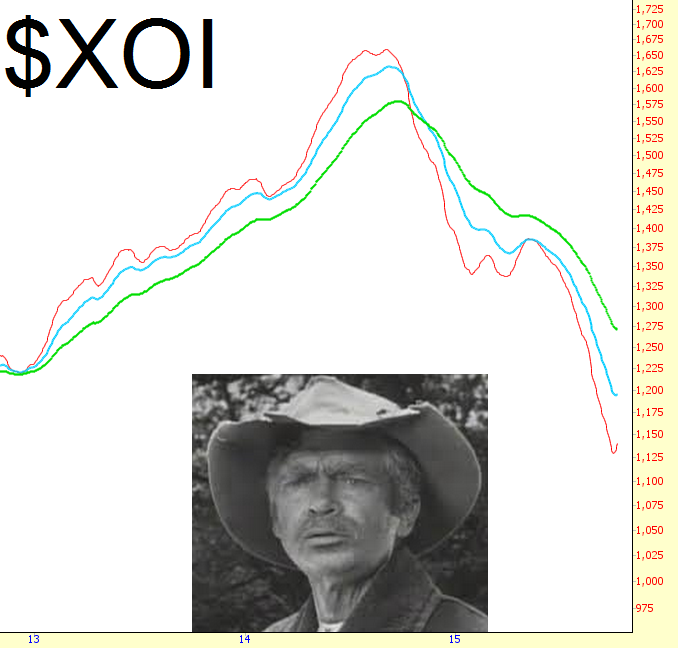

Even more enticing to me is the shape of the energy sector, which has been simply nuked:

I have vastly expanded my short holdings over the course of this week, and if we (finally) start re-weakening this week, I’m going to augment my favorite positions. As I suggested, my favorite sector is (once again) energy, as giants like Exxon (NYSE:XOM) are exhibiting topping patterns that strike me as once-a-generation type opportunities.