Japan’s benchmark equity index, like many global bourses, had a rough start to 2022.

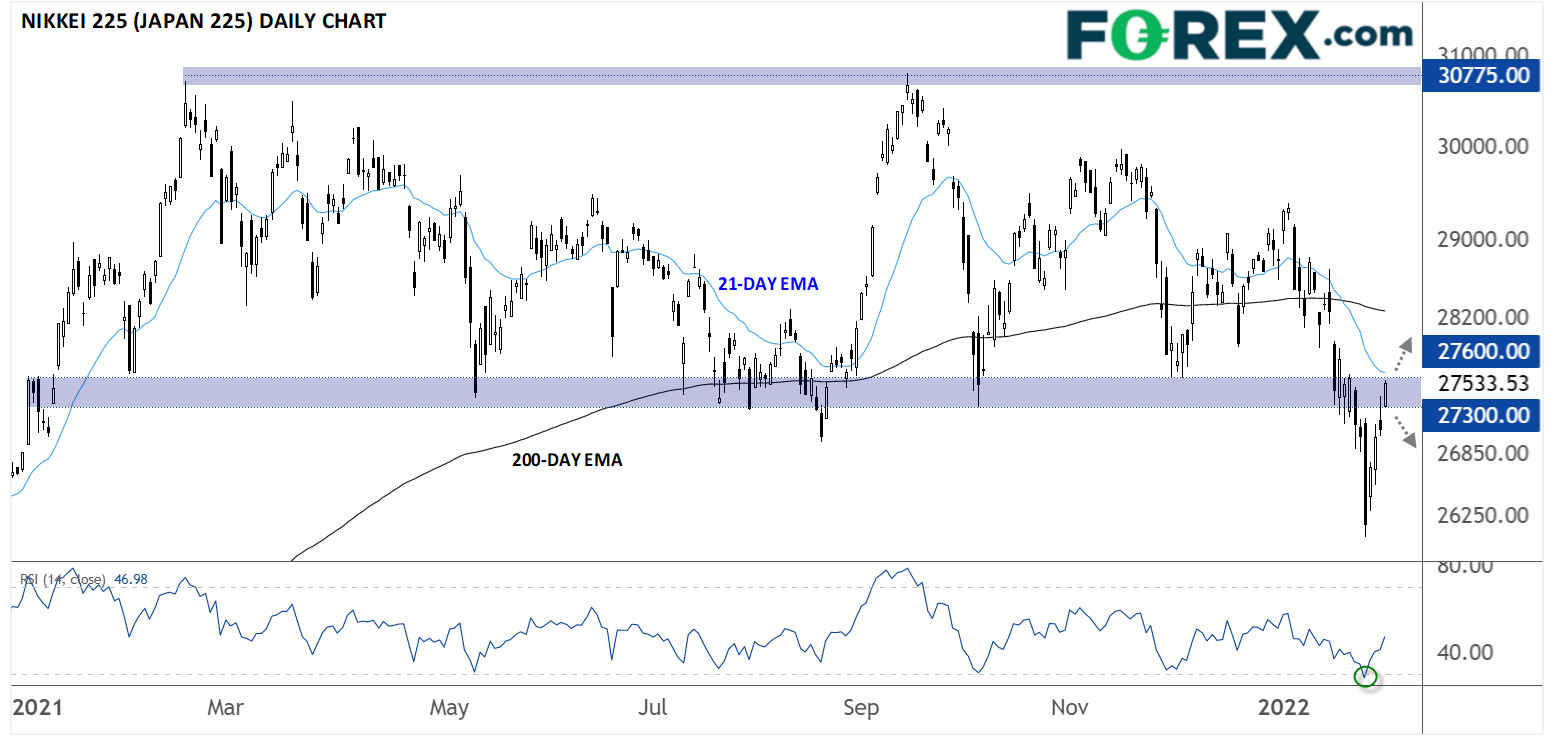

The Nikkei 225 (Japan 225) peaked above 29,300 on the second trading day of the year before dropping more than -10% over the next three weeks to hit a 14-month low in the lower-26,000s last week. After an impressive recovery through the first half of this week, the index is testing a critical technical zone in the 27,300-27,600 area.

As the chart below shows, that range served as reliable support throughout 2021, and now that the index has broken below it, that area may now act as resistance on future rallies for the index. Crucially, the January breakdown pushed the 14-day RSI indicator into “oversold” territory.

Source: StoneX, TradingView

From a technical perspective, the outlook is relatively straightforward. If the Nikkei can break conclusively back above 27,600, bulls may look to target previous resistance levels at 29,300, 30,000, or even the record highs near 30,775 in the coming months; meanwhile, a failure at the current resistance level could see the index retesting its January lows near 26,000 sooner rather than later.

From a fundamental perspective, economic data out of Japan has been mixed, with soft industrial production and retail sales reports last week painting a more pessimistic picture than this week’s solid manufacturing PMI and employment reports.

Outside of economic data, Japan’s new government is also seeing support erode slightly, raising the specter of another short-lived regime, though the next major election isn’t until July. Finally, unlike their peers at the Federal Reserve or Bank of England, BOJ policymakers are unlikely to raise interest rates at all this year, leaving a generally supportive monetary policy backdrop for the Nikkei that could keep the index relatively well supported.