Low-volume, daily-lifetime-highs summer trading continues. Let’s take a quick look at a few key items.

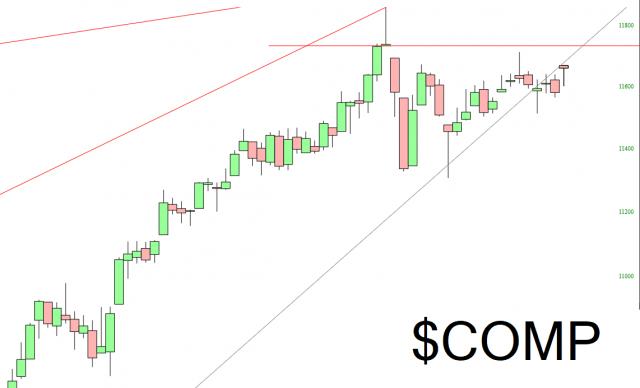

The Dow Jones Composite is hugging its trendline and still beneath its price gap. This is a big fat “meh”— basically there hasn’t been a net change in weeks.

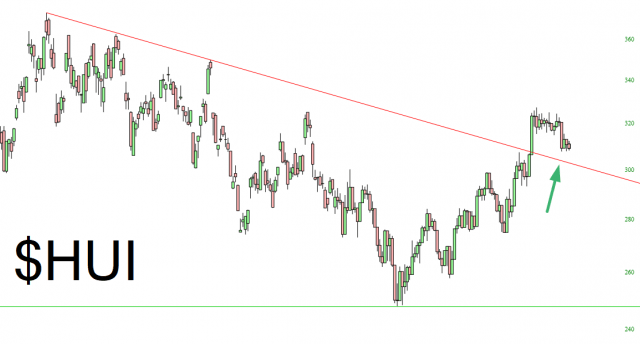

The gold bugs might be ready to rally again. It got smacked hard, but notice how the trendline (which is now support) was successfully tested.

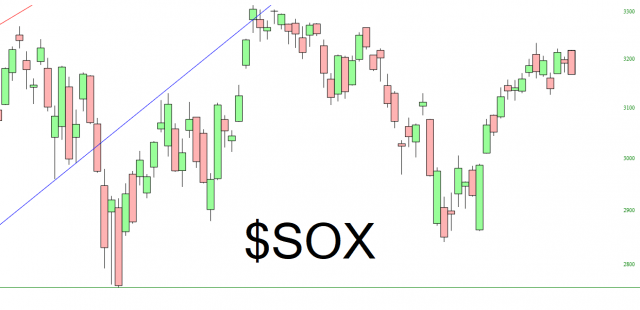

One of the few indexes which looks plausibly at-risk is the semiconductor group, although broadly speaking it is still widely range-bound.

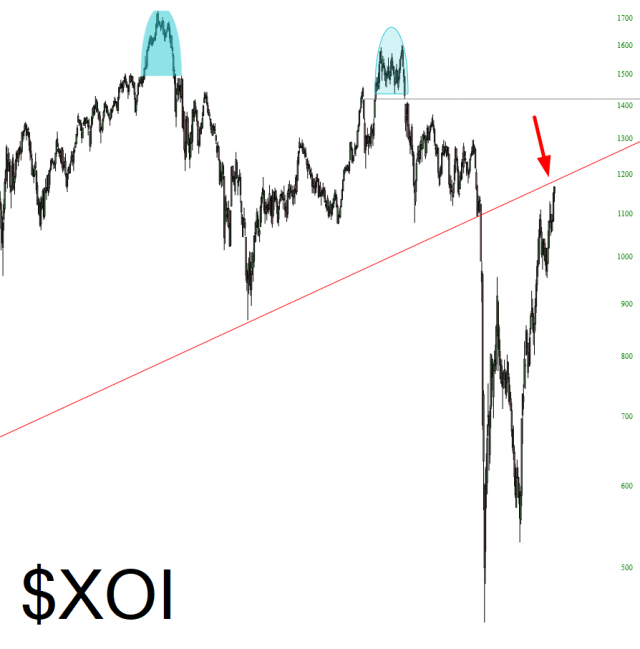

And the only straight-up, I-am-happy-to-be-short sector is oil (sorry, TNRev!) which has repeatedly threatened and challenged its own trendline but is still safely beneath it. I would suggest XLE if you want to play this one.