Chinese Devaluation Round 2

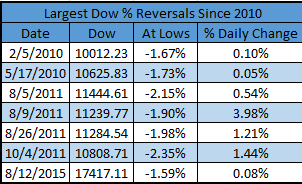

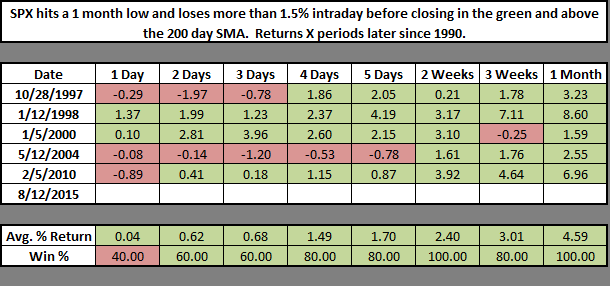

After a sluggish trade on Tuesday, the S&P 500 opened last nights globex session and tried to climb higher, until China again devalued it’s currency which sent the futures down 20 handles in less than an hour, and 30 handles lower into the Euro session. The futures did try to bounce, but failed, opening the regular session at 2064.25 and proceeded to sell nearly 20 handles before finding an early low of 2046.75, and in turn rallied hard in the afternoon to close at it’s high tick of 2084.75. Noted by Ryan Detrick in the above image, “the last time S&P 500 was down 1.5%+ in the AM and closed higher on the day was 10/4/11”.

In essence, it took all the Asian session, euro session, and U.S. Morning session to take it down nearly 40 handles, and only one afternoon to take them right back up!

No stops go untouched in the S&P

“Over the years, both in the open outcry and electronic markets, there has been a tendency to “run the stops,” as most traders can certainly attest. Scalpers tend to use 3-5 handle stops. When the markets are moving they trail the stops up or down based on the direction of the move. Most algorithmic and program trading systems are set to move in the direction of those stops on a daily basis. The short-term stops are the easiest targets to reach, but eventually, mid- and long-term stops fall like dominoes. We like those extremes because it turns small moves into longer, more profitable moves. Just make sure you’re on the right side and in control.” – Danny Riley, MrTopStep’s Trading Rules

Seen In the MrTopStep IM Pro Room Today:

Dboy1( 10:25:11 AM ): 10:24:35 PITBULL: 1020am always sell the shit out of them

Dboy1( 10:25:41 AM ): paid 48 small

Dboy1( 10:26:49 AM ): offering half at 51

Dboy1( 10:27:44 AM ): using a 46 sell stop

Dboy1( 10:36:53 AM ): offering 54s on the balance

Cautious But Optimistic…

Tomorrow’s calendar is the heaviest of the week, as Thursday’s have been the best performing days of 2015, up 60%, as the only positive day of the week this year.

Time and again the last 3 years we have seen take the S&P down then bring it back with violent vengeance and continue the rally taking out higher buy stops and that’s what may be in store as the pre-OPEX week comes to an end. With today’s price action the S&P 500 tends to continue stronger as noted in the study below by Chad Gassaway.However a word of warning as we must realize that much is centered on Chinese monetary policy right now so as Danny Riley says “don’t fall in love with your positions and please use protective stops”

Tomorrow’s Notable Earnings: Advance Auto Parts Inc (NYSE:AAP), Kohl`s Corporation (NYSE:KSS), Nordstrom Inc (NYSE:JWN)

Tomorrow’s Economic Calendar:

Jobless Claims 8:30 AM ET

Retail Sales 8:30 AM ET

Import and Export Prices 8:30 AM ET

Bloomberg Consumer Comfort Index 9:45 AM ET

Business Inventories 10:00 AM ET

EIA Natural Gas Report 10:30 AM ET

3-Month Bill Announcement 11:00 AM ET

6-Month Bill Announcement 11:00 AM ET

52-Week Bill Announcement 11:00 AM ET

5-Yr TIPS Announcement 11:00 AM ET

30-Yr Bond Auction 1:00 PM ET

Fed Balance Sheet 4:30 PM ET

Money Supply 4:30 PM ET

- Open: 2064.25

- High 2084.75

- Low: 2046.75

- Close: 2084.75

- Volume: 2,349,214 total

- MOC: 340 Million to Buy