March options expiration, a quadruple witching, takes place today. And the S&P 500 ETF (NYSE:SPY) comes into the day having gone ex-dividend. The $1.05 payment will not hit accounts until April but is reflected in the ETF this morning. Despite that it is fighting in the pre-market to regain ground, and has recovered almost half of it already. All sorts wild activity can happen on a quadruple witching as dealers, market makers, traders and investors square their positions. If you look at options open interest there is a case to be made for a move higher with the highest open interest near by at the 205 strike expiring today.

Today may then turn out to be a bit boring. Who knows. But reflecting back at the end of the week there are a lot of positive things in the SPY chart. It moved over the 200-day SMA this week, and held. A weekly close over that level is a big plus. The Bollinger Bands® have turned higher. This allows the SPY to continue higher without becoming overbought. Momentum is also in favor of more upside price action with both the RSI and MACD rising and bullish.

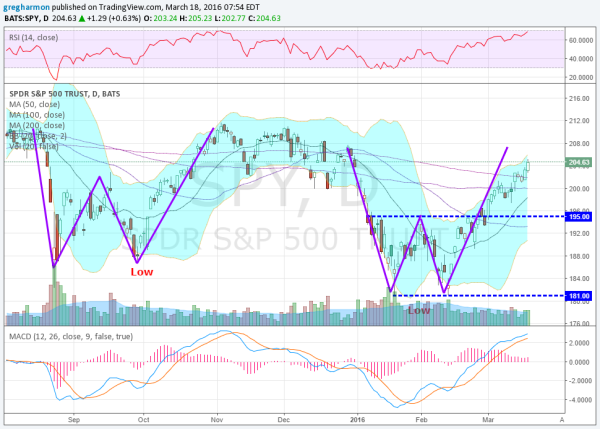

The “W” in the chart that I first noted as building 3 weeks ago, has continued to control the path. And it is closing in on that symmetrical move at about 208. This will likely be a big battle ground for all parties. I have included the broader picture back to August in the chart above to help explain why. There was “W” before. And that “W” ended up being the top as price rolled back lower into the end of the year before starting the current “W”. Sentiment from my unscientific study remains rather bearish. Participants continually describe the current leg higher as a relief or bear market rally. This view will be defended at that 208 level no doubt.

How it resolves could set the course of price action for the next 6 to 12 months. A continued push through to new highs could easily see rapid buying in a Fear of Missing Out (FOMO). A failure that falls back under the 200-day SMA will have bears pounding their chests harder and likely gain more followers to their cause. There has been a lot of good for the SPY that has come from the last 3 weeks. But it is the next 2 or 3 that will really matter.