At home we have taken to watching a lot of cooking shows. Master Chef has become our favorite. I fancy myself a decent cook when the task requires but man I could not even wash the dishes for these contestants. How a drummer can speed chop vegetables is beyond me. I know the technique, keep the blade on the cutting board, but have you tried it? Not as easy as it looks.

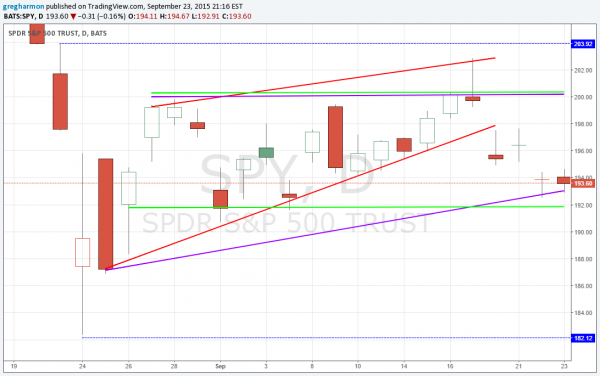

The markets have been going through a bit of chop recently as well. But unlike chopping vegetables, the goal in investing and trading is not to get your portfolio chopped up. The S&P 500 has moved in a wide range since August 20th. Down 200 points, then up 200, then down 100 and up 100. Remember the 6 month period with less than 20 point moves. The SPDR S&P 500 (NYSE:SPY) ETF below shows the volatility. There are many giving advice on how to deal with this.

This leads to confusion in reading the chart. Is price falling from a rising wedge (Red), or still in an ascending triangle (Purple), or in a horizontal channel(Green). Some suggest that you cut your position size as a way of lowering risk. That is not a bad idea. others suggest moving to cash. That is a viable option as well, but seems a bit overkill for a long term investor. Still others suggest changing your timeframe to a shorter one, like a day trader. That may work for a few who can watch the market minute to minute.

But it surprises me that more are not suggesting to change your timeframe to a longer one. How do you avoid the noise? Make the noise small relative to your perspective. So why not instead change to a longer weekly timeframe. If we do that the chart transforms into one where nearly the entire activity activity since the first drop in late August is contained in the range of that first week AND the the range is generally shrinking. How do you trade this type of activity? By sitting on your hands.

This consolidating triangle can resolve either to the upside or the downside. If you are a long term investor this is a good time to add downside protection as the range tightens and volatility shrinks. And then develop a list of stocks to buy at a discount if it breaks higher. If you are a trader wait for the break of the range in either direction.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.