Just as the market encountered an earnings recession in 2015/2016 due in part to the after effects of higher oil prices and a stronger US Dollar, current earnings reports show S&P 500 earnings growing at a low single digit pace. A large part of today's earnings slowdown is attributable to the tougher prior period comparisons resulting from the earnings improvement from the tax cut in late 2017. I wrote a post earlier this year on this topic and will not repeat it here, but those interested can read it at this link, The Tax Cut And Jobs Act Is Distorting 2019 Estimated Earnings Growth.

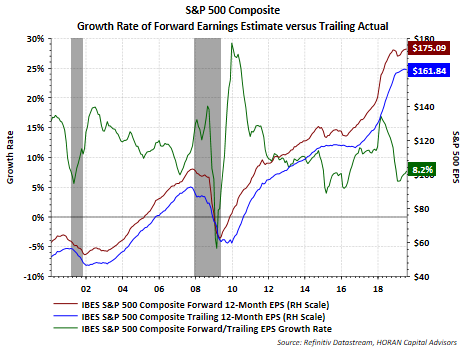

Brian Gilmartin at Trinity Asset Management, writes weekly on market earnings. In his post this week he stated he should maybe look at forward earnings estimates versus what actually was reported in the earlier trailing period. I have been tracking this as well and his post prompted me to write this article. As can be seen in the below chart, 12-month forward earnings are expected to increase 8.2% on a YoY basis versus the trailing 12-month actual earnings in the prior 12-month period. This represents an improvement from the first quarter when the growth rate was just over 6%. A similar earnings slowdown occurred in 2015/2016 with the current slowdown not as pronounced as then.The green line on the chart is beginning to turn higher and the worst of this earnings recession may be behind the market, all else being equal. I/B/E/S data from Refinitiv notes that 450 companies have reported earnings for the second quarter. Collectively, revenues are expected to be up 4.7% and earnings growth for the quarter are expected to be up 2.8%.

In summary, recession chatter seems a topic of interest for many strategist due in part to the flattening yield curve. Certainly, the trade and tariff issue play into that narrative as well. If earnings matter though, possibly the worst of the earnings slowdown may be behind us.