As Germany experiences economic turmoil, this article reveals the multifaceted impact of its economy on both the European Union and the broader global markets. Exploring Germany's pivotal role in the EU and Asian markets, as well as the impact of its economic well-being on international trade, we dive into a comprehensive study. This article analyzes the challenges and identifies the opportunities ahead, offering a panoramic view of Germany's economic resilience and its crucial impact on global market stability.

Recession cycles in Germany

The recession, officially recognized as actual GDP contracting for two consecutive quarters, has caused economic problems. It all starts with a reduction in consumer spending, which leads to a decrease in production and an increase in unemployment, further unwinding the spiral of negative economic aspects. These episodes accentuate the complex dynamics of the German economy's response to recessionary pressures, highlighting the interdependence of different economic sectors and the challenges associated with reversing recessionary trends.

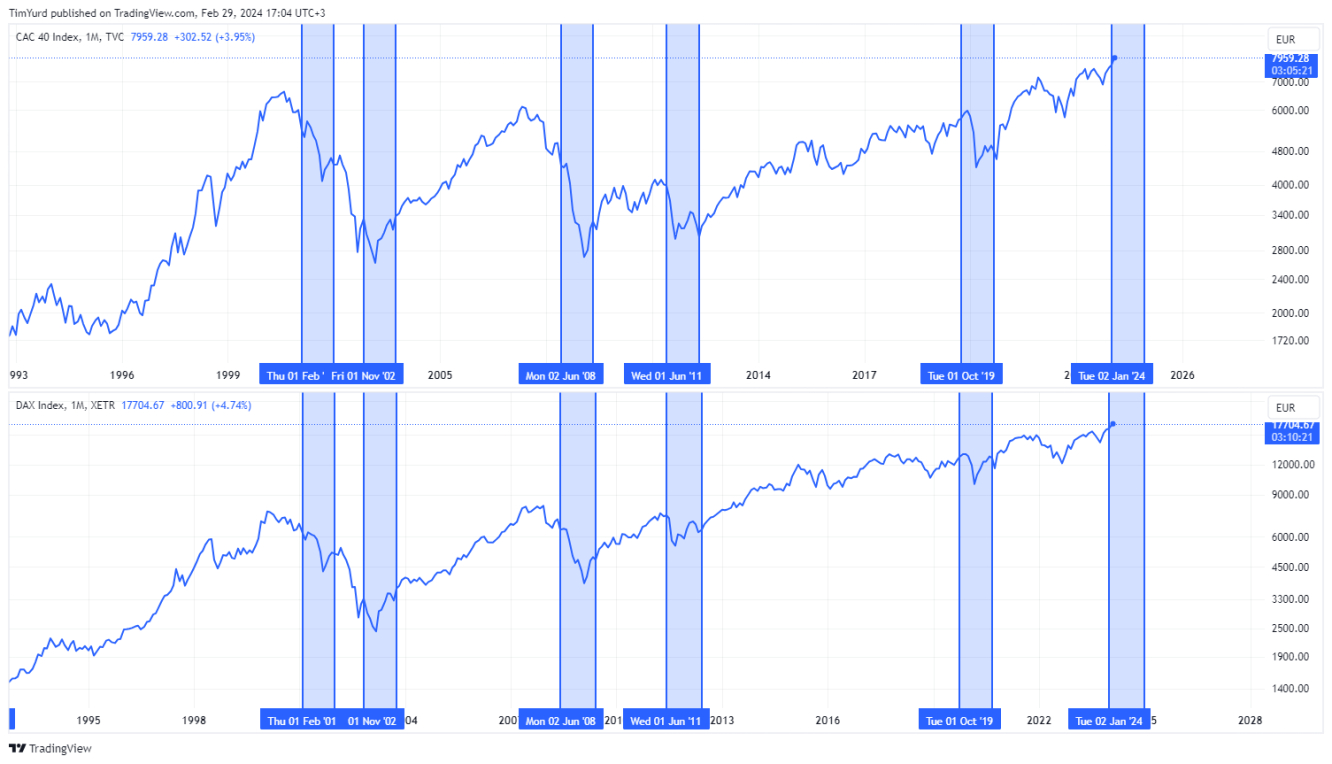

The recession in Germany has historically highlighted the country's economic resilience and, at the same time, vulnerability. The country navigated through significant downturns, such as the 1991 recession, a challenging period from July 2001 to March 2002, and a shorter recession in 2004, during which the DAX index surprisingly grew by 2.5%. The 2008 global financial crisis led to a dramatic 37% drop in the DAX from Q2 2008 to Q1 2009. Furthermore, a recession emerged from Q4 2012 to Q1 2013 amidst the European sovereign debt crisis, and the economy was hit again in 2020 by the COVID-19 pandemic.

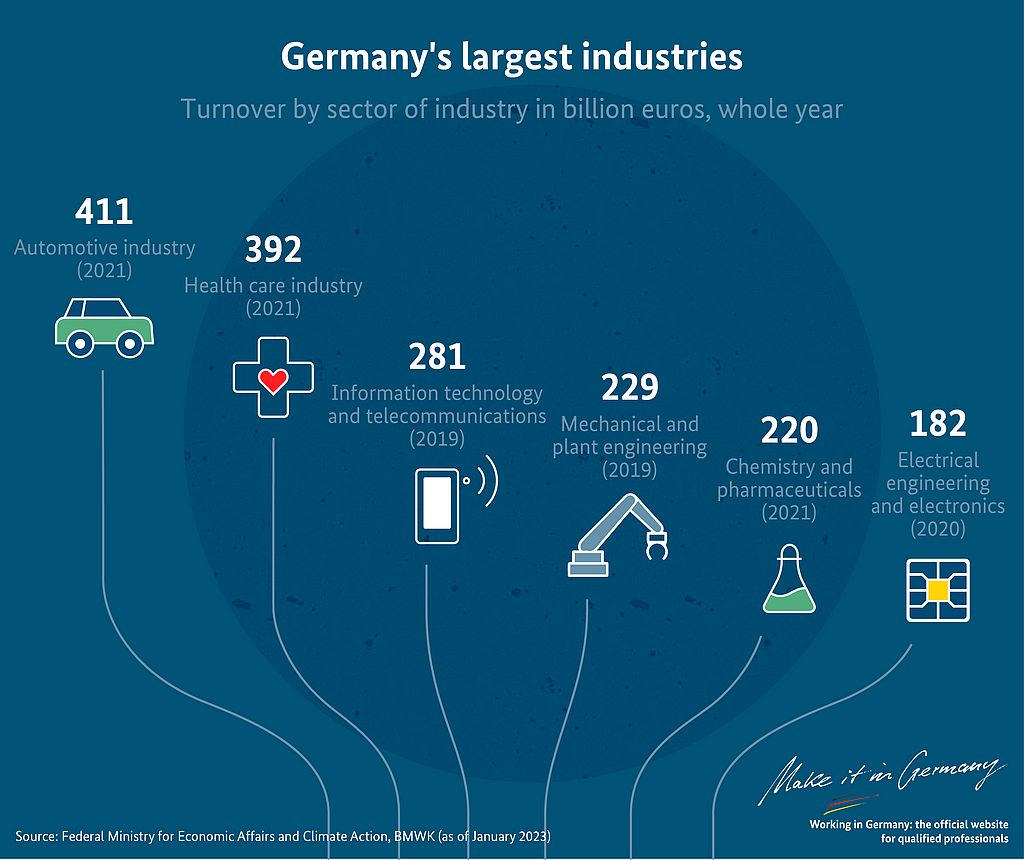

Germany's Economic Footprint

Germany is pivotal in the European Union (EU) and a crucial trade partner to Asian countries, underlining its significance in the global economic landscape. As Europe's largest economy, Germany's economic activities have far-reaching implications not only within the EU but also across the world.

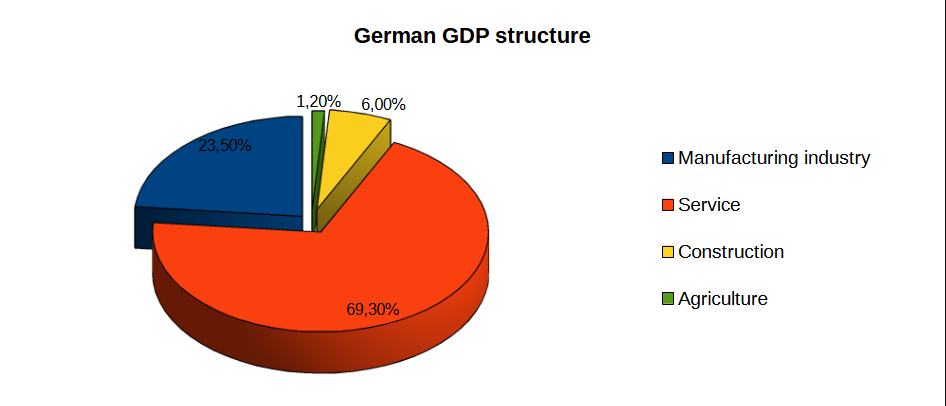

The backbone of Germany's economy is anchored in its manufacturing industry and services sector, contributing 23.5% and 69.3%, respectively, while construction and agriculture add another 6.0% and 1.2% to the economic mix.

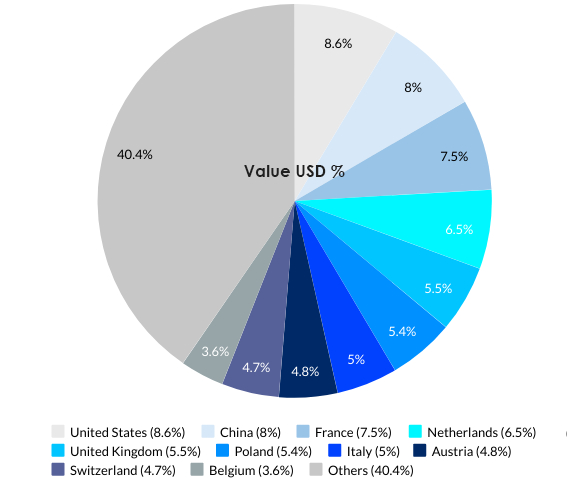

In terms of trade, intra-EU exchanges constitute 53% of Germany's exports, with France and the Netherlands being prominent partners. Conversely, China is a major non-EU trading partner. Notably, imports from EU member states represent 52% of Germany's total imports, highlighting the deep economic integration within the EU.

Since 2016, China has emerged as Germany's principal trading partner, underscoring the shifting dynamics of global trade. The trade volume with China accounts for nearly 20% of Germany's total trade activities. Furthermore, German industries heavily rely on the Chinese market, with an average of 20% of their sales originating from China. This reliance highlights Germany's challenges in diversifying its trade relationships. The dependency on China as a vital market for Germany's leading industries suggests a complex path toward reducing economic reliance.

Impact on the European Union and Trade Dynamics within the EU

Germany's economic prowess significantly influences the European Union's trade dynamics, given its central role in the European Single Market and as a significant beneficiary of the euro. Almost 52 percent of Germany's imports come from the EU, showcasing its interconnectedness with the bloc's economy. A recession in Germany could disrupt these trade flows, particularly affecting Central and Eastern European countries like the Czech Republic, Poland, Hungary, Romania, and Slovakia, which are heavily reliant on the German market. The potential decrease in German demand for imports could adversely affect these nations' economic growth, underscoring the intricate web of dependencies within the EU.

Financial Market Repercussions

A downturn in Germany's economy could send shockwaves through European financial markets. Stock market volatility and a weakened euro might result from decreased investor confidence in the eurozone's stability. The ECB and national governments might be compelled to enact monetary and fiscal interventions to mitigate these effects, aiming to stabilize the euro and maintain investor confidence.

In sum, Germany's economic health is vital for the stability and prosperity of the European Union. The potential impacts of a German recession highlight the need for robust economic policies and a coordinated response from the ECB and individual EU countries to safeguard the bloc's economy against such downturns.

Impact on Asian Economies

The recession in Germany could theoretically impact Asian economies, especially those with strong trade and investment ties to the European powerhouse.

As Germany is one of the significant import destinations for Asian products, a downturn could result in decreased exports from these countries, negatively affecting their trade balances and economic growth. Additionally, Germany's critical role in global manufacturing processes means a slowdown could disrupt supply chains. Consequently, a German recession might lead to a cautious reassessment of growth forecasts for key Asian economies, as negative factors contribute to a more uncertain economic outlook.

Trade turnover between the most prominent players in the Asian region and Germany includes:

- China – Germany: In 2023, Chinese exports to Germany amounted to US$116 billion, while imports from Germany totaled US$111 billion.

- Japan – Germany: Japanese exports to Germany reached US$25.2 billion in 2023, with imports from Germany at US$20.5 billion.

- Korea – Germany: Korean exports to Germany were US$12.1 billion, with imports at US$23 billion in 2023.

Despite the extensive economic ties between Germany and major Asian economies like China, Japan, and South Korea, it's crucial to note that these nations do not rely heavily on Germany. For instance, Germany constitutes only 4.1% of China's imports, 3.22% for Korea, and 2.70% for Japan, indicating a balanced relationship. This interdependence means that Germany also depends on Asia for imports and as a vital export market, underscoring the mutual benefits of their economic interactions.

Global Implications

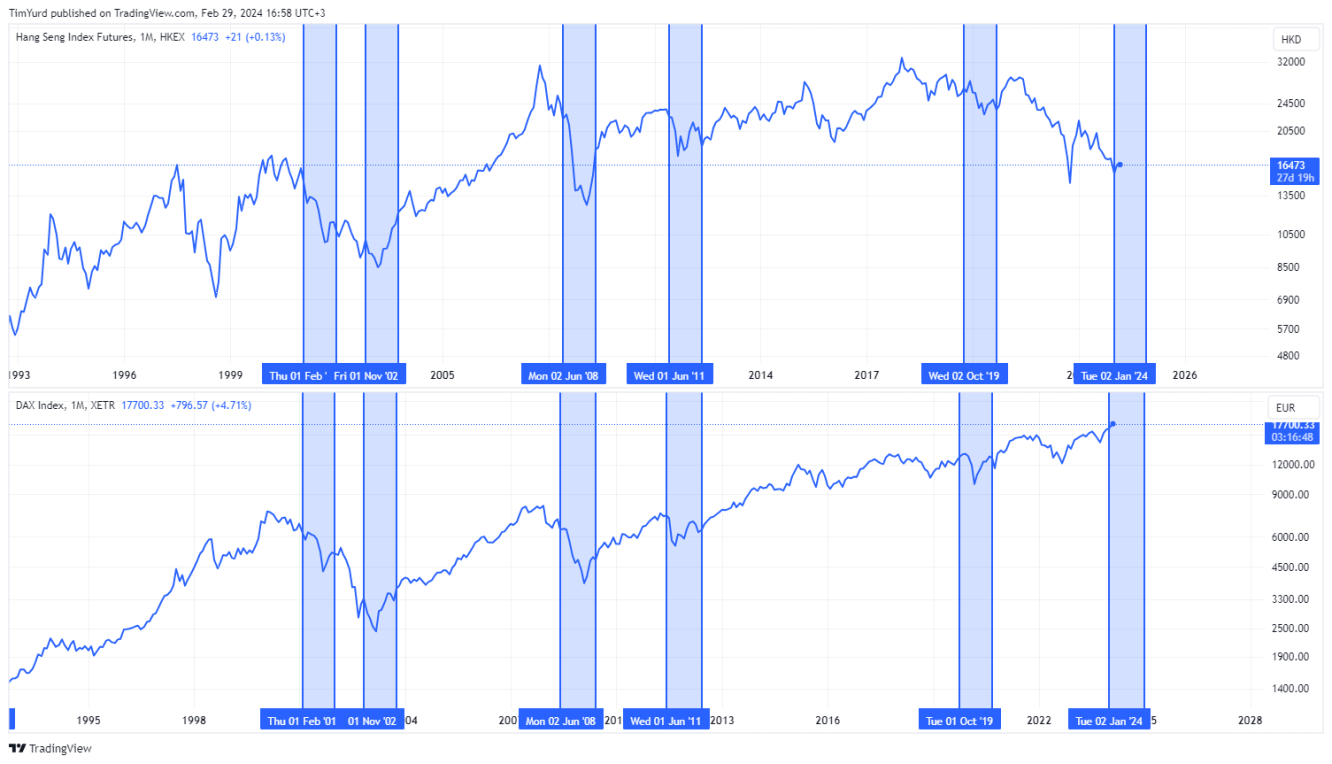

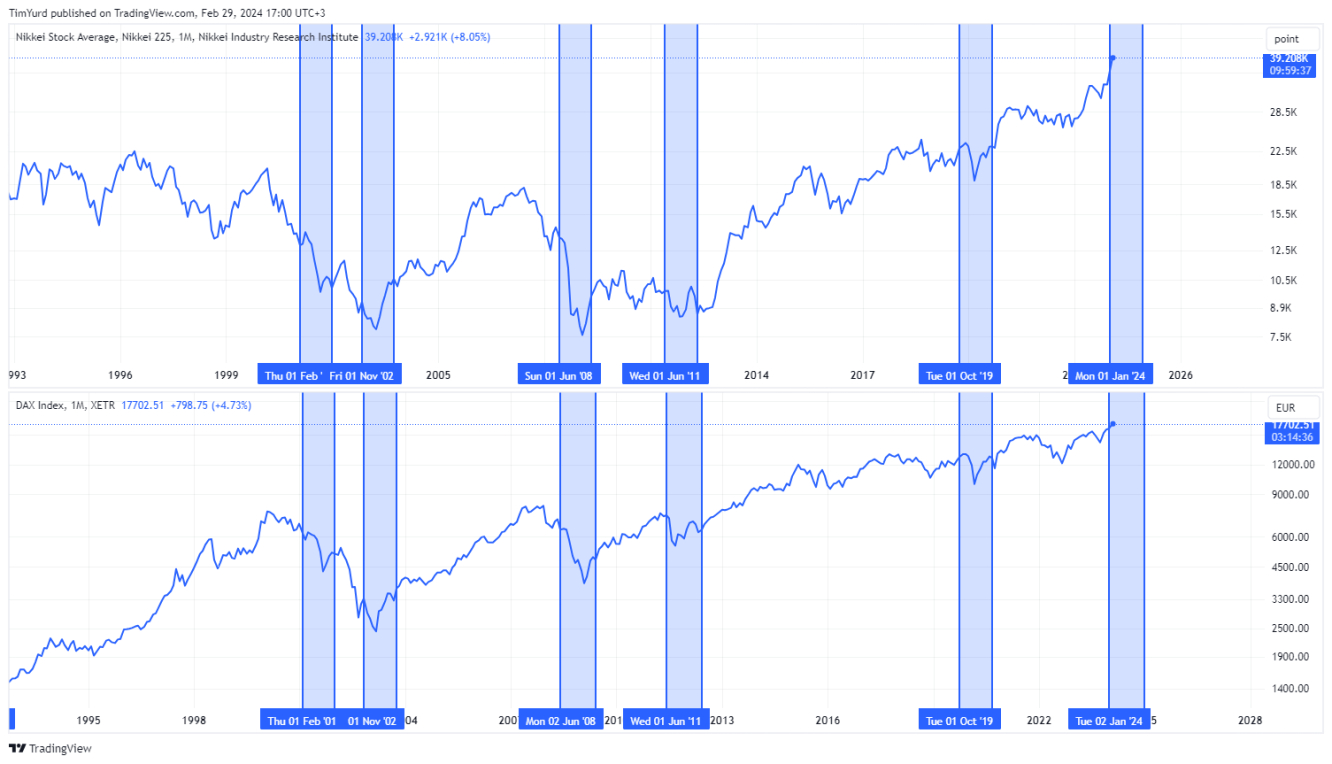

Recessions in Germany often lead to a decline in German “blue chips” value, as reflected in the DAX index, and a fall or slowdown in German GDP growth. This decline is often reflected in the dynamics of the European index due to the close interconnection of EU economies.

For example, the correlation between the DAX and the French CAC40 is visible, emphasizing the EU's dependence on Germany's economic viability.

Such correlations extend to Asia, where the slowdown in the German economy and the EU indicates a decline in business activity across the continent.

Historical data show a simultaneous decline in the Hong Kong HSI index and the Japanese Nikkei index, as well as recessions in Germany, which indicates the global impact of the economic cycles of Germany and the EU.

Looking at past recessions, we can try to anticipate potential trends in the markets of these regions. However, each economic downturn is unique, and any future projections must consider external factors such as geopolitical instability, China's declining import capacity, and potential commercial real estate crises that could lead to banking sector failures in Europe and Asia.

Mitigating Factors and Opportunities

The situation in Germany is an essential reminder of the interconnectedness of global economies. If Germany's economy falters, it is only a matter of time before the consequences are felt throughout the EU and beyond. However, current challenges also present opportunities for optimism and growth. The German government's recognition of economic vulnerabilities is the first step towards recovery, signaling a proactive approach to addressing these challenges.

The latest release showed that German inflation, measured by the change in consumer price index (CPI), fell to 2.5% in early February from 2.9% in January. This gives us reasonable hope that the ECB will soon decide to loosen its monetary policy, and an interest rate cut is just around the corner. This step will help revive the economy of both Germany in particular and the eurozone as a whole.

However, one should not unquestioningly hope for an optimistic scenario since the main geopolitical and macroeconomic influences still need to be on the agenda and continue to threaten the stability of Germany and the world economy.

Regarding the DAX, we can project with caution that in 2024, due to recessionary pressures, it might not surpass the 18,000 resistance level, potentially correcting to 16,000 before rebounding to 19,000.

For the Nikkei index, a similar trajectory is expected. After an unsuccessful attempt to exceed the 40,000 resistance, it is anticipated to adjust downwards to 33,000 before climbing to 44,000.

Conclusion

In conclusion, the economic interdependence between Germany, the EU, and big Asian economies highlights the global impact of the German recession. The synchronized movements of the DAX index with European and Asian stock indices during recessions show the degree of worldwide interconnectedness and Germany's vital role in the global economy.

While historical patterns provide insight into the market's potential response to future recessions, the unique context of each economic downturn underscores the difficulty of predicting economic outcomes. This interconnected situation highlights the need for vigilant monitoring and adaptive strategies to navigate the complex web of global financial relationships.

***

Traders and investors should be aware of the key market milestones and the consequences for the future economy. Using FBS, traders can benefit from rising and falling markets. The company offers over five hundred fifty trading instruments to build trading strategies on.

Disclosure: FBS is an international brand present in over 150 countries. Independent companies united by the FBS brand are devoted to their clients and offer them opportunities to trade Margin FX and CFDs. FBS Markets Inc. – Belize FSC 000102/6, Tradestone Ltd. – CySEC license number 331/17, Intelligent Financial Markets Pty Ltd – ASIC License number 426359.