Here is your Bonus Idea with links to the full Top Ten:

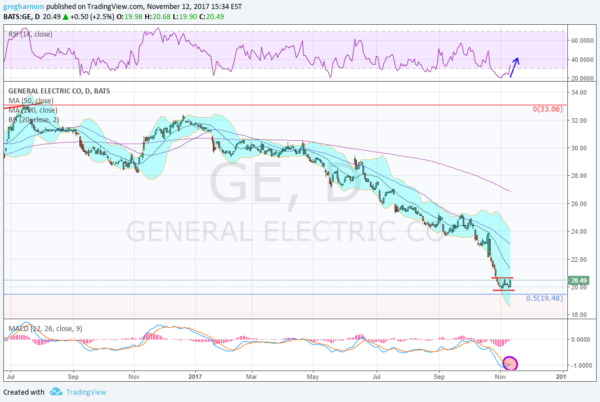

General Electric (NYSE:GE), had been moving higher ever since making a bottom in 2009 during the financial crisis until topping in mid-2016. It went through a long consolidation then and started lower early this year. It accelerated to the downside in April and has continued ever since. The past 2 weeks it seems to have found some support at 20, and near a 50% retracement of the 7 year move higher.

As it finds some short term footing, the momentum picture is improving rapidly. The RSI is running higher out of technically oversold territory while the MACD is crossing up, a buy signal for many. With that backdrop the strong close Friday could be the start of a reversal. There is resistance just above at 20.65 and then 22 and 23 before 23.85 and 25.25 then 26 and a gap to fill to 26.75. Support lower is found at 19.90 and below that the downtrend resumes. Short interest is low at 1.4$ and the company is expected to report earnings next on January 19th.

The November options chain expiring this week have enormous open interest above at the 22 and 23 strikes on both sides. It is also sizable at the 20 and 21 strikes though. In December open interest is biggest at 20 on the put side and 22 on the call side. And the January options, expiring the day of the earnings report, show open interest growing from 17 to 28 on the put side and 20 to 30 on the call side.

General Electric, Ticker: $GE

Trade Idea 1: Buy the stock on a move over 20.65 with a stop at 19.90.

Trade Idea 2: Buy the stock on a move over 20.65 and add a December 20/19 Put Spread (29 cents) while selling a January 23 Call (24 cents) to fund the protection.

Trade Idea 3: Buy a January 21/23 Call Spread (61 cents) and sell the January 19 Put (38 cents).

Trade Idea 4: Buy a December/January 22 Call Calendar (20 cents) and sell the December 19 Put (26 cents).

After reviewing over 1,000 charts, I have found some good setups for the week. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading into November Options Expiration sees the Equity markets have weathered a minor tremor but are still fazed.

Elsewhere look for Gold to pause in its downtrend while Crude Oil slows in its uptrend. The US Dollar Index is looking better to the upside after some consolidation while US Treasuries are biased lower. The Shanghai Composite has gained strength and is rising again while Emerging Markets continue to churn following their break of long term resistance.

Volatility looks to remain at low levels keeping the bias higher for the equity index ETF’s SPY (NYSE:SPY), IWM and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their charts show strength on the longer timeframe intact, with the SPY and QQQ the strongest and the iShares Russell 2000 (NYSE:IWM) retesting the breakout. On the shorter timeframe the IWM is most vulnerable as it continues in a long bull flag, while the SPY and QQQ appear to have held off deeper pullbacks for now. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.