Illinois Tool Works Inc. (NYSE:ITW) is a worldwide manufacturer of highly engineered products and specialty systems. The company’s diversified range of industrial products and equipment are sold in 57 countries. It currently has a $50.9 billion market capitalization.

Despite a long-term growth potential, this industrial tool maker faces risks from global uncertainties, industry rivalry and adverse foreign currency movements. Investors are eagerly waiting for the company’s latest earnings report.

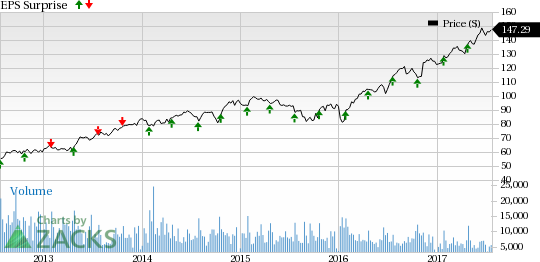

Illinois Tool Works recorded better-than-expected results in the four trailing quarters, with an average positive earnings surprise of 3.16%. The earnings estimate for the second-quarter 2017 is stable at $1.63 per share.

Currently, Illinois Tool Works has a Zacks Rank #2 (Buy), but that could definitely change after the release of first-quarter 2017 earnings report. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here. We have highlighted some of the key stats from this just-revealed announcement below:

Earnings: Illinois Tool Works’ earnings came in at $1.69 per share in second-quarter of 2017. The bottom line result surpassed the Zacks Consensus Estimate of $1.63 per share.

Revenue: Revenues lagged. Illinois Tool Works generated revenues of $3.6 billion, slightly the Zacks Consensus Estimate of $3.62 billion.

Key Stats to Note: Illinois Tool Works’ operating margin in the second quarter grew 180 basis points (bps) year over year to 24.9%. Enterprise initiatives added 100 bps to operating margin growth. The company raised its 2017 earnings guidance to $6.32−$6.52 per share from the previous projection of $6.20−$6.40 per share.

Stock Price: Illinois Tool Works shares were up 0.12% ahead of the report.

Check back our full write up on this ITW earnings report later!

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Illinois Tool Works Inc. (ITW): Free Stock Analysis Report

Original post

Zacks Investment Research