Industrial tool maker Illinois Tool Works Inc. (NYSE:ITW) reported impressive bottom-line results for second-quarter 2017. Earnings in the quarter came in at $1.69 per share. Excluding benefits of 3 cents from a legal settlement, adjusted earnings were $1.66, surpassing the Zacks Consensus Estimate of $1.63.

Also, the bottom-line of $1.63 topped the year-ago tally of $1.46 by 13.7%. Further, it exceeded the guidance range of $1.55−$1.65. The year-over-year improvement can be attributed to a 3.1% reduction in the company’s share count due to its ongoing share buyback activity. Earnings were also boosted by its enterprise initiatives.

Revenues in the quarter totaled $3.599 billion, slightly below the Zacks Consensus Estimate of $3.62 billion. However, the top line grew 4.9% year over year. The improvement was driven by 2.6% positive impact from organic revenue growth and 3.5% gain from the acquired assets of Engineered Fasteners & Components (completed in 2016). However, the positives were partially offset by 1.2% adverse impact from unfavorable foreign currency movements.

Segmental Details

Illinois Tool Works reports its revenues under the segments discussed below:

Test & Measurement and Electronics’ revenues increased 2.5% year over year to $519 million. Revenues from Automotive OEM (Original Equipment Manufacturer) grew 22.2% to $820 million. Food Equipment generated revenues of $529 million, dipping 1.4% year over year.

Welding revenues came in at $385 million, growing 2.9% year over year. Construction Products’ revenues were up 0.4% to $425 million while revenues of $490 million from Specialty Products reflected growth of 1.1%. Polymers & Fluids’ revenues of $437 million declined 1.3% year over year.

Margins

In the quarter, Illinois Tool Works’ cost of sales increased 6.1% year over year, representing 58% of total revenue compared with 57.3% in the year-ago quarter. Selling, administrative, and research and development expenses, as a percentage of total revenue, came in at 16.3%.

Operating margin improved 120 basis points (bps) year over year to 24.3%, driven by roughly 100 bps contributions from enterprise initiatives. Excluding the impact from the Engineered Fasteners and Components business acquisition, operating margin in the quarter was 24.9%.

Balance Sheet & Cash Flow

Exiting the second quarter, Illinois Tool Works had cash and cash equivalents of approximately $2,496 million, slightly above $2,493 million recorded in the previous quarter. The company’s long-term debt grew 2.2% sequentially to $7,360 million.

In the quarter, Illinois Tool Works generated net cash of $464 million from its operating activities, down 13.3% year over year. Capital expenditure on purchase of plant and equipment totaled $77 million. Adjusted free cash flow was $502 million, reflecting a conversion rate (as a percentage of net income) of 85%.

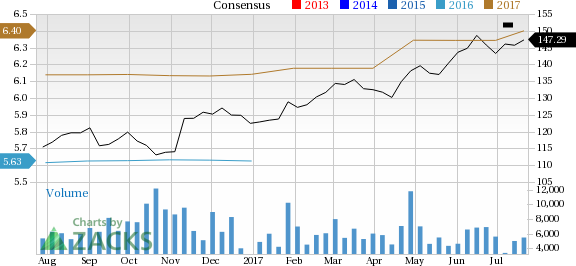

Outlook: Impressed with its second-quarter results, Illinois Tool Works increased its earnings guidance to $6.32−$6.52 per share for 2017 from the earlier projection of $6.20−$6.40.

Organic revenue growth is expected to be 2−4% while operating margin is expected to be 24%. Full-year free cash flow is anticipated to be 100% of net income. Effective tax rate will be roughly 29%.

For third-quarter 2017, earnings per share are expected within $1.57−$1.67. Organic revenues are expected to be 1−3%.

Zacks Rank & Key Picks

With a market capitalization of $50.9 billion, Illinois Tool Works carries a Zacks Rank #2 (Buy). Some other stocks worth considering in the machinery industry include Atlas Copco AB (OTC:ATLKY) , Dover Corporation (NYSE:DOV) and Parker-Hannifin Corporation (NYSE:PH) . While Atlas Copco sports a Zacks Rank #1 (Strong Buy), both Dover Corporation and Parker-Hannifin carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Atlas Copco’s earnings estimates for 2017 and 2018 were revised upward in the last 60 days. Also, its earnings are anticipated to grow roughly 15% in the next three to five years.

Dover Corporation’s earnings estimates for 2017 and 2018 were revised upward in the last 60 days. Also, the company pulled off an average positive earnings surprise of 1.62% for the last four quarters.

Parker-Hannifin reported an average positive earnings surprise of 14.94% for the last four quarters. Also, earnings expectations for fiscal 2018 improved over the past 60 days.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Dover Corporation (DOV): Free Stock Analysis Report

Parker-Hannifin Corporation (PH): Free Stock Analysis Report

Illinois Tool Works Inc. (ITW): Free Stock Analysis Report

Atlas Copco AB (ATLKY): Free Stock Analysis Report

Original post