Slow burn as China cuts industrial capacity

The pause in the oil price and the weakness in the US dollar appears to have helped equity markets overnight. WTI oil has now climbed 6.5% from its lowest point yesterday and was actually trading higher than Brent for the first time since January, helped along by Congress’s removal on the ban on US oil exports. This saw the S&P 500’s energy sector rally 1.4%, helping ease some of the concerns in the junk bond complex, with high yield ETF N:HYG gaining 1.2%. Unfortunately, concerns for high yield debt look unlikely to go away in the near future with US territory, Puerto Rico, widely expected to default on its US$70 billion of debt by failing to pay its 1 January interest payments. Nonetheless, these concerns seem unlikely to be affecting markets today who are looking to see some recovery after a bruising December. Currently, we are calling all markets in Asia to open in the green. The good performance of US markets overnight and Chinese promises for further stimulus bode well for the ASX today. Currently, we are calling for it to open up roughly 0.3%.

The final estimate for US Q3 GDP was revised down to 2% from a previous 2.1%, although this still came in above expectations for 1.9% reading. After Q2’s 3.9% growth, it was the most volatile components of GDP - inventories and trade - that weighed down Q3 growth. The strong US dollar saw net exports subtract 0.3% from Q3 growth. But Janet Yellen’s preferred measure of final sales to private domestic purchasers grew at 3.2%, which shows that there is still a lot of positive momentum to the domestic economy even if it is somewhat weaker than Q2.

The Qingdao iron price rose to US$40.8 yesterday, seeing a cumulative 3.5% gain over four days. And these gains have been mirrored across the industrial metals spectrum in recent days with copper, zinc, nickel, aluminum, and lead also being buoyed by China’s Central Economic Work Conference (CEWC). Although these industrials metals did decline overnight on the London Metals Exchange. But there are two forces at play, the commitment to further stimulus and the commitment to cutting over-capacity – one supportive of industrial metals, the other not. The announcement last week that Wuhan Iron and Steel Group was cutting 11,000 jobs, following on from coal-producer Longmay’s 100,000 job losses in October, does seem to give credence to the argument that the government will follow through on its commitment to cutting over-capacity this time. There are also reports that around 35 steel plants in 13 provinces have now entirely stopped, cutting 53 million tonnes of production and 3.6 million tonnes of aluminium smelting capacity has reportedly been cut this year as well. Alongside the central government’s commitment to cutting over capacity, local government’s increasing inability to stump up the cash needed to keep these businesses going seems to be having just as much an effect. While this will bring some rationality to the market, in the near term China’s true demand for commodities may be laid bare likely bringing further pain for materials companies in 2016.

The post-Fed rally in the US dollar has almost been completely unwound after the DXY dollar index lost another 0.2% overnight. China’s central bank halting the depreciation of the CNY this week seems to have been a driving factor in taking some of the steam out of the USD. But the CEWC’s commitment to further stimulus has also buoyed a range of emerging market and commodity related currencies. The Aussie dollar gained 0.5% overnight and the kiwi gained 0.6%.

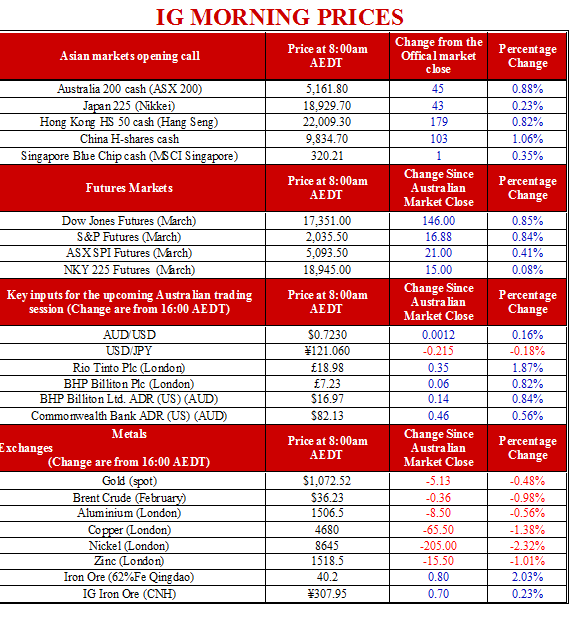

IG provides round-the-clock CFD trading on currencies, indices and commodities. The levels quoted in this email are the latest tradeable price for each market. The net change for each market is referenced from the corresponding tradeable level at yesterday’s close of the ASX. These levels are specifically tailored for the Australian trader and take into account the 24hr nature of global markets.