The US Dollar traded up on Tuesday against other major currencies with the US Dollar Index (USDX) trading up by 0.39%. The support for the Dollar came through Fed’s chair Yellen’s remark that waiting for the inflation to hit the 2% target would not be prudent, indicating that the Federal Reserve is indeed interested to raise rates soon.

Gold traded down on the news from the Federal Reserve as it has to compete with interest bearing investments and a rate hike could make the lack of interest from the precious metal less interesting.

While oil initially was trading down, it recovered with WTI oil closing almost unchanged as the American Petroleum Institute’s published oil stockpile numbers were far below market expectations. While the market expected an increase in supplies, stockpiles actually decreased in the last reporting week. Oil traders will look forward to the publication of the Energy Information Administration’s oil stockpile statistics on Wednesday.

US equities closed mixed with the technology sector and the technology index NASDAQ (US Tech 100) recovering from Monday’s losses with many affected stocks showing a significant recovery such as Snapchat with up 5.38%.

Cryptocurrencies traded mixed with lower volatility. Bitcoin took an aim towards the $4,000 level again but failed yet to reach it. Of the major cryptocurrencies Ripple had one of the more significant gains of the day with up 3%. Former Fortress Investment manager Novogratz mentioned that he thinks the cryptocurrency trend is a huge bubble but plans to benefit from that.

On Wednesday the ECB publishes private sector lending statistics and the money supply M3 figures. From the US we will see Durable Goods New Orders, Pending Home Sales Index statistics and the MBA Composite, Purchas, and Refinance Indexes. Also the EIA oil stockpile statistics will be published.

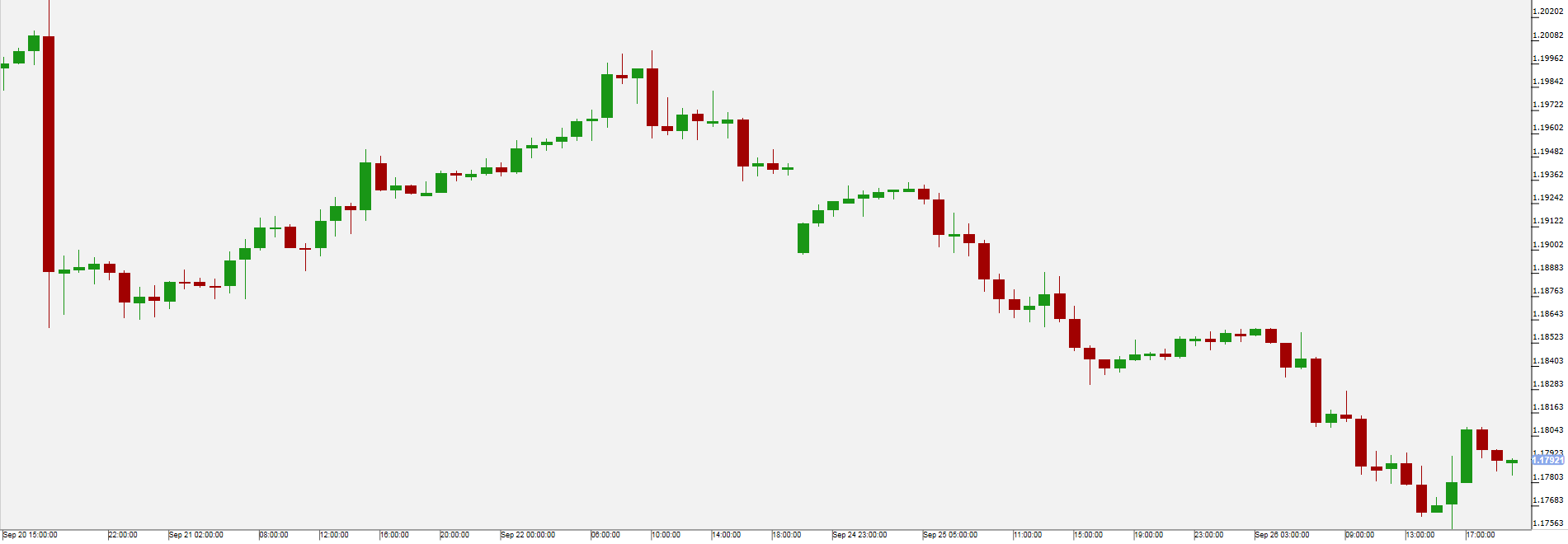

EUR/USDThe EUR/USD was again under pressure and traded as low as five weeks ago due to the strong Dollar and weakened Euro.

The Dollar received support by Federal Reserve’s chair Yellen mentioning that the Fed would not necessarily wait for rate hikes until inflation reaches the 2% target. The Euro was again under pressure as voices from different political parties in Germany indicate that forming a government under Merkel could be more difficult than anticipated as the current partner of Merkel’s CDU/CSU, the Social Democrats (SPD) do not want to continue with the current coalition.

On Wednesday the ECB publishes private sector lending statistics and the money supply M3 figures. From the US we will see Durable Goods New Orders and Pending Home Sales Index statistics.

Pivot: 1.183

Support: 1.176 1.173 1.169

Resistance: 1.183 1.186 1.189

Scenario 1: short positions below 1.1830 with targets at 1.1760 & 1.1730 in extension.

Scenario 2: above 1.1830 look for further upside with 1.1860 & 1.1890 as targets.

Comment: the RSI is mixed to bearish.

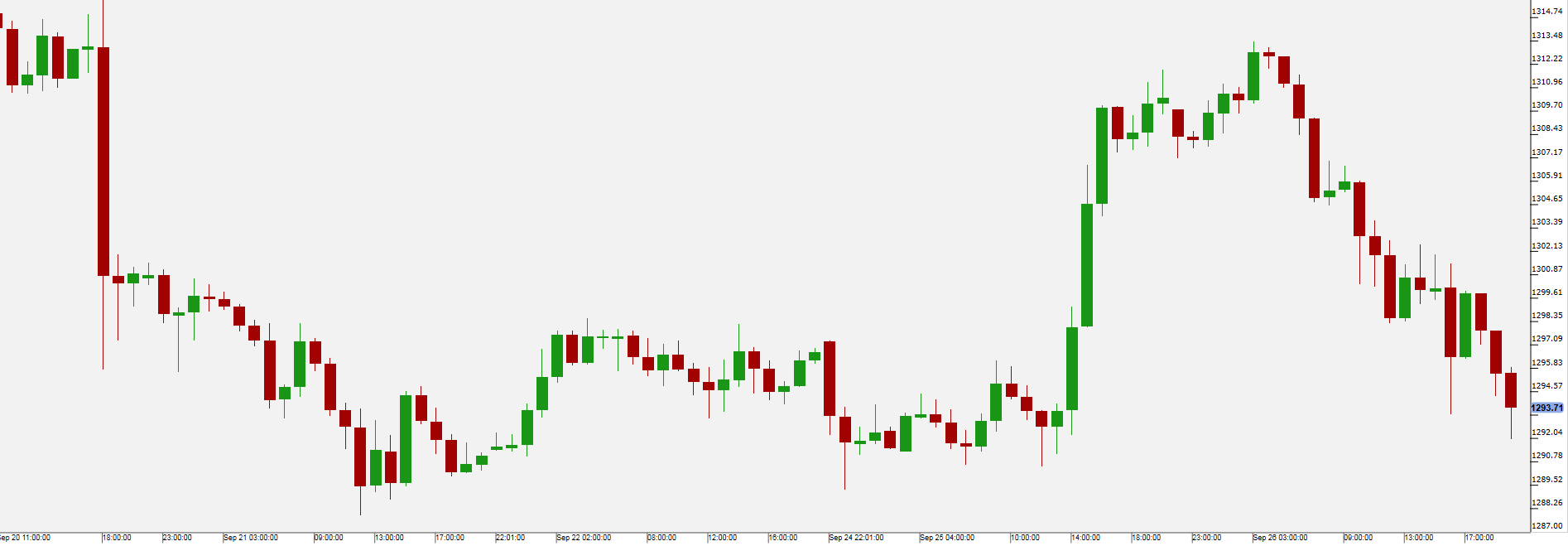

Gold was under pressure on Tuesday, following Fed’s Yellen’s remarks that the inflation target of 2% does not have to be necessarily be reached for rate hikes to continue as that would be not prudent. Gold is sensitive to interest rates as it has to compete with interest bearing safe haven assets.

It is not clear how markets are reacting to the current war of words between North Korea and Donald Trump, as Trump weighted down again on Tuesday that a military option would not be preferred but “devastating”.

Gold traders will continue watching the development surrounding North Korea and the movement of US rates.

Pivot: 1305

Support: 1293 1288 1281.5

Resistance: 1305 1307.5 1313.5

Scenario 1: short positions below 1305.00 with targets at 1293.00 & 1288.00 in extension.

Scenario 2: above 1305.00 look for further upside with 1307.50 & 1313.50 as targets.

Comment: the RSI broke below a rising trend line.

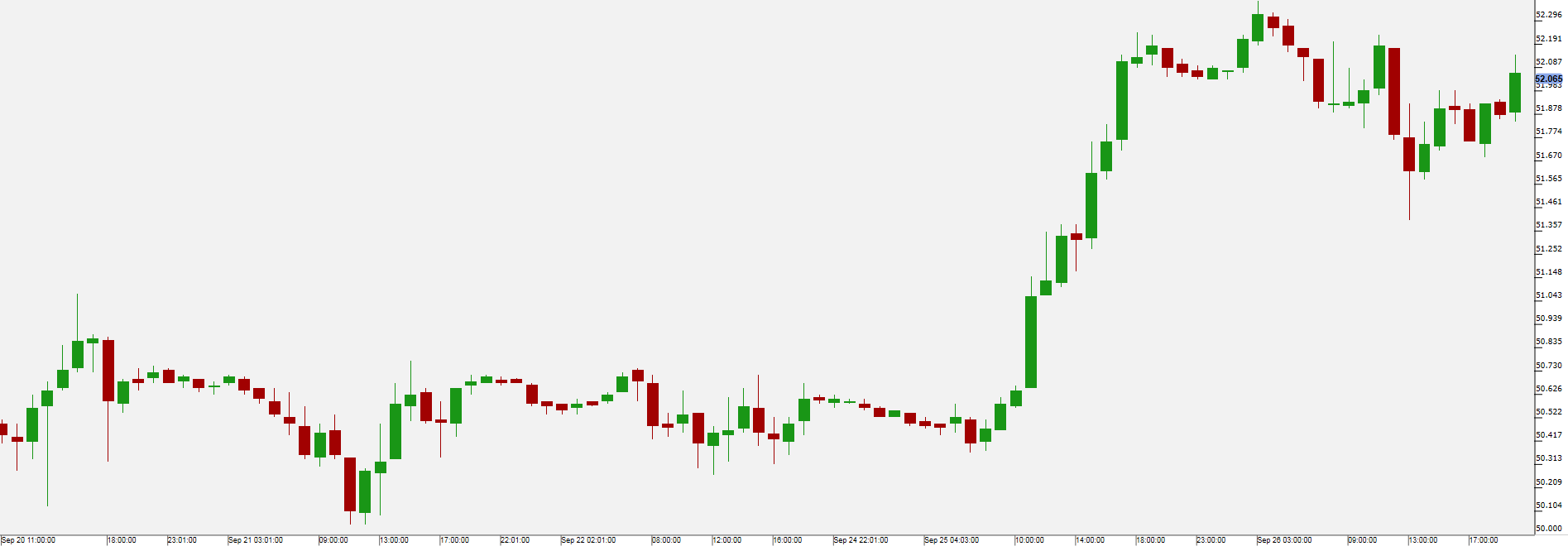

WTI oil traded almost unchanged on Tuesday following the surge up on Monday. After initial losses oil recovered on the publication of American Petroleum Institute (API) Weekly Crude Oil stock figures as they indicated lower stockpiles by 0.761 million barrels, while the market expected the stockpiles to rise.

The Kurdish Northern part of Iraq held an independence referendum on Monday and it is expected that the results will be pro-independence. All neighbors of this possibly newly formed country are opposed towards such development. As the region has huge oil reserves this could affect oil supplies.

On Wednesday the Energy Information Administration (EIA) releases its crude oil stockpile statistics.

Pivot: 52.05

Support: 51.63 51.42 51.1

Resistance: 52.05 52.45 52.7

Scenario 1: short positions below 49.70 with targets at 48.10 & 47.67 in extension.

Scenario 2: above 49.70 look for further upside with 50.13 & 50.43 as targets.

Comment: technically the RSI is below its neutrality area at 50.

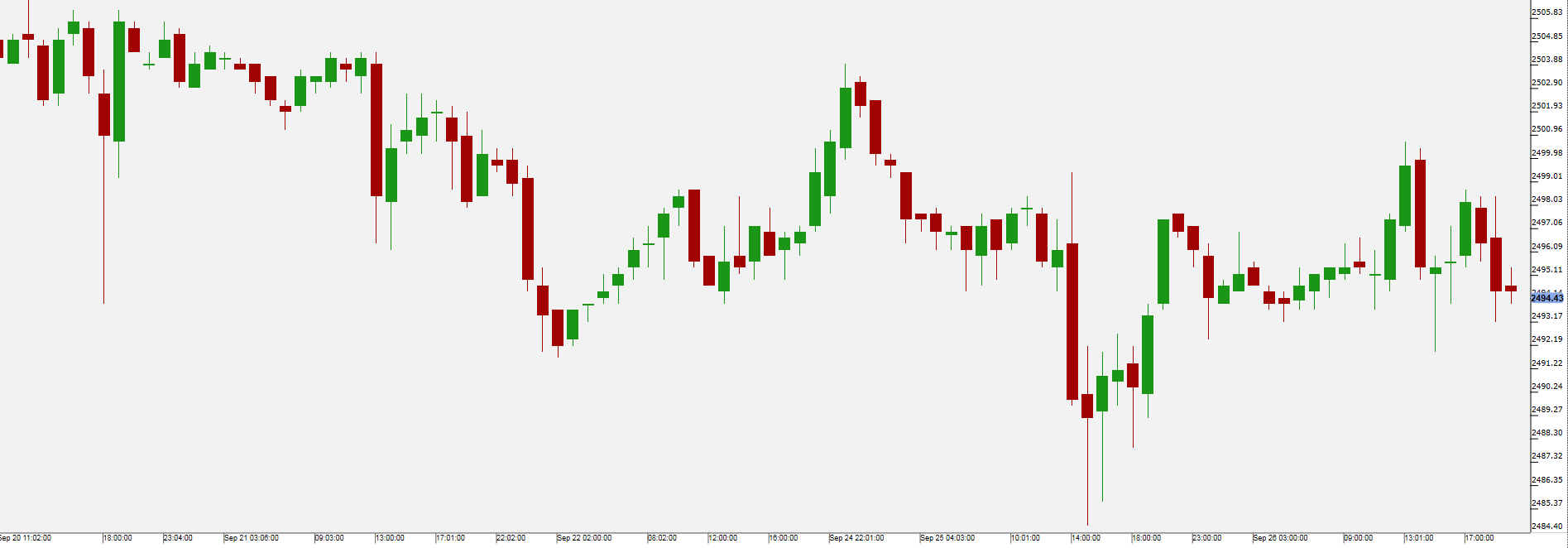

US equity indices traded mixed on Tuesday with small losses in the S&P 500 (US 500) and Dow Jones Industrial Average (US 30) and gains in the NASDAQ (US Tech 100) and Russell 2000 (US 2000).

NASDAQ and tech stocks recovered after high losses on Monday. The technology sector was one of the sectors trading up on Tuesday with the US Technology ETF trading up by 0.36%, while being surpassed by the US Banks ETF up 0.67% up performance.

Snapchat was one of the top performing shares with 5.38% up on Tuesday. The now six years old service tries to improve the content to face its main competitor – Instagram.

On Wednesday the MBA Indexes, Durable Goods New Orders and Pending Home Sales Index statistics will be published.

Pivot: 2492

Support: 2492 2489 2486

Resistance: 2501.25 2504.5 2506

Scenario 1: long positions above 2492.00 with targets at 2501.25 & 2504.50 in extension.

Scenario 2: below 2492.00 look for further downside with 2489.00 & 2486.00 as targets.

Comment: the RSI is mixed with a bullish bias.