On Monday the US Dollar was trading again stronger with the basket of major currencies against the Dollar, the US Dollar Index (USDX) trading up by 0.63% as strong manufacturing data from the US pushed it higher. The Euro was under pressure after the Catalan independence referendum, where the wealthy north-eastern region of Spain seeks to secede from the rest of the country.

Gold continued its downward trend as US Treasuries continued their rate up-trend. Gold was in recent weeks under pressure even though the Trump administration and North Korea’s regime continue their war of words.

Oil traded down as a report about likely OPEC country production figures indicated that the compliance with the agreed cuts was lower than earlier expected. Traders are worried what this could mean for the extension of the agreed production quotas.

Most major US equity indices with the exception of NASDAQ (US Tech 100) closed at record high after good US economic data and investors seeing the global political risk less negative. General Motors (NYSE:GM) traded 4.49% up after the announcement of an electric car strategy that would see the company make 20 electric car models within 6 years.

Bitcoin received support as an unconfirmed report by the Wall Street Journal indicated that the investment bank Goldman Sachs (NYSE:GS) is looking into offering Bitcoin and possibly other cryptocurrencies to its customers. The market for cryptocurrencies was unusually flat with almost all major coins trading at less than 1% movements at the end of the day on Monday.

On Tuesday the European Union publishes its region’s Retail Sales, PMI and Producer Price Index (PPI) data. Japan will publish its inflation data. The United Kingdom will disclose its construction and services statistics. The US publishes Redbook Store Sales numbers. The API (American Petroleum Institute) releases its Weekly Crude Oil Stock numbers.

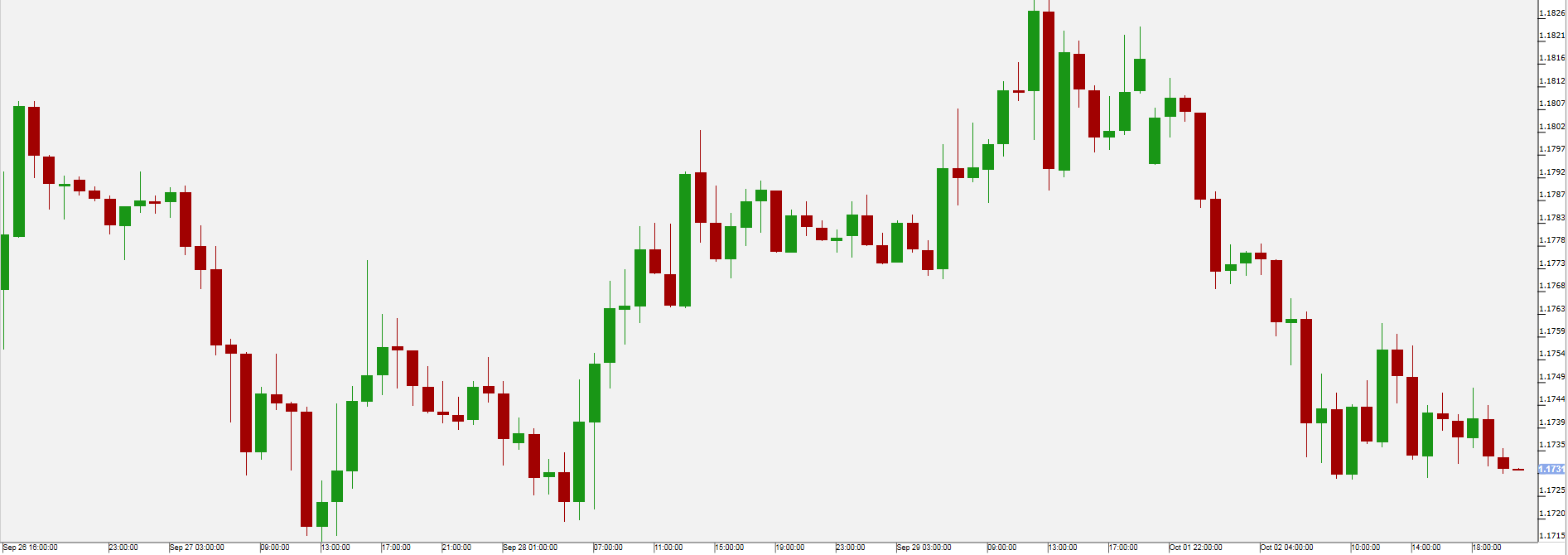

EUR/USDThe EUR/USD [i] continued the downtrend in the new week as the independence referendum in the Spanish region of Catalonia gave rise to political uncertainty as the government of the region now likely will demand actual independence in the disputed referendum.

Strong manufacturing and construction sector data in the US also gave the Dollar support.

On Tuesday the European Union publishes its region’s Retail Sales, PMI and Producer Price Index (PPI) data. The US publishes Redbook Store Sales numbers.

Pivot: 1.1775

Support: 1.172 1.168 1.1645

Resistance: 1.1775 1.18 1.1835

Scenario 1: short positions below 1.1775 with targets at 1.1720 & 1.1680 in extension.

Scenario 2: above 1.1775 look for further upside with 1.1800 & 1.1835 as targets.

Comment: the RSI is mixed with a bearish bias.

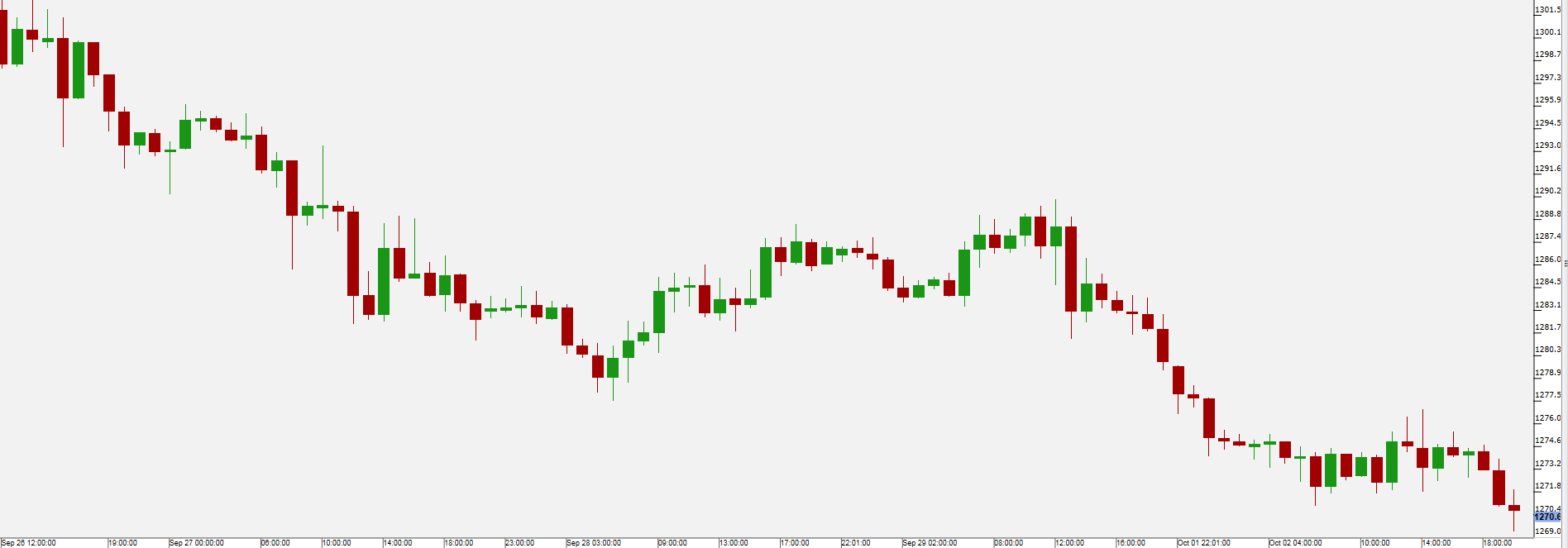

Gold [i] reached a 1.5 months low on Monday as positive US economic data pushed US Treasury yields were again higher and while regional uncertainty in Iraqi Kurdistan and Spanish Catalonia still exists, market valuate the global risk and safe haven demand down.

Gold is under pressure especially after the Federal Reserve announced that rate hikes could come sooner than the market expects them. Non-interest bearing gold declined against interest rate sensitive assets such as bonds.

No major US centric data is expected on Tuesday which could bring back the focus on global political events and the US government policies.

Pivot: 1281

Support: 1267 1262 1254

Resistance: 1281 1286.5 1290.5

Scenario 1: short positions below 1281.00 with targets at 1267.00 & 1262.00 in extension.

Scenario 2: above 1281.00 look for further upside with 1286.50 & 1290.50 as targets.

Comment: the RSI is mixed to bearish

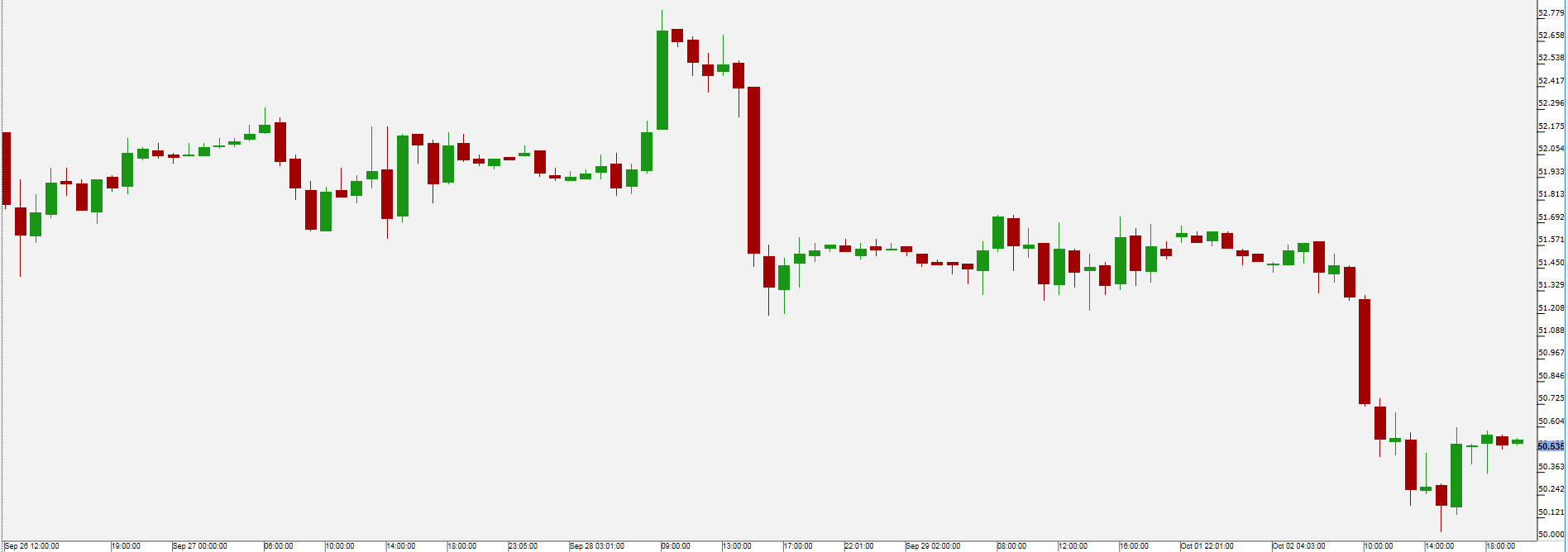

WTI oil [i] lost a significant amount on Monday for a first time after the surge on last week’s Monday. The downturn comes amidst an increased output by OPEC countries last month and higher number of operating oil rigs in the US according to the Baker Hughes rig count.

The market reacted harshly to the worsening OPEC compliance with the agreed output cuts, increasing concern that the oil cartel could still avoid an agreement to extend production cuts beyond March next year.

On Tuesday the API (American Petroleum Institute) Weekly Crude Oil Stock numbers will released, followed by crude oil stock statistics from the Energy Information Administration (EIA) statistics on Wednesday.

Pivot: 50.95

Support: 50.95 51.3 51.75

Resistance: 49.25 49.75 50.05

Scenario 1: short positions below 50.95 with targets at 50.05 & 49.75 in extension.

Scenario 2: above 50.95 look for further upside with 51.30 & 51.75 as targets.

Comment: the RSI broke below a rising trend line.

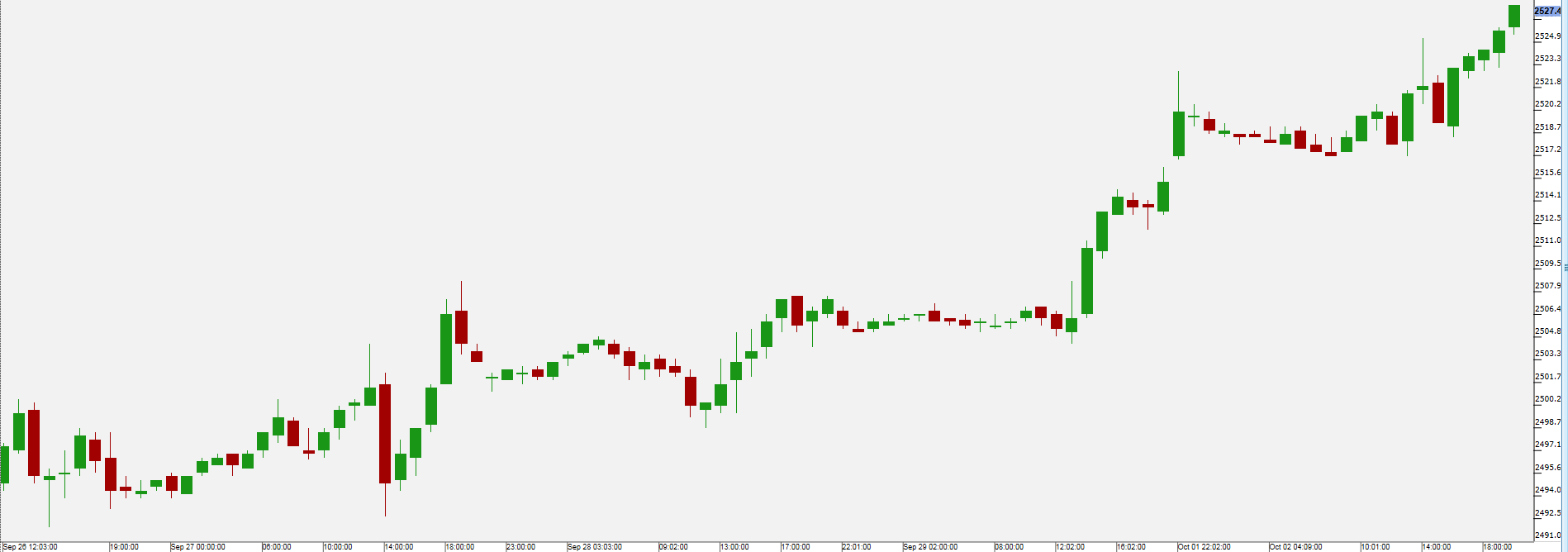

US equity indices [i] were again up on Monday with the S&P 500 (US 500), Dow Jones Industrial Average (US 30) and the Russell 2000 (US 2000) closing at record high. This rise comes amid very positive numbers in the manufacturing sector as the ISM Manufacturing Index surpassed the previous result of 58.8 and similar expectations significantly with the level of 60.8.

The biggest gains on Monday were in the biotech sector with the US Biotech ETF up 1.45% followed by US Health Care ETF up 0.99% and US Financials ETF up 0.89%. The US Financials ETF rose within the last three weeks by 7.2% amidst positive interest rate expectations from the Federal Reserve.

The automaker General Motors (GM)’s shares rose 4.49% on Monday as it presented a strategy to enter the market of electric cars within 1.5 years with two and within 6 years with 20 all electric models.

On Tuesday the Redbook Store Sales numbers will be releases

Pivot: 2517.5

Support: 2517.5 2512 2505.5

Resistance: 2530 2535 2540

Scenario 1: long positions above 2517.50 with targets at 2530.00 & 2535.00 in extension.

Scenario 2: below 2517.50 look for further downside with 2512.00 & 2505.50 as targets.

Comment: the RSI is bullish and calls for further upside.