The US Dollar was weaker against other major currencies on Friday for the fourth day in a row with the US Dollar Index (USDX) closing 0.35%. The US Dollar index which measures the strength of the US Dollar against six other significant currencies lost over the course of the week 1.2%, the biggest loss since 2.5 months.

The USD/ZAR opened significantly higher in early Monday trading as S&P downgraded the country's credit rating and Moody's gave it a negative outlook indicating also a possible downgrade.

Gold settled lower retracing some of its gains from earlier in the week. Oil reached a new two year high ahead of the OPEC meeting in Vienna scheduled for Thursday as it is understood that OPEC and Russia are agreeing on outlines for the extension of production cuts and are discussing some details for the agreement.

US equities traded mixed, while the S&P 500 (US 500) and NASDAQ (US Tech 100) reached all-time highs as markets have a positive outlook on retail spending on Black Friday weekend, helping Amazon (NASDAQ:AMZN) reach a new all-time high.

Bitcoin surged on Sunday to new record highs surpassing $9,500 before retracing above $9,000. Bitcoin which is considered the most significant cryptocurrency by market capitalization experienced gains of over $1,300 over the course of the weekend or over 15%. Other cryptocurrencies such as Ethereum (one week performance +33%) or Dash (one week performance +43%) were also very strong. Belorussia is set to legalize cryptocurrencies, pushing them even further towards the mainstream.

On Monday in the US new home sales statistics will be published. In the Euro zone Italy publishes its ISAE Consumer Confidence level statistics.

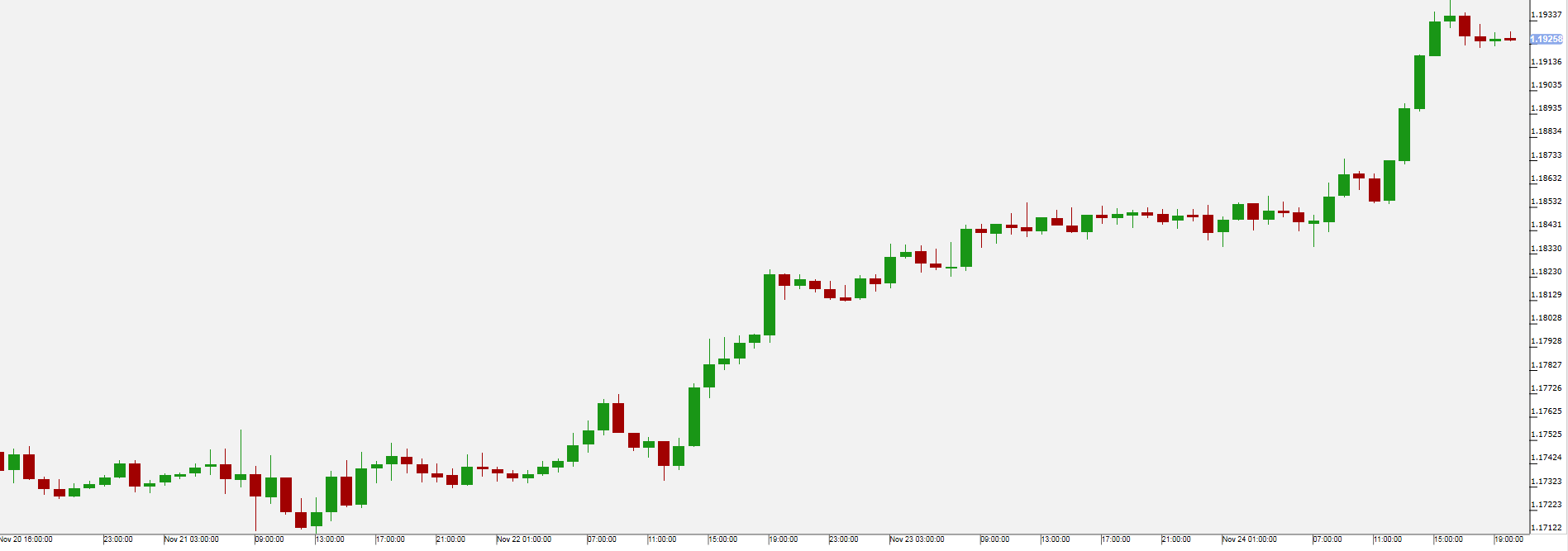

The Euro closed on Friday higher against the US Dollar for the fourth time that week and climbed to new 2-months high. The rise was supported by positive business sentiment in Germany according to the IFO survey but also to weaker than expected services and manufacturing PMI in the US. Due to the Thanksgiving Holiday few impulses to the markets came for the US towards the end of the week. On Monday in the US new home sales statistics will be published. In the Euro zone Italy publishes its ISAE Consumer Confidence level statistics.

Pivot: 1.1895

Support: 1.1895 1.1855 1.1825

Resistance: 1.196 1.199 1.202

Scenario 1: long positions above 1.1895 with targets at 1.1960 & 1.1990 in extension.

Scenario 2: below 1.1895 look for further downside with 1.1855 & 1.1825 as targets.

Comment: the RSI shows upside momentum.

Natural Gas

Natural gas recovered late in Friday's trading session but still lost almost 5% over the course of the week. This comes amid a mild winter allowing the US to export more natural gas than normal amidst a dip in domestic demand. While the weather in North America until December, 6th is expected to remain mild, some forecasts indicate that afterwards a cooler weather trend might be approaching. Natural gas is used in the US by commercial and residential consumers who both increase their gas consumption during winter months. US natural gas storage is announced by the Energy Information Administration (EIA) on Wednesday.

Pivot: 2.92

Support: 2.76 2.7 2.65

Resistance: 2.92 2.96 2.985

Scenario 1: short positions below 2.9200 with targets at 2.7600 & 2.7000 in extension.

Scenario 2: above 2.9200 look for further upside with 2.9600 & 2.9850 as targets.

Comment: the RSI is capped by a bearish trend line.

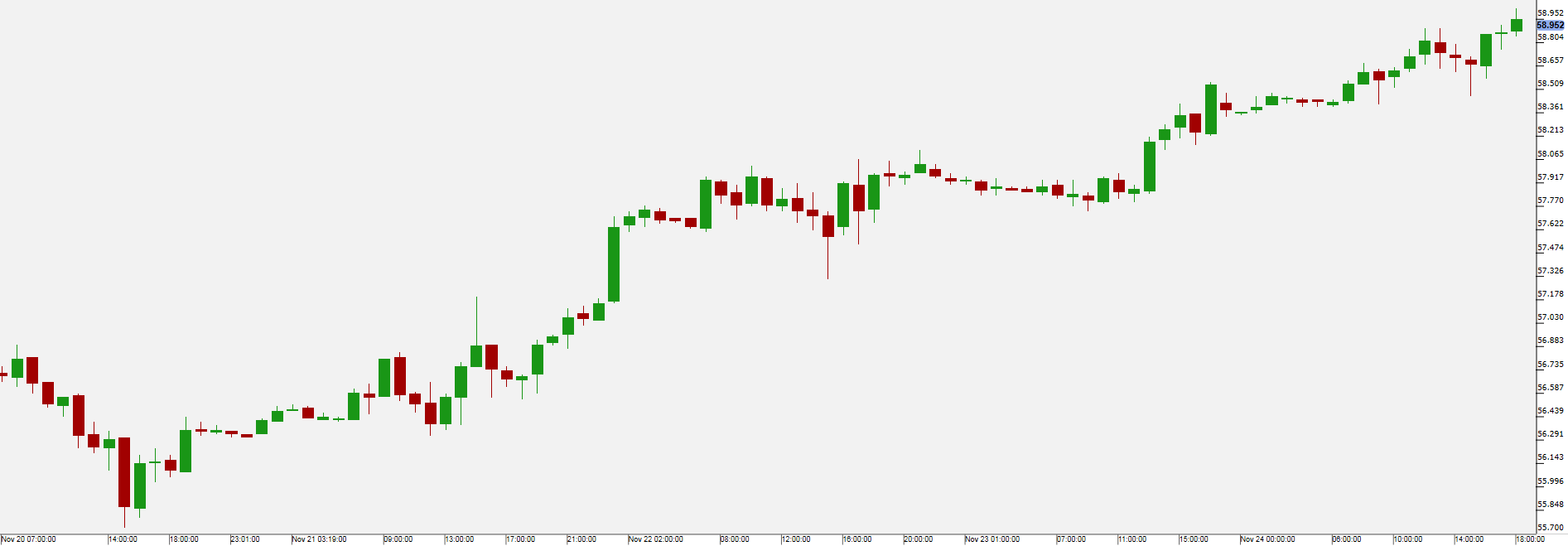

WTI Oil

Oil continued its rise ahead of the much anticipated OPEC meeting scheduled for Thursday and WTI oil reached the level of $59 for the first time since July 2015. It is understood that Russia and OPEC have agreed on an outline for a deal to cap production, while still working out some details.

On Tuesday the American Petroleum Institute (API) will release oil stockpile figures, followed by the Energy Information Administration (EIA) on Wednesday.

Pivot: 58.15

Support: 58.15 57.8 57.3

Resistance: 59.4 60 60.45

Scenario 1: long positions above 58.15 with targets at 59.40 & 60.00 in extension.

Scenario 2: below 58.15 look for further downside with 57.80 & 57.30 as targets.

Comment: the RSI advocates for further advance.

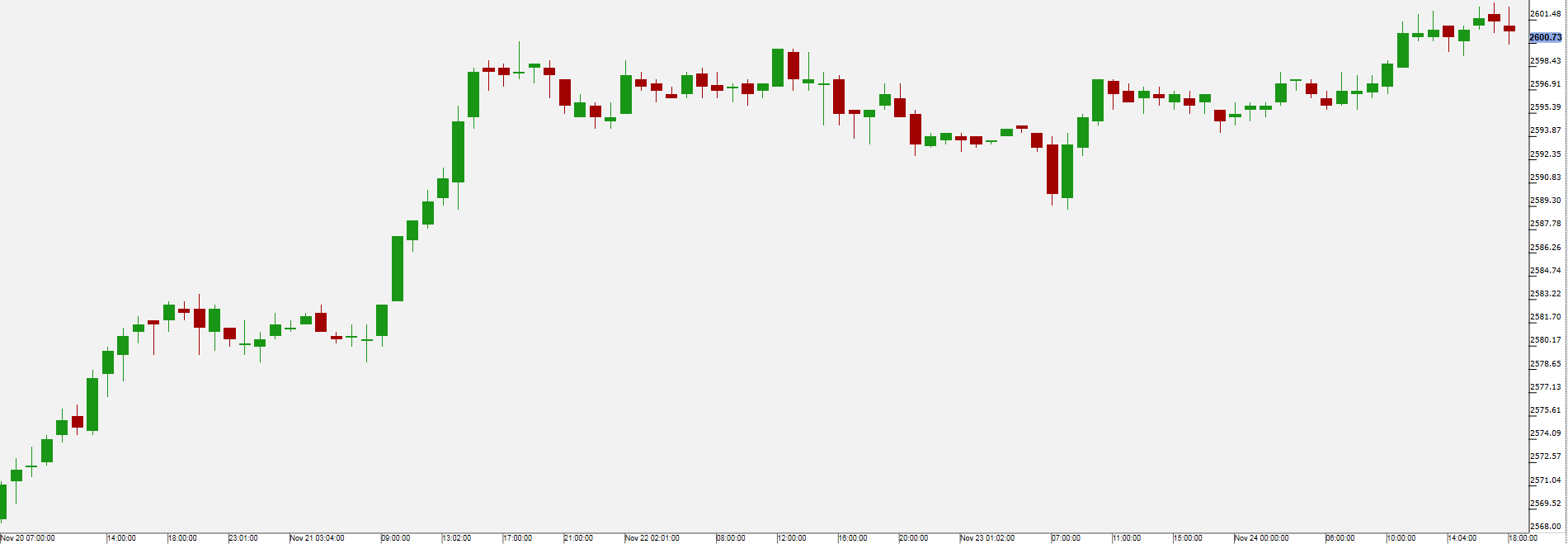

US 500

US equity indices closed mixed with the Russell 2000 (US 2000) closing lower, while the S&P 500 (US 500) and NASDAQ (US Tech 100) both edged higher towards a new all-time high. The move was supported by positive sentiment in retail this Black Friday and ahead of the festive shopping season. Amazon was seen as one key stock in this event as it rose to an all-time high thus making its founder Jeff Bezos worth $100 bn. by some estimates. Technology stocks were the best performer of the day (US Technology ETF +0.5%), whereas banks lost most in that session (US Banks ETF -0.53%).

ON Monday new home sales statistics will be released. On Tuesday among other statistics, consumer confidence statistics will be released and could draw some interest ahead of Christmas shopping season.

Pivot: 2594.5

Support: 2594.5 2590 2584

Resistance: 2605 2609 2613

Scenario 1: long positions above 2594.50 with targets at 2605.50 & 2609.00 in extension.

Scenario 2: below 2594.50 look for further downside with 2590.00 & 2584.00 as targets.

Comment: the RSI is bullish and calls for further advance.