Despite the Federal Reserve raising the interest rate by 25 basis points and announcing additional rate hikes this year, the Dollar traded weaker against other major currencies on Wednesday, with the US Dollar Index (USDX) closing 0.28% lower. Emerging market currencies such as the Mexican Peso (MXN) or the South African Rand (ZAR) were further under pressure against the greenback. Analysts say that higher interest rates in the US, make investments in emerging markets less relevant for some investors seeking returns. Also possible slowing global trade and geopolitical unrest might be putting additional stress on those areas.

Gold edged up in early trading on Thursday to the highest level in two weeks, while the Dollar continued to decline following the FOMC meeting. Oil traded higher over an unexpectedly high draw on oil inventories according to data from the EIA.

Cryptocurrencies faced further losses but mostly stabilized early on Thursday at a low level, with Bitcoin below $6,500. Cryptocurrencies face even more pressure after a break-in at a crypto exchange was made public on Sunday and a recent study indicated that the rally in Bitcoin last year might have been manipulated by the Tether cryptocurrency.

US equity indices were under pressure following the rate announcement by the Fed and settled lower, with the S&P 500 (US 500) future having its worst day this month so far.

On Thursday the ECB is due to make its interest rate decision. In Germany and France inflation data is set to be released and in the United Kingdom data on Retail Sales.

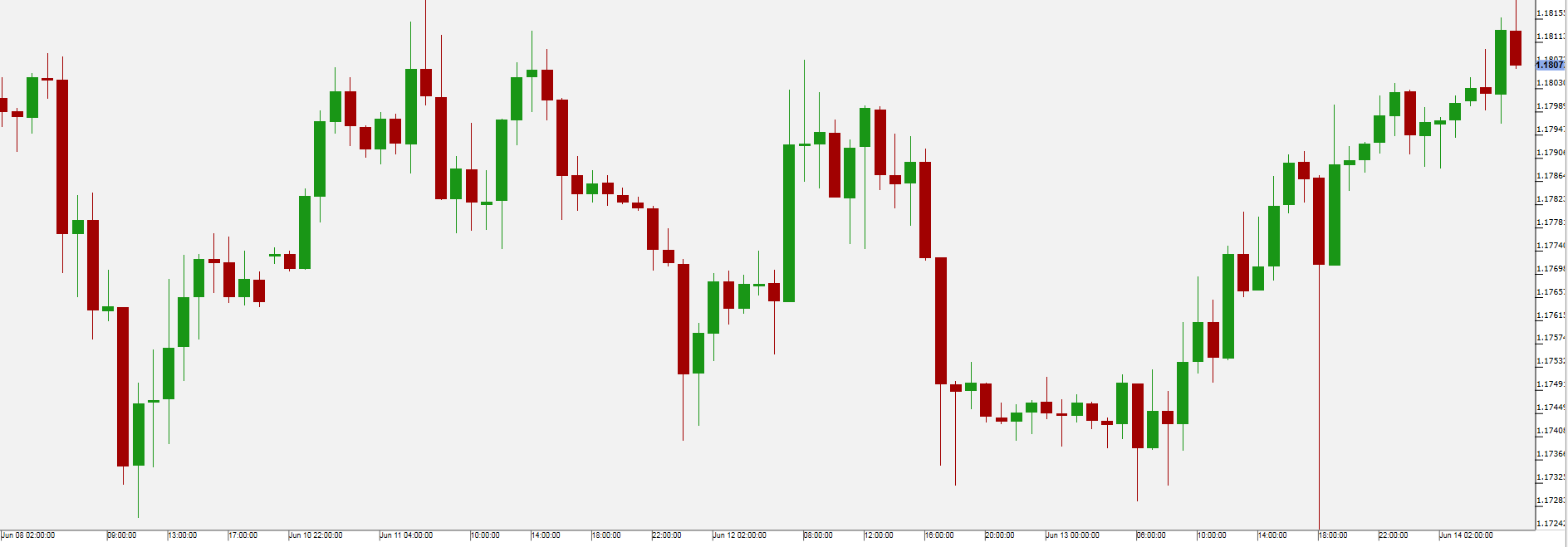

EUR/USDWhile there was extensive volatility as the Federal Reserve announced a rate hike by 25 basis points and pointed towards two additional rate hikes this year, the Euro was able to trade higher in anticipation over today’s ECB meeting. It is expected that at the meeting on Thursday, the ECB will discuss the exit from the quantitative easing (QE) policy of a significant asset purchase program by the end of this year.

In the Euro-zone the reported Industrial Production (IP) fell by 0.9% m/m (expected -0.7%). On Thursday, besides the ECB meeting, Germany and France are set to release their Consumer Price Index (CPI) numbers. Further CPI data is expected on Friday from Italy and for Europe.

Pivot: 1.177 Support: 1.177 1.1755 1.173Resistance: 1.184 1.187 1.1895 Scenario 1: long positions above 1.1770 with targets at 1.1840 & 1.1870 in extension. Scenario 2: below 1.1770 look for further downside with 1.1755 & 1.1730 as targets. Comment: the RSI shows upside momentum.

Pivot: 1.177 Support: 1.177 1.1755 1.173Resistance: 1.184 1.187 1.1895 Scenario 1: long positions above 1.1770 with targets at 1.1840 & 1.1870 in extension. Scenario 2: below 1.1770 look for further downside with 1.1755 & 1.1730 as targets. Comment: the RSI shows upside momentum.

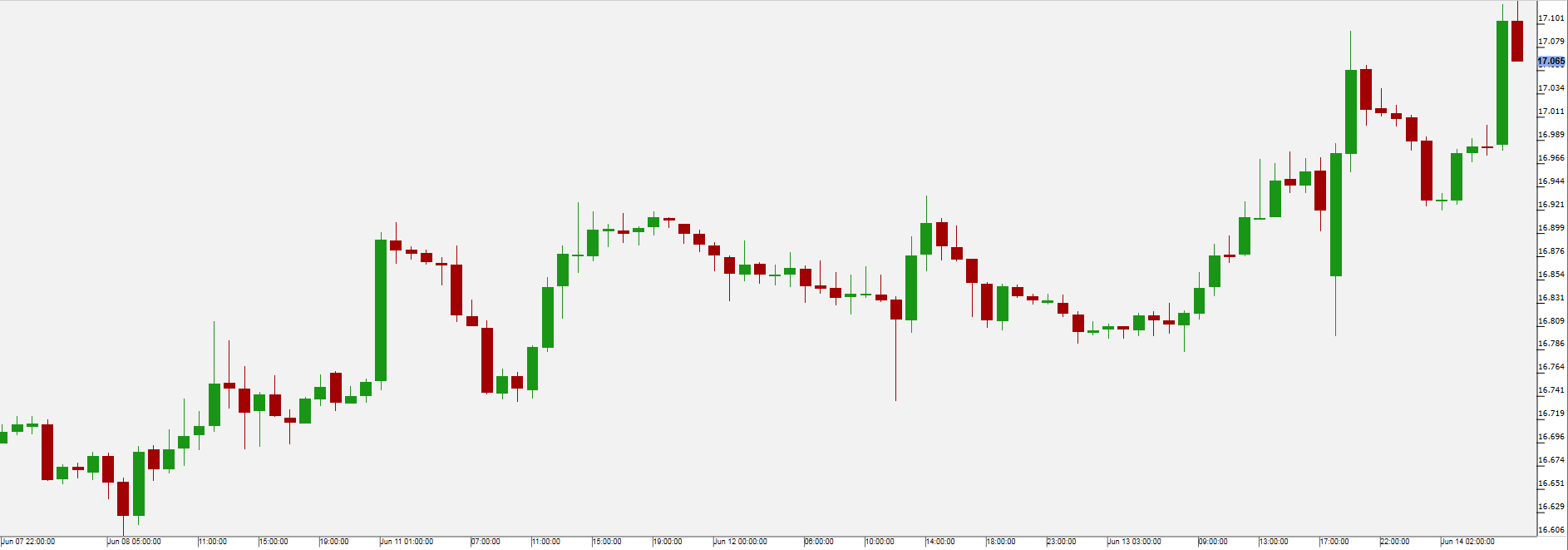

Silver continued to rise on Wednesday, clearly outperforming gold for this month so far. Data from the Commodity Futures Trading Commission (CFTC) on Friday, revealed that while speculative long positions on gold fell, those for silver were higher for the fifth consecutive week. Some analysts see the move as a mostly chart-technical move and not necessarily an indication of a bullish momentum.

Further data on the Commitments of Traders (COT) will be released by the CFTC again on Friday.

Pivot: 16.9 Support: 16.9 16.78 16.68Resistance: 17.2 17.26 17.36 Scenario 1: long positions above 16.9000 with targets at 17.2000 & 17.2600 in extension. Scenario 2: below 16.9000 look for further downside with 16.7800 & 16.6800 as targets. Comment: the RSI advocates for further upside.

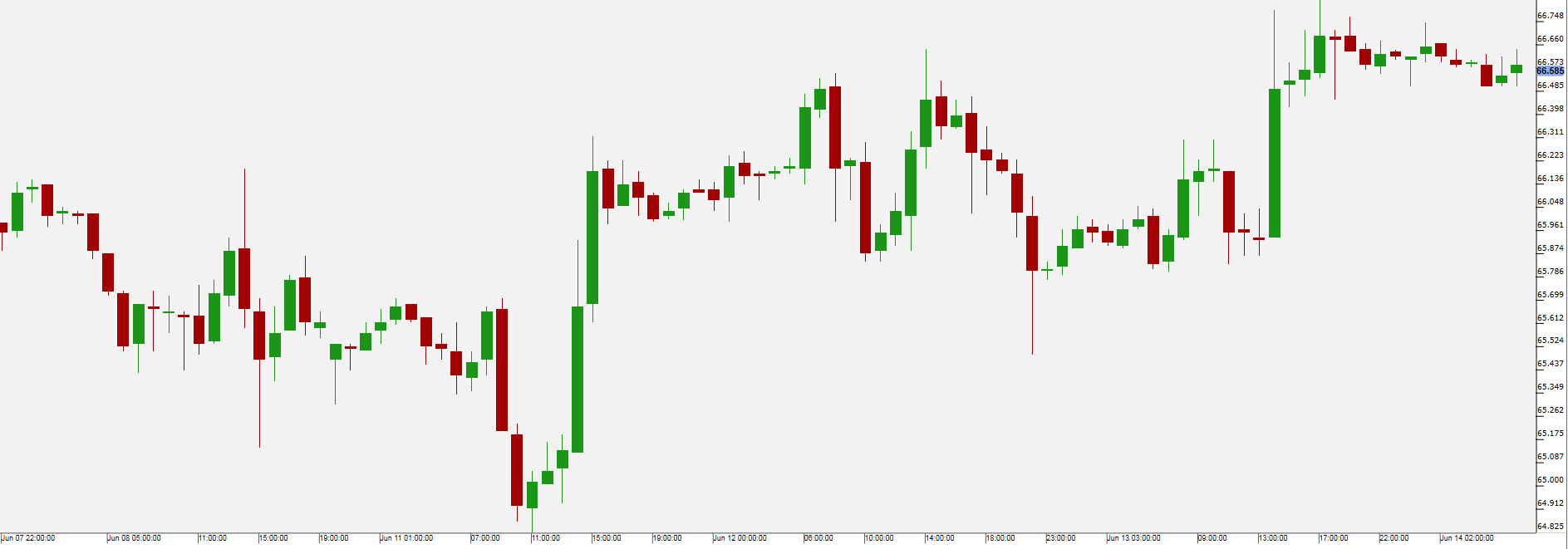

Oil traded sharply higher on Wednesday after data from the Energy Information Administration (EIA) revealed a draw on crude oil inventories in the US by a magnitude of 4.1 million barrels. This came in contrast of expectations of only a smaller draw and also data from the American Petroleum Institute (API) on Tuesday, which showed crude inventories higher by 0.8 million barrels.

Also on Wednesday the International Energy Agency (IEA) published their monthly report where they are expecting that a sharp increase in oil prices from now on would be less likely as around a year ago.

On Friday the Baker Hughes Oil Rig count for the US is set to be released. The statistic, which indicates the number of operating oil rigs was not seen falling over the previous 10 consecutive weeks.

Pivot: 66.25 Support: 66.25 65.85 65.5Resistance: 67 67.35 67.9 Scenario 1: long positions above 66.25 with targets at 67.00 & 67.35 in extension. Scenario 2: below 66.25 look for further downside with 65.85 & 65.50 as targets. Comment: the RSI advocates for further advance. The 20-period moving average crossed above the 50-period one.

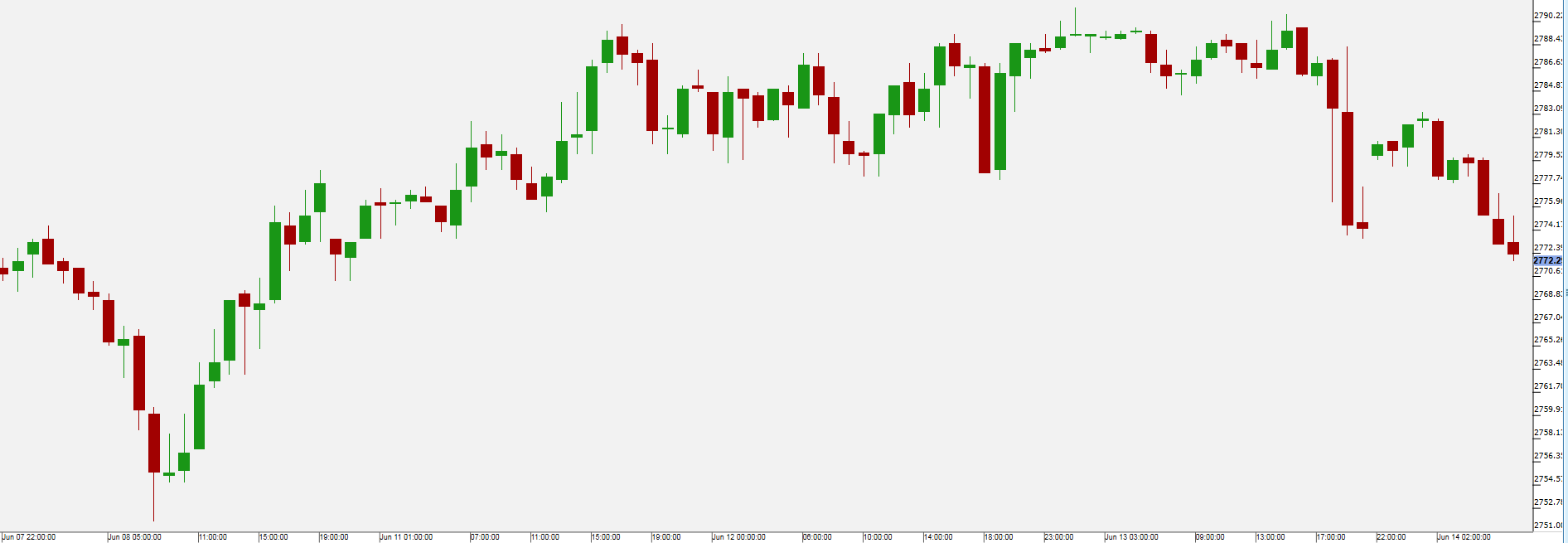

Major US equity indices traded lower after the Federal Reserve announced that it would raise the interest rates by 25 basis points to 2 percent and indications that it would follow up with two additional rate hikes this year. With that especially real estate sector shares (US Real Estate ETF -1.92%) were especially under pressure.

Netflix (NASDAQ:NFLX) (+4.52%) was one of the best performing blue chip shares after the investment bank Goldman Sachs (NYSE:GS) raised its price target for the stock by $100. Netflix stocks have gained since the beginning of 2018 97.5% in value. Tesla (NASDAQ:TSLA) (+0.49%) was also able to close higher, despite announcements that it planned to lay off 9 percent of its workforce. It was also revealed that CEO Elon Musk acquired Tesla shares worth $25M this week, even further raising his stake in the company.

On Thursday in the US data on Import and Export Prices, Jobless New Claims and Retail Sales is going to be released. Adobe Systems (NASDAQ:ADBE) is set to release their quarterly earnings today.

Pivot: 2774 Support: 2774 2765 2758 Resistance: 2789 2796 2802 Scenario 1: long positions above 2774.00 with targets at 2789.00 & 2796.00 in extension. Scenario 2: below 2774.00 look for further downside with 2765.00 & 2758.00 as targets. Comment: even though a continuation of the consolidation cannot be ruled out, its extent should be limited. The downside potential should be limited by the key support at 2774.