The US Dollar continued to trade lower against other major currencies, with the US Dollar Index (USDX) settling 0.57% lower on Tuesday following comments from US President Trump, as he complained about currency manipulation of other countries and interest rate hikes of the Federal Reserve.

Gold continued to recover pushing towards the $1,200 level, supported by a weaker Dollar. Oil received support by data from the API showing crude inventories in the US lower by 5.2 million barrels over the previous week.

Equities traded overall higher during the regular trading session, allowing the S&P 500 (US 500) to reach its all-time high level, before sizably retracing in extended hours trading.

Bitcoin sharply gained over the last 24 hours, surpassing even the performance of the ailing Ethereum, as the US SEC is expected to decide on the approval of two proposed Bitcoin based ETFs this week.

On Thursday in Canada data on Retail Sales will be released. Traders will be eagerly awaiting the release of the minutes from the FOMC meeting to see if the Fed might see it fit to react to the recent developments in global trade.

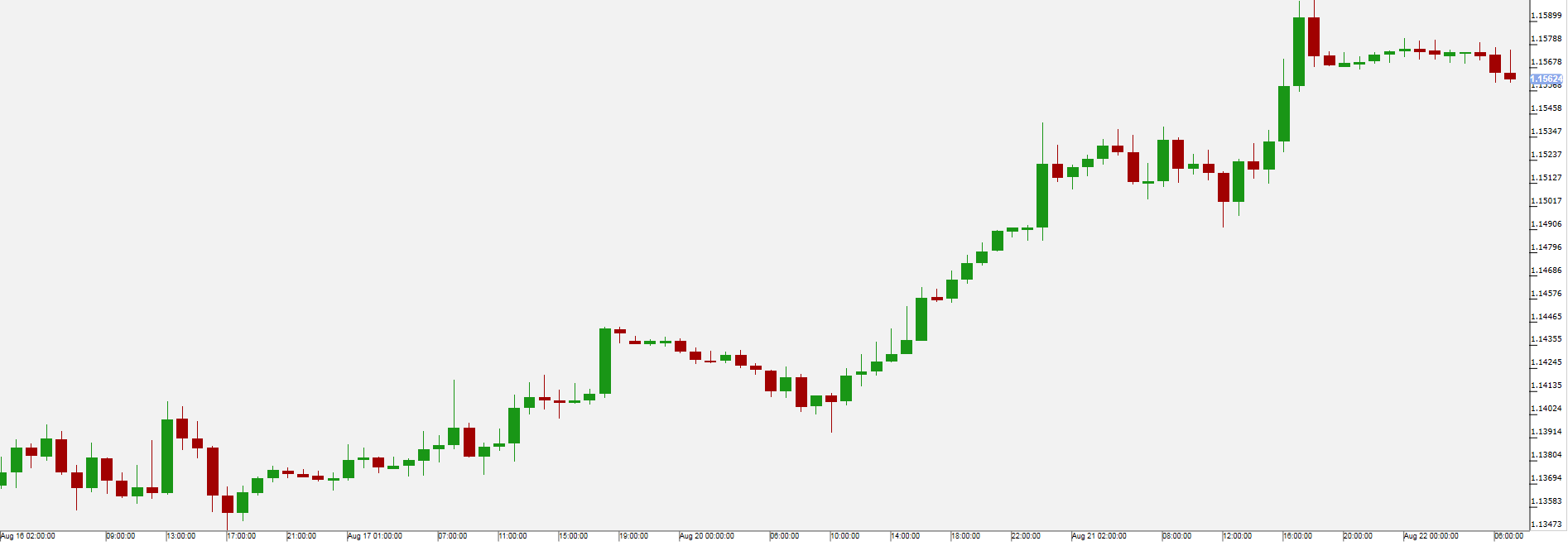

The Euro continued to gain against the weaker Dollar reaching on Tuesday above the 1.155 level, which was seen as a support level from May until the recent fall of EUR/USD rates. The Dollar was pressured by comments from Trump at the start of this week, where he complained about alleged currency manipulation in the EU and China and also about the continuous rate hikes of his own Federal Reserve.

Redbook Store Sales as reported on Tuesday were up at 4.7% y/y compared to 4.5% the previous week.

On Wednesday data from the Mortgage Bankers’ Association regarding the mortgage market will be released, followed by data on Existing Home Sales and the release of the minutes from the FOMC meeting towards the end of the day.

Pivot: 1.154

Support: 1.1541.1491.145

Resistance: 1.161.1631.165

Scenario 1: long positions above 1.1540 with targets at 1.1600 & 1.1630 in extension.

Scenario 2: below 1.1540 look for further downside with 1.1490 & 1.1450 as targets.

Comment: the RSI shows upside momentum

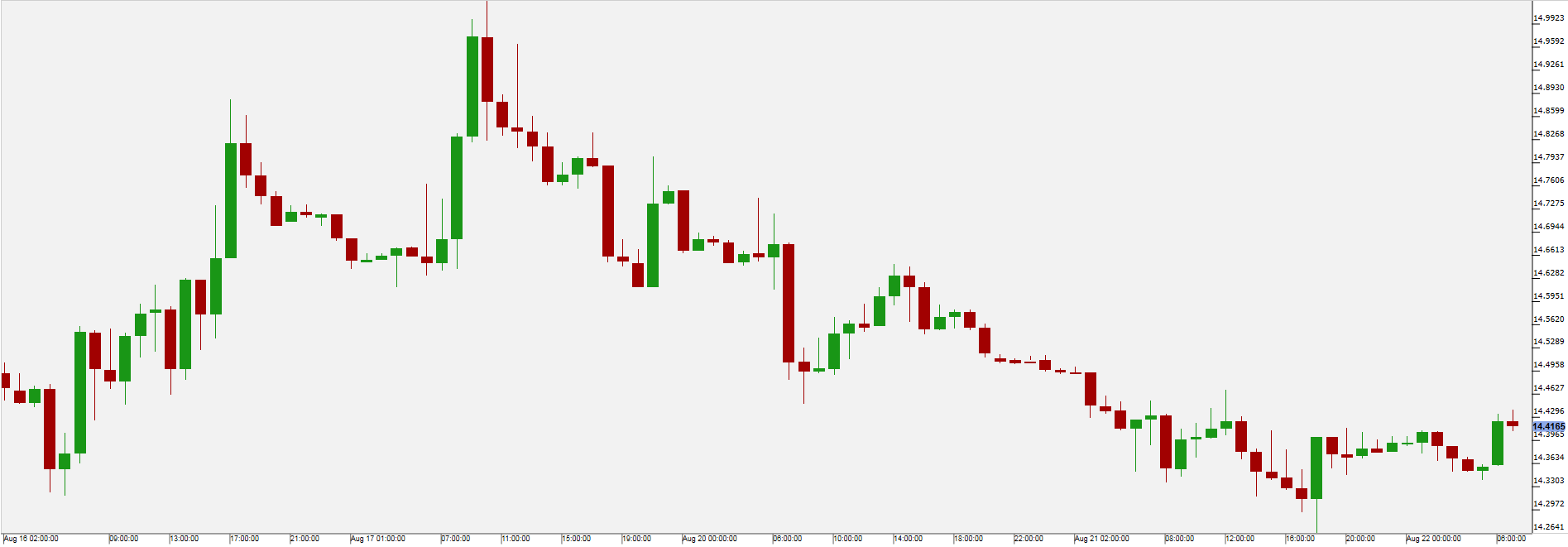

While the Rand recovered from its slump during the recent Lira crisis, as the Dollar weakness gave some room for a recovery, it is still considerably weaker than in the previous weeks.

There are concerns what the recently implemented measures allowing to seize land from white farmers without compensation would mean for the market as it was reported that the government seized the first farms this week, following their owners’ refusal to accept lowball buyout offers from the government. The agriculture financing ‘Land Bank’ voiced concerns that seizing land without compensation could mean a default due to contract obligations, which could cost the government to the tune of ZAR41 bn.

In South Africa the Consumer Price Index (CPI) data will be released on Wednesday morning. Next week data on Trade Balance, the Producer Price Index (PPI), Private Sector Credit and M3 Monetary Supply will be released.

Pivot:14.264

Support:14.26414.12114.036

Resistance:14.6414.72614.811

Scenario 1: rebound towards 14.6400.

Scenario 2: the downside breakout of 14.2640 would call for 14.1210 and 14.0360.

Comment: the RSI is below 50. The MACD is negative and above its signal line. The configuration is mixed. Moreover, the pair stands below its 20 and 50 MAs (respectively at 14.3911 and 14.3925).

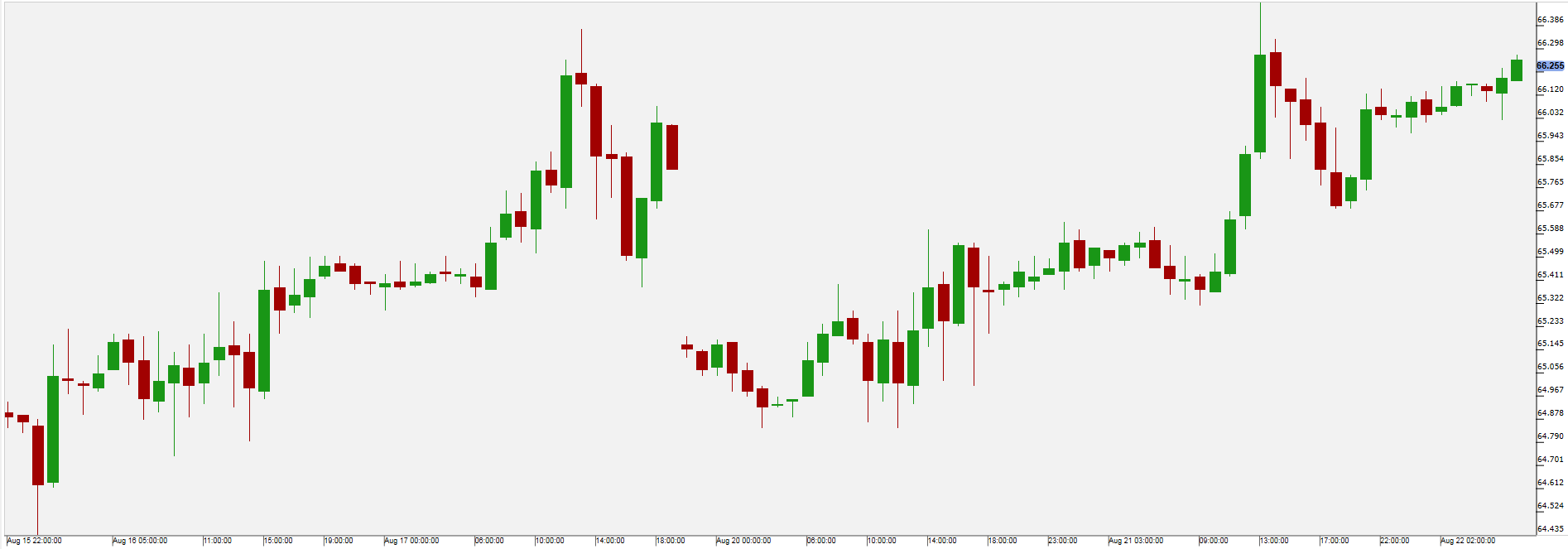

WTI Oil

Oil continued to recover, closing also on Tuesday higher with the American Petroleum Institute (API) reporting a draw of 5.2 million barrels from oil stockpiles in the US.

Uncertainty regarding the market impact of the Iran sanctions, which the US implements at the beginning of November could be pushing prices higher. France’s Total was reported stopping its activities in Iran over the fear of US sanctions, despite attempts by the European Union to keep companies doing business with Iran in order to maintain the nuclear agreement, which was brokered by the previous US president Obama.

The Energy Information Administration (EIA) will release its oil stockpile statistics on Wednesday.

Pivot: 65.6

Support: 65.6 64.85 64.4

Resistance: 66.5 66.8 67.2

Scenario 1: long positions above 65.60 with targets at 66.50 & 66.80 in extension.

Scenario 2: below 65.60 look for further downside with 64.85 & 64.40 as targets.

Comment: the RSI is mixed to bullish.

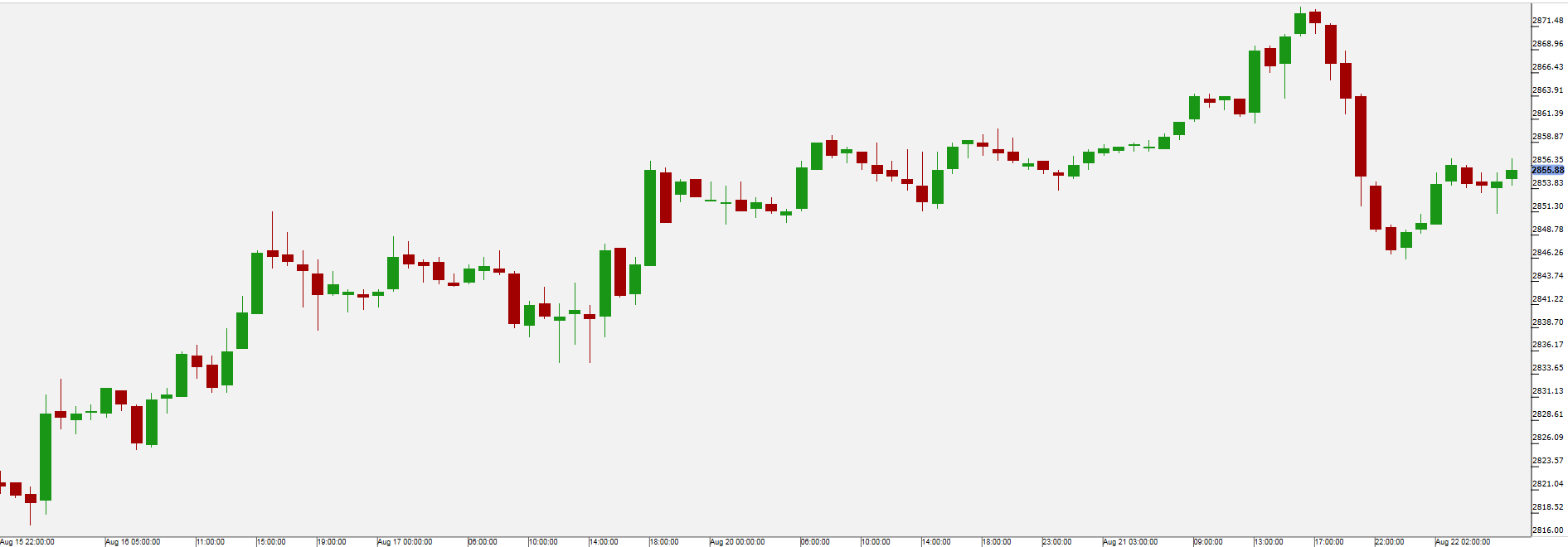

US 500

The S&P 500 (US 500) went up to its highest level on record on Tuesday, but was again down in the extended trading session, just as most other equity indices retreated. It was not immediately clear if that had anything to do with President Trump’s former attorney Cohen pleading guilty and his campaign manager Manafort being found guilty by a jury.

Especially chip maker’s stocks (US Semiconductors ETF +2.07%) strongly recovered from the recent low, while non-cyclical (US Non-cyclicals ETF -0.69%) and real estate (US Real Estate ETF -0.66%) stocks traded overall lower.

Tesla (NASDAQ:TSLA) (+4.41%) started to recover again from its recent low over conflicting details regarding the move to take the company private. Investment bank Morgan Stanley (NYSE:MS) unexpectedly removed its coverage of Tesla’s stock, which added rumours that it could be part of Tesla’s bid to take the company private. Goldman Sachs (NYSE:GS) removed its rating for Tesla last week as it was announced that it would take part in that effort.

The earning season is coming to an end but still some earnings will come in this week such as from Lowe’s and Target on Wednesday and Alibaba (NYSE:BABA) on Thursday.

Pivot: 2860.75

Support: 2843 2835 2826

Resistance: 2860.75 2868.5 2874

Scenario 1: short positions below 2860.75 with targets at 2843.00 & 2835.00 in extension.

Scenario 2: above 2860.75 look for further upside with 2868.50 & 2874.00 as targets.

Comment: as long as 2860.75 is resistance, expect a return to 2843.00. The former rising trend line is acting as resistance.