Are you looking for a new swimsuit? Because September is the best month to buy one.

Stores have to get rid of their inventories. And with summer vacations officially over, beachwear is the furthest thing from everyone’s mind right now.

Retailers are just finishing up back-to-school pushes. From here, they’ll turn to Halloween before skipping right past Thanksgiving to unload Christmas decorations and inventory.

In the first quarter, retailers take inventory. If it’s not in the store, they don’t have to count it. So, to save themselves a whole lot of trouble -- and boost cash -- they liquidate as much as possible through inventory-reduction sales.

That’s why February is the perfect time to buy a new winter coat. It’s also the best time of the year to buy suits.

September Is Your Friend

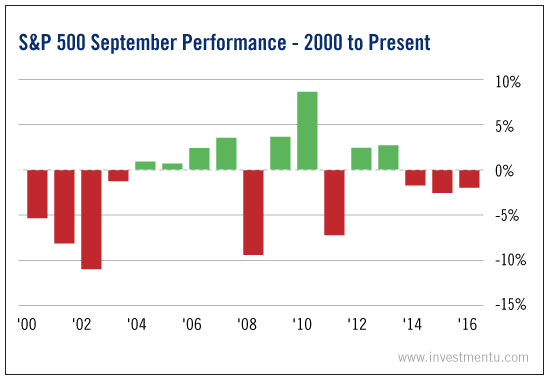

September is just “one of those months” for the markets. Since 2000, it’s been a real thorn in the sides of investors.

The S&P 500 has fallen nine times in the month, with five of those losses being more than 5%.

Currently, the S&P is down about 2% in September. That’s right in line with what we saw in September 2014 and September 2015.

In fact, in four out of the past six years, September has yielded a negative return. It follows August, a month where the S&P has ended lower five out of the past seven years. And before August, we had June -- a month when the S&P has seen declines in seven out of the past 10 years.

You could view this all in a negative light, sure. But if you’re an investor looking to buy shares of companies at some of their lowest levels possible, September is your friend.

From the second half of the month through October, it’s the prime teriod to buy shares in a variety of sectors. Especially businesses that do poorly during the summer months but really heat up during the winter.

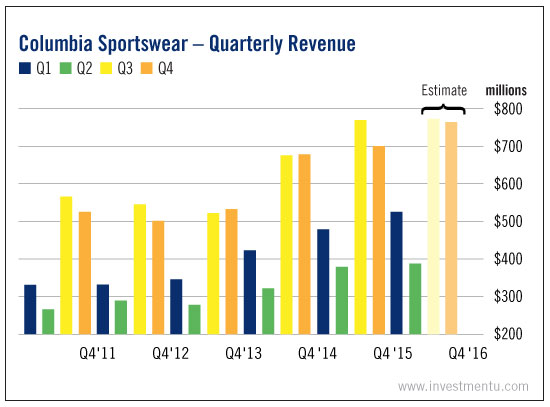

For example, let’s look at quarterly revenue for Columbia Sportswear Company (NASDAQ:COLM).

About To Make A Killing

We can clearly see that the third and fourth quarters are the periods when Columbia makes most of its money. The outdoor apparel maker sees weaker revenue in the first quarter. And then no one is buying warm outdoor wear in the second quarter.

Shares of Columbia Sportswear are up 10% year to date. But they are 14.5% below their 2016 peak. And so far in September, they’re down 4%.

Looking at the company’s quarterly revenue, does that come as a surprise?

In the third quarter of 2015, Columbia reported record sales of $767.6 million. In the second quarter of 2016, it reported revenue of $388.8 million. This was a record in its own right, but only a 2% increase year over year.

And it was a far cry from the 10% revenue increase seen in the first quarter... or the 14% increase seen in the third quarter of 2015.

The majority of investors simply see that revenue has been cut in half over two straight quarters. Something similar happens every year.

Again, like clockwork.

As a result, shares of Columbia tend to fall from their peak, trailing lower through the spring and summer. Which is perfectly fine with me.

I’m actually looking for shares to go lower at the moment. There’s a specific date on my calendar that I’ve circled, knowing that the stock will have finally bottomed out (give or take a few points).

But these are the types of trades that should be on your radar now. We’re talking about companies that are going to make a killing in the months ahead. And the lower the prices of shares, the better.

That’s why a down month like September is really a great month. It’s truly your friend.