Commodities are historically cheap to the S&P 500. This after the monster move over the last 18 months ignited by the Fed more than doubling its balance sheet during the same time period. Funny thing about looking at a chart of commodities. That rally largely has not included gold and silver. But that is likely to change:

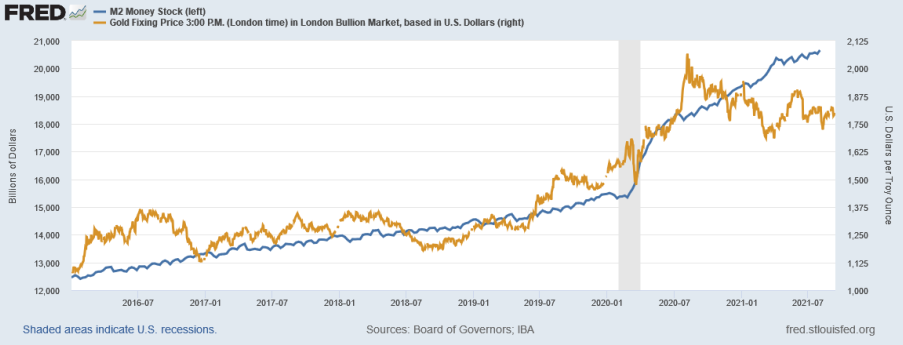

The chart above shows gold vs the M2 measure of money supply from 2016 to present (the 4 1/2-year bear market in the sector ended late December 2015). The chart suggests that at some point the gold price will correct “up” to the M2 line. Even if the Fed were to start tapering its monthly money printing, the money supply will not decline unless the Fed engages in “quantitative tightening” (permanent reverse repos to remove money from the system).

To be sure, the current effort by the banks and western Central Banks to cap the gold price is one of the most aggressive I’ve witnessed in 20 years. They are in a fight to maintain their last shred of credibility with the markets in a bid to keep the current fiat currency monetary system intact. It’s a battle they will eventually lose.

Wall Street Silver hosted myself along with David Morgan (silver-investor.com) and Andrew Pollard, CEO of BlackRock Silver (NYSE:BLK) to discuss the energy and precious metals markets: