IDACORP, Inc. (NYSE:D) reported third-quarter 2019 earnings of 93 cents per share, which improved 78.8% from the year-ago figure of 52 cents.

The year-over-year improvement in earnings was attributable to strong economic activity in Idaho Power's service area and solid performance across IDACORP's other subsidiaries. Customer addition and cost management also had a positive impact on the company’s bottom line.

Highlights of the Release

In 2019, its customer base improved 2.5% year over year, which resulted in $18.8 million increase in operating income from 2018 levels.

Net income in the quarter under review was $47.1 million compared with $26.1 million recorded in the year-ago period.

The company continues to lower the usage of coal in its electricity generation units. The usage of coal dropped 59% in 2019 from 2005 levels.

Guidance

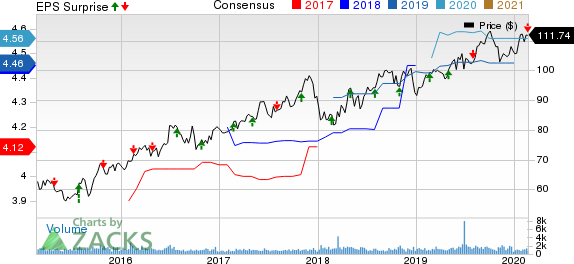

IDACORP initiated its full-year 2020 earnings guidance in the range of $4.45-$4.65 per share and this guidance assumes normal weather in its service territories. The mid-point of the guidance is $4.55, which is a penny less than the current Zacks Consensus Estimate.

The company expects 2020 operating and maintenance expenses associated with Idaho Power in the range of $350-$360 million. Idaho Power capital expenditure for 2020 is expected in the range of $300-$310 million.

Zacks Rank

Currently, IDACORP has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Industry Releases

Exelon Corporation’s (NASDAQ:EXC) fourth-quarter 2019 operating earnings of 83 cents per share surpassed the Zacks Consensus Estimate of 73 cents by 13.6%.

Dominion Energy Inc. (NYSE:D) reported fourth-quarter 2019 operating earnings of $1.18 per share, beating the Zacks Consensus Estimate of $1.16 by 1.7%.

NextEra Energy, Inc. (NYSE:NEE) reported fourth-quarter 2019 adjusted earnings of $1.44 per share, lagging the Zacks Consensus Estimate of $1.54 by 6.5%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Exelon Corporation (EXC): Free Stock Analysis Report

Dominion Energy Inc. (D): Free Stock Analysis Report

IDACORP, Inc. (IDA): Free Stock Analysis Report

NextEra Energy, Inc. (NEE): Free Stock Analysis Report

Original post